Spotlight on Indie Film Platform FilmDoo

by Orly Ravid.

by Orly Ravid.

I was introduced to indie film platform FilmDoo.com and decided to share it with you all here by asking FilmDoo some questions. I spoke to Weerada Sucharitkul, CEO & Co-Founder and most of what is below are Weerada’s own words in response to my questions.

What is FilmDoo’s Mission?

We help people to discover and watch great films from around the world, including documentaries and shorts. Essentially, we help people discover non-Hollywood films, which include independent films from the US and UK, as well as mainstream blockbuster films from China and Japan, for example. We not only help people to discover films but languages and regions, and are very much a ‘TripAdvisor for Films.’ On FilmDoo, you can discover films from Africa, Asia, Latin America and Europe, many of which we are the first to show internationally outside of film festivals. Furthermore, we also have a very engaged global film community (users can have an active social profile and leave reviews, comments as well as engage with other community members) and are an extensive international film database source, which is increasingly becoming an alternative to IMDB for foreign language films. As such, we are not only a VOD platform, we are more than that—a global database of foreign films as well as rapidly growing international community of film fans.

How does the platform work? What is FilmDoo’s Business Model?

FilmDoo’s current model is TVOD (pay-per-view) for feature films on the main FilmDoo site. We are a global online streaming platform and have the ability to sell and show films anywhere in the world. We are at over 500,000 visitors a month, with users from 194 countries. As we are increasingly getting a lot of traffic from emerging countries (e.g. Indonesia is now our second biggest traffic country, and countries like Turkey, India, Malaysia and Philippines make our Top 10 list), we are now looking at more ways to further monetize from these parts of the world and could be looking to do an AVOD model in these countries in the near future. We are able to geo-block for any country combination, and only require one month notice from filmmakers or content owners if they would like to change the geo-block country combination. We are able to accept transactions in UK Pound, US Dollar, Australian Dollar and Euro, as well as Paypal and AliPay (for Chinese-based users).

Which types of films do best on your platform?

Search ’gay movies’ and ’lesbian movies,’ and you will see we rank very high on Google from a SEO perspective. At the moment, their best selling category is LGBT films. FilmDoo claims to already have one of the biggest LGBT online film collections in the world. In terms of typical demographics, the audience base is a lot younger than typical ‘world cinema’ audience. They tend to be globally mobile, active on social media, speak many languages and/or learning languages, and come from an international or expatriate background (such as second generation French or Italian). Human rights documentaries have also tended to do well. As such, we see strong appeal for films that fit our current demographics: average age 22-39, young, learning languages, loves travelling and enjoys watching coming-of-age movies, first love movies, thriller movies, road movies, LGBT movies and human rights and social issues.

Where do most of your consumers live? Explain which countries.

Our current Top 10 countries by traffic, in order, include: 1. US, 2. Indonesia, 3. Turkey, 4. UK, 5. Turkey, 6. Malaysia, 7. Philippines, 8. Egypt, 9. Germany, and 10. Saudi Arabia. However, in terms of sales, our top selling countries include: US, UK, Canada, Australia, France, Germany, Ireland, Norway, Netherlands and India. As you can appreciate, given the global nature of our traffic, for many in emerging countries in Asia and Africa, for example, the current TVOD price point is either too high for them, they do not have credit card or they are more used to an AVOD or free viewing model and not used to making transactions online. Hence why we are now exploring AVOD as an option to do more in the rest of the world.

What is the revenue split? Are there any costs recouped?

Revenue share is 70/30, same as iTunes. There are no costs to put the films on the FilmDoo platform, no further additional transcoding or ingestion costs. There are no marketing costs recouped either. The mission is to make it as easily and as flexible as possible for film makers to be able to put their films online at no additional costs and with maximum ease to be able to maximize their full global potential.

Some of their top selling content partners are LGBT content partners who have a collection of films with us and are able to make a decent sum month (I was asked not to share the exact sum publicly).” They note doing increasingly better for other film genres and collections. Launched in 2015, FilmDoo claims to be growing rapidly and expects to grow its catalog and audience.

Please speak to the simplicity, ease, and flexibility of the platform as far as geo-blocking, limiting territories, and the simple delivery, non-exclusivity…

Simplicity, ease and flexibility are absolutely at the heart of what we do at FilmDoo. Our goal is to reduce current barriers to international distribution in the film industry and most of all, to help films, especially films that have had their festival runs and may have already sold in a few territories, to continue to be able to monetize and reach their full global potential. That’s why we want to make it as easy as possible for them.

This includes:

- Ability to geo-block to any country combination requirement, with only one month notice required if you need to make changes to this. We will be able to sell your film in any country.

- We will try our best to work with your material—we can take both HD and SD files (where HD is not available), AppleProRes and H.264. We can accept the digital files via our FTP, WeTransfer, Aspera as well as any other way.

- We can also accept film files sent to us in hard drives by post.

- Where the films are not available digitally, we will also accept DVD/ Blurays and will digitize these at no additional costs to the film makers.

- We do require that all films have English subtitles. If available, it would also help to have native language caption files as separate files (e.g. English captions for English language films, French caption for French language films, etc), although this is not required.

- Our preference is for clean film files with separate subtitle files in .SRT or .WebDTT format.

- However, if separate subtitles are not available, we can also accept film files with burnt in English subtitles.

What is FilmDoo’s Term?

Our terms are 2 years non-exclusive.

As you will see, we are much more flexible and easier to work with than most other global platforms, because our number one goal is to make it as easy as possible for film makers and content owners to put their films online and reach their global audience.

Are filmmakers able to see the data of where their audiences live (country) and how many transactions per each country? Is there a dashboard?

Yes, we have an online reporting dashboard. Film makers or content owners will be able to log in any time to see their total sales in real time. They will be able to see where the sales are coming from, the countries their films are getting the most interest in, and where available, the demographics breakdown of people interested in their films such as gender and age.

Can filmmakers contract with you directly?

Absolutely, please feel free to email me directly at wps@filmdoo.com. In addition, we can also be contacted at our general email: info@filmdoo.com. Please also feel free to follow our news, film releases and reach out to us on our social media: Facebook • Twitter • YouTube.

What is FilmDoo doing to increase its consumer/audience reach?

Through our proprietary marketing technology, we are doing very well on SEO, where we are able to reach global audience interested in Lesbian and Gay movies as well as films by language collection. Furthermore, our proprietary technology include our personalized film recommendation engine.

At the same time, we also have a very strong Editorial and Curation team, where we continuously help to promote our films via our Blog, YouTube channel, social media and newsletters. We are also able to interview directors and film makers at no additional costs to help create promotional and editorial content. We also have community user-generated content, such as film playlists and film reviews, which are growing rapidly.

Most importantly, what is unique about FilmDoo, is our “DooVOTE” concept, whereby we are empowering users to discover films not yet available in their country and to express a demand in seeing that film. Consequently, we are using this data to try to go after the films we know there is interest from our community:

filmdoo.com/doovote. To increase our audience reach, we often do a lot of on the ground marketing, including partnerships with film festivals and giving presentations and talks at film workshops and events.

Please share anything else you think is relevant — including that you may turn into an SVOD or AVOD

I think it’s important to note that unlike other players in this space, we are not going after the already hardcore indie or world cinema film fans. We are identifying and converting new film audiences, many of which are traditional mainstream audiences, who may be increasingly interested in exploring new and refreshing content, whether from a cultural and language perspective or from an awareness of gender or human rights topics. Effectively, our audience is an increasingly growing group of people who are becoming more interested in travel, studying or traveling abroad, as well as forming multi-cultural families. FilmDoo is all about providing a truly global platform to traditionally underrepresented voice, such as emerging film makers and female and LGBT film makers from around the world. Their films deserve to be discovered and seen legally and FilmDoo is building a community and global platform to help them achieve that.

Sydney Levine has written an article on FilmDoo as well. Please read it here.

Please note: I did not publish information about revenue per FilmDoo’s request as that is proprietary information, but I am told I can discuss it privately/confidentially with filmmakers.

Orly Ravid October 18th, 2017

Posted In: Digital Distribution, Distribution, DIY, International Sales

Tags: Digital Distribution, FilmDoo, independent film, Orly Ravid, VOD

Uncertain state of distribution

At the recent Toronto International Film Festival, veteran independent film distributor Bob Berney gave a state of the industry address on distribution. TIFF was kind enough to make his keynote video available on Youtube (you can find it below), but here are some of the highlights if you don’t have 30 minutes to spare watching it.

-We’re in a chaotic, disruptive state right now with bigger studios making fewer, but massively budgeted films that involve huge risk.

-On the flip side, there are many more outlets now available to get a film into the market. The challenge as a producer is how to get revenue from these outlets in order to fund your next work.

-There are now well funded entities coming to major festivals and buying films without any real plan about how to release them.

-Open Road and Relativity Media are now distributing wide release theatrical films, sometimes as service deals (the production pays them to release, instead of the distribution company paying for rights).

-But platform release films, ones that start with opening in only 2-4 cities and then keep expanding their theatrical runs, are starting to have a tougher time finding a home, a company that will take them on. Fewer distributors are taking the traditional theatrical route and there are now more companies taking the day and date or VOD first route. Films that want a traditional release far outweigh the distribution companies that are willing to take on films for that kind of release.

-Berney believes that a theatrical release is the only way for a film to truly break out in the market in a big way.

-The bar for films that warrant having a large theatrical release has really been raised. The expense to release those films, even if using digital marketing, is big and the market is very competitive. Distributors who fund the marketing and distribution costs for those films are very wary about the ability to recoup.

-This summer there were many indie films that played in theaters against the studio blockbusters and did well. Boyhood, Magic in the Moonlight, Chef, Belle, Begin Again all surpassed expectations about how they would fare against the studio films. Berney believes it was because there was nothing else to see. Either superhero films or these and nothing in between. He guesses that the market could have taken even 4-5 more indie films this summer. People went to see some of those successful titles 2-3 times because there wasn’t much to choose from. Theatrical companies could have picked up more. The Fall season is crowded, but the summer could have used a few more releases.

-Because the deals are so different and the numbers come in sporadically, releasing VOD numbers is still not common.Also there aren’t very many success stories being reported from day and date or VOD only releases.

-Many European companies or smaller indie division within the studio units are not finding deals on their films very viable now. P&Ls for sales coming domestically (US) often have a 0 in the profit column. Sales can’t be counted on any more. Budgets have had to shrink accordingly because large deals aren’t happening so much any more.

Many of the newer players in the digital and VOD arena are constantly looking for content to fill their channels. Those films can play for a while until the audience gets more discerning.

-For any avenue chosen for distribution, the release has to create the feeling of an event to catch an audience’s attention. There is just too much in the market.

There is no one size fits all marketing and distribution plan. Each film needs to have its own plan handcrafted.

-Given the risk and expense, distributors are going to be much more discerning about what films they are passionate about and believe in before offering a deal.They want to be very sure there is an audience for a theatrical release before committing to such a deal.

-The Blu Ray market is still huge for certain types of films. Genre including family, horror, sci fi still do business on disc for Walmart and Redbox.

-Certain theaters are catching onto the idea of making the cinema an experience. Food, bigger seats, more varied showtimes, 4D seats are all increasing the feeling of an event in the cinema.

-Theaters are still resisting the idea of day and date. Regal and Cinemark chains are adamant about preserving the theatrical window. But AMC is more open to experimentation as long as the distributor will pay a 4 wall fee to rent their theaters. IFC and Magnolia own their own theater chains so they have been the most aggressive about trying Ultra VOD and day and date release. IFC buys about 50 films a year that they run though VOD and day and date releases.

-Due to regulation, Canada has not been able to experiment with this kind of releasing model yet.

-Berney still believes in the power of the theatrical release to affect an audience and that it is the best way to make a film break out.

-Netflix has been the savior for films that may not get a pay TV deal. Essentially, subscription VOD is on par with selling to HBO or Showtime. But Netflix takes far more films than those broadcasters.

-Social media advertising is allowing a more targeted and lower cost alternative to traditional advertising, plus providing much needed data on which to base strategic marketing decisions. Also these tools allow filmmakers to get clips, trailers, images etc to get out more widely for a lower cost and build pre release awareness that wasn’t even possible 10 years ago.

-There are just so many more opportunities now to get a film out, but it will take some time for the business side, the money making side, to catch up. That’s the uncertainty we are dealing with now.

Sheri Candler September 19th, 2014

Posted In: Digital Distribution, Distribution, Theatrical

Tags: Bob Berney, digital film distribution, Picturehouse Films, State of Film Distribution, theatrical release, Toronto International Film Festival, VOD

Is VOD Collapsing The Festival Window?

Filmmakers often ask me how long they should keep their films on the festival circuit. For years now, I’ve been saying that for any film that is performing well on the circuit (meaning getting accepted into a significant number of festivals on a more or less regular basis), there is a general rule you can follow.

Most films will see their festival bookings continue robustly for 1 year from the date of the world premiere, and then significantly drop off (but still trickle in) in months 12 – 18. After 18 months, festival bookings will nearly cease worldwide, except for those films that have a perennial hook (i.e. a film about black history during the annual Black History Month, a film about the AIDS crisis on World AIDS day, etc).

Given that general rule, I am going to go ahead and call that 18 months the Festival “window.” Now, of course, most Hollywood companies don’t consider the festival circuit as a window akin to the “traditional” windows of theatrical, broadcast, DVD, VOD etc. For studios and mini-majors, a long festival run isn’t always necessary…they have the money and staff to market the film in other ways, and any potential revenue the film can make on the festival circuit is relatively meaningless given the scale of the budgets they work with. In many cases, larger distributors see festivals as really just giving away free tickets to their movie, and therefore limit any festival participation to only the largest, most prestigious and best publicized festivals in the world, and simply ignore all the rest.

But for individual filmmakers without the benefit of studio/mini-major release, and also for many small distribution companies, the festival window is invaluable and irreplaceable in terms of the marketing/publicity value it can afford, and the modest revenue that can be generated. For many films of course, the festival window IS the theatrical release of the film – meaning it’s the way the largest number of people can actually see the film in a theater. Even those indie films that do get a traditional theatrical release are usually limited to a few big cities, meaning festivals are the only way the films are ever going to be screened beyond New York, L.A., and few other cities. Since most individual filmmakers and small distributors work on a modest budget, any and all revenue the film can bring in is significant. Additionally, the free marketing/publicity that a festival offers is just about the only kind of marketing the film may ever get.

So – and this is back to the original question – when filmmakers ask me how long they should keep their film on the festival circuit if it is doing well, my initial answer is always “at least one year.” Given that you only have 12 – 18 months for your film to be seen this way, why not take advantage of it?

Filmmakers have a lot of fears around this; often they feel in a rush to get their movie available for theatrical or home purchase as soon as possible. Often they fear that people are going to “forget” about their film if they don’t release it as soon as possible after the premiere. Often they regard the festival circuit as a lot of work, and they just want their film released so they can move onto their next thing. Even more often, they are in great financial need following all the money invested into the film, so they feel the need to get it out quickly so they can start making money from it. I can say with great confidence that all of these fears are bad reasons to release a film – and many of the worst release failures I have ever seen comes from exactly these fears (both on the studio/mini-major level AND individual filmmaker level).

First of all, unless you’ve been extremely successful in attracting people to your social media, very few people actually know about your film when it first premieres…so rather than fear those people will forget about your film, your job is to get the film out as wide as possible so you can grow your audience awareness – both through repeated festival marketing and social media. Secondly – yes, it is true that the Festival circuit is a lot of work, but independent filmmakers need to understand that distribution is a business, and you need to commit yourself to it the way you would to any other business endeavor you would undertake and expect to be successful. A business takes time to grow.

The most vexing reason for rushing a film into release – needing to make your money back as quickly as possible – is a perfectly understandable human need and a situation many filmmakers find themselves in. I can just all but guarantee you that if you haven’t taken the time to grow your audience in all the ways possible, your release won’t succeed, and you won’t be making back your money anyway.

Despite all this – despite everything I have laid out in this post thus far – in 2014 I find more and more films going into release and off the festival circuit faster and faster than ever before. The reason for this trend is simple, technological, and perhaps inexorable – and of course it is the continuing rise of Video On Demand (VOD).

Think about how it worked in the (not so) old days. Until very recently, if your film was lucky enough to get a theatrical release offer, it would take the distributor many months to get their marketing/publicity ducks in a row, book theaters, and release the film into theaters. All this time, the film could play festivals. Then, upon theatrical release, a few cities would be lost to festivals…just the usual NY, LA, San Francisco, Boston, Seattle etc. of a traditional indie release. But for the many months between the theatrical release and the DVD release, the film could continue to play all festivals outside of the major cities…because DVD release is a physically demanding process of authoring, dubbing, shipping, shelf space, store stocking, etc. As such, it was completely normal for DVD release to be at least a year after the premiere…just because it all took time. Once the DVD was released, the overwhelming majority of festival programmers would no longer consider the film, so the festival window was all but shut at that point.

But in 2014, day-and-date VOD release with the theatrical release is commonplace, and becoming even more so. So, its not that distributors are any faster in getting the film into theaters (they’re not), but once New York and L.A. open (or shortly after), chances are that the film is also available on various VOD platforms, meaning it becomes available all at once in most North American homes (via cable VOD, application like Apple TV, or various internet platforms). And once that happens, the majority of festival programmers no longer will consider the film, believing (perhaps incorrectly) that the VOD release will cannibalize their audiences and they will no longer be able to fill their theaters with patrons willing to go to see a film at a festival when they can just watch it at home.

In addition, there is a rise in the number of cable TV channels seeking exclusive content for their VOD platforms (i.e. CNN, DirectTV, Starz, etc.) who are acquiring films with or without theatrical releases, and are in a haste to get those films out to their audiences. Exclusive content is the currency of premium platforms these days (there is no better evidence of this than the incredible success of HBO exclusive content of course), and so more and more of these companies are making offers to indie films, largely driven by the VOD.

I am not sure there is a lot independent filmmakers can do to change this trend. Filmmakers are going to continue to want distribution deals and this just may be what distribution deals look like moving forward. Of course, filmmakers can ASK that distributors put off the release as long as possible (as discussed, approx. a year after world premiere), but many distributors may not have reason to agree to that. Keep in mind that the distributor may not have complete control over that release date, in many cases the biggest VOD companies (esp. the big cable providers like Comcast, Time Warner etc.) will also tell the distributors when THEY think the film should be released, and resist the pushback…especially as they tend to want the VOD release to be closely timed with the theatrical.

That doesn’t mean I think filmmakers should cave easily….by all means try to make the distributor understand why you want to control your own festival “window.” Personally, I am consistently impressed with how much the various arms of Public Television (ITVS, Independent Lens, etc.) seem to get this, and basically allow filmmakers to set their own broadcast window relatively far into the future.

So despite my musings to this point, some of you may still be asking, “Why does all this matter? Isn’t being released into the majority of North American homes a good thing?” The biggest problem is that we simply don’t know….because VOD numbers are very rarely publicly reported, in fact almost never.

My strong suspicion is films that are rushed into VOD release perform far less on VOD than they would if they were given the time to find their audience via organic word-of-mouth methods (including festivals). I have certainly seen that with other windows, especially theatrical. As we all know now, a digital release is not enough…a film that is released into the digital marketplace without adequate marketing is just a tree falling in the forest. But ultimately I cannot support that argument with figures because so few companies (nearly none), will tell us what kind of numbers they do on VOD with their films.

Until we get real numbers that allow us to see what VOD numbers really look like for festival-driven independent films….and we can truly assess the marketing impact on those VOD numbers…we will all remain in the dark on this topic to the detriment of independent filmmakers trying to make distribution decisions. I can say for sure that films performing well on the festival circuit are forfeiting their festival revenue by going onto VOD….but until I can compare it with the VOD numbers I cannot determine whether losing that festival revenue is worth it or not.

So, is VOD collapsing the Festival window? Yes, that part is for sure, and we at The Film Collaborative have handled festival distribution on films in the last two years that bear this fact out. Is that a net negative for independent filmmakers? That part I cannot answer yet….although I suspect I already know the answer.

Let this be one more call to our Industry to release the VOD numbers. I would absolutely love to be proven wrong on this.

Jeffrey Winter June 26th, 2014

Posted In: Distribution, DIY, Film Festivals, Marketing

Tags: day and date film release, film festival distribution, Film Festivals, independent film, Jeffrey Winter, maximum time on the festival circuit, The Film Collaborative, VOD

Sneak Peek #4: Carpe Diem for Indie Filmmakers in the Digital/VOD Sector

In this final excerpt from our upcoming edition of Selling Your Film Outside the U.S., Wendy Bernfeld of Amsterdam-based consultancy Rights Stuff talks about the current situation in Europe for independent film in the digital on demand landscape.

There have been many European platforms operating in the digital VOD space for the last 8 years or so, but recent changes to their consumer pricing structures and offerings that now include smaller foreign films, genre films and special interest fare as well as episodic content have contributed to robust growth. European consumers are now embracing transactional and subscription services , and in some cases ad-supported services, in addition to free TV, DVD and theatrical films. Many new services are being added to traditional broadcasters’ offerings and completely new companies have sprung up to take advantage of burgeoning consumer appetite for entertainment viewable anywhere, anytime and through any device they choose.

From Wendy Bernfeld’s chapter in the forthcoming Selling Your Film Outside the U.S.:

Snapshot

For the first decade or so of the dozen years that I’ve been working an agent, buyer, and seller in the international digital pay and VOD sector, few of the players, whether rights holders or platforms, actually made any serious money from VOD, and over the years, many platforms came and went.

However, the tables have turned significantly, and particularly for certain types of films such as mainstream theatrical features, TV shows and kids programming, VOD has been strengthening, first in English-language mainstream markets such as the United States, then in the United Kingdom, and now more recently across Europe and other foreign language international territories. While traditional revenues (eg DVD,) have dropped generally as much as 20% – 30%, VOD revenues—from cable, telecom, IPTV, etc.—have been growing, and, depending on the film and the circumstances, have sometimes not only filled that revenue gap, but exceeded it.

For smaller art house, festival, niche, or indie films, particularly overseas, though, VOD has not yet become as remunerative. This is gradually improving now in 2014 in Europe, but for these special gems, more effort for relatively less money is still required, particularly when the films do not have a recognizable/strong cast, major festival acclaim, or other wide exposure or marketing.

What type of film works and why?

Generally speaking, the telecoms and larger mainstream platforms prioritize mainstream films in English or in their local language. In Nordic and Benelux countries, and sometimes in France, platforms will accept subtitled versions, while others (like Germany, Spain, Italy, and Brazil) require local language dubs. However, some platforms, like Viewster, will accept films in English without dubbed or subtitled localized versions, and that becomes part of the deal-making process as well. This is the case, particularly for art house and festival films, where audiences are not surprised to see films in English without the availability of a localized version.

Of course, when approaching platforms in specific regions that buy indie, art house, and festival films, it is important to remember that they do tend to prioritize films in their own local language and by local filmmakers first. However, where there is no theatrical, TV exposure, or stars, but significant international festival acclaim, such as SXSW, IDFA, Berlinale, Sundance, or Tribeca, there is more appetite. We’ve also found that selling a thematic package or branded bundle under the brand of a festival, like IDFA, with whom we have worked (such as “Best of IDFA”) makes it more recognizable to consumers than the individual one-off films.

What does well: Younger (i.e., hip), drama, satire, action, futuristic, family and sci-fi themes tend to travel well, along with strong, universal, human-interest-themed docs that are faster-paced in style (like Occupy Wall Street, economic crisis, and environmental themes), rather than traditionally educational docs or those with a very local slant.

What does less well: World cinema or art house that is a bit too slow-moving or obscure, which usually finds more of a home in festival cinema environments or public TV than on commercial paid VOD services, as well as language/culture-specific humor, will not travel as well to VOD platforms.

Keep in mind that docs are widely represented in European free television, so it’s trickier to monetize one-offs in that sector, particularly on a pay-per-view basis. While SVOD or AVOD offerings (such as the European equivalents of Snagfilm.com in the US) do have some appetite, monetization is trickier, especially in the smaller, non-English regions. Very niche films such as horror, LGBTQ, etc. have their fan-based niche sites, and will be prominently positioned instead of buried there, but monetization is also more challenging for these niche films than for films whose topics are more generic, such as conspiracy, rom-com, thrillers, kids and sci-fi, which travel more easily, even in the art house sector.

However, platforms evolve, as do genres and trends in buying. Things go in waves. For example, some online platforms that were heavily active in buying indie and art house film have, at least for now, stocked up on feature films and docs. They are turning their sights to TV series in order to attract return audiences (hooked on sequential storytelling), justify continued monthly SVOD fees, and /or increase AVOD returns.

Attitude Shifts

One plus these days is that conventional film platform buyers can no longer sit back with the same historic attitudes to buying or pricing as before, as they’re no longer the “only game in town” and have to be more open in their programming and buying practices. But not only the platforms have to shift their attitude.

To really see the growth in audiences and revenues in the coming year or two, filmmakers (if dealing direct) and/or their representatives (sales agents, distributors, agents) must act quickly, and start to work together where possible, to seize timing opportunities, particularly around certain countries where VOD activities are heating up. Moreover, since non-exclusive VOD revenues are cumulative and incremental, they should also take the time to balance their strategies with traditional media buys, to build relationships, construct a longer-term pipeline, and maintain realistic revenue expectations.

This may require new approaches and initiatives, drawing on DIY and shared hybrid distribution, for example, when the traditional sales agent or distributor is not as well-versed in all the digital sector, but very strong in the other media—and vice versa. Joining forces, sharing rights, or at least activities and commissions is a great route to maximize potential for all concerned. One of our mantras here at Rights Stuff is “100% of nothing is nothing.” Rights holders sitting on the rights and not exploiting them fully do not put money in your pockets or theirs, or new audiences in front of your films.

Thus, new filmmaker roles are increasingly important. Instead of sitting back or abdicating to third parties, we find the more successful filmmakers and sales reps in VOD have to be quite active in social media marketing, audience engagement, and helping fans find their films once deals are done.

To learn more about the all the new service offerings available in Europe to the savvy producer or sales agent, read Wendy’s entire chapter in the new edition of Selling Your Film Outside the US when it is released later this month. If you haven’t read our previous edition of Selling Your Film, you can find it HERE.

Sheri Candler May 15th, 2014

Posted In: book, Digital Distribution, Distribution, International Sales

Tags: attitude shift, AVOD, digital film distribution, dubbing, Europe, Rights Stuff, self distribution, Selling Your Film Outside the U.S., subtitling, SVOD, VOD, Wendy Bernfeld

Our partnership with Devolver Digital and Humble Bundle

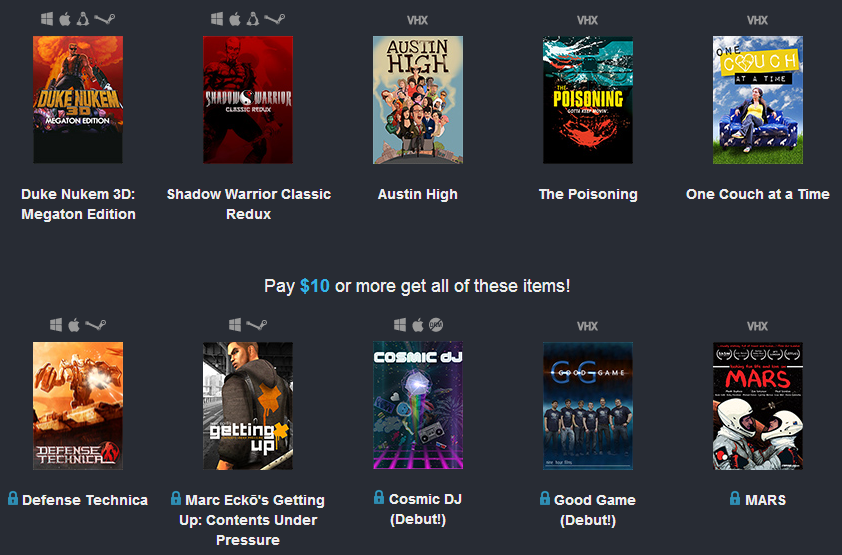

You may remember that I profiled a new digital distributor last year called Devolver Digital who was adding independent films to their existing line up of video games. Yesterday, Devolver announced a new initiative with the folks at Humble Bundle and VHX to release the “Devolver Digital Double Debut” Bundle, a package that includes five games both classic and new and the new documentary Good Game profiling the professional gaming lives of the world-renown Evil Geniuses clan as well as other films on the VHX platform. Proceeds from the bundle benefit the Brandon Boyer Cancer Treatment Relief Fund as well as The Film Collaborative.

You may remember, we are a registered 501c3 non profit dedicated to helping creators preserve their rights in order to be the main beneficiary of their work. We plan to use our portion of the proceeds to fund the new edition of our book Selling Your Film Without Selling Your Soul which will be given away totally free upon its publication. If you’ve ever benefited from our advice, our speaking or our written posts, now is the opportunity to give us support in expanding even more of your knowledge as well as help Brandon Boyer, chairman of the Independent Games Festival (IGF), to help with his astronomical medical bills for cancer treatment.

You can find the Bundle here https://www.humblebundle.com/

It is just this kind of out of the box thinking we love and we couldn’t wait to be involved.

As a follow up to last year’s piece, I asked Devolver Digital founder, Mike Wilson, to fill me in on how the company has ramped up and what this initiative means to gamers, to filmmakers and to the non profits involved.

In the year since Devolver Digital started, how has your games audience transitioned into an audience for the films you handle?

MW: “When we announced the start the Films branch of Devolver Digital last SXSW, we did so for a few reasons. The first was seeing an opening to create a more publishing-like digital distributor for micro-indies. Curation, promotion, transparency, versus what we perceived as the status quo in the VOD distribution space where films were uploaded in bulk and they hope for the best.

One of the biggest reasons, though, was the knowledge that the biggest games platforms that we do 95% of our (very healthy) digital distribution business with on the games side were going to be moving to start delivering films this year. Those platforms are still not very active in the film space, aside from Games/Movies bundle with Humble Bundle that just kicked off. But they are coming, so we’ll know more about how much we are able to turn the indie game-loving audience onto indie films from the fest circuit a little later this year. Our hopes remain high, as these are people who consume an inordinate amount of digital media, are very comfortable with digital distribution and watching films on their computers, and they have a community around independent content from small teams around the world like nothing we’ve seen on the film side. It’s more akin to music fans, turning friends on to great bands they’ve never heard of, and gaining their own cred for unearthing these gems. THIS is what we hope to finally bring to the independent film space, along with these much more sophisticated platforms in terms of merchandising digital content.”

Where are you seeing the greatest revenues from? Cable VOD, online digital, theatrical? Even if one is a considered a loss leader, such as theatrical typically, does it make sense to keep that window?

MW: “We just started releasing films on cable VOD in the Fall, and most of that content didn’t hit digital until recently, so the jury is still a bit out. We are now able to do day-and-date releasing on all platforms as well. We have done limited theatrical, purely as a PR spend on a couple of our strongest releases, and that has been very successful in terms of getting press the films never would have gotten otherwise, but of course it does cost some money and it’s just an investment in the VOD future of the films. There is still no hope of breaking even on a theatrical run for indies as far as we can tell… but at least the cost to entry has gone down and will hopefully continue to do so. For now, we still expect cable and iTunes to be our best performers, until the games platforms start delivering.”

What lead to this recent initiative through Humble Bundle and VHX? Have you partnered with them before?

MW: “Humble Bundle has been a miraculous success on the indie games side. We do bundles with them as often as possible. The key was getting them and VHX to work together, as we needed a high-quality, low-cost streaming solution to deliver what we expect to be hundreds of thousands of ‘keys’ purchased in these bundles.

VHX is pretty forward thinking on this front, again watching the games platforms carefully, and has come up with an elegant solution that works. We have been asking Humble to let us do a movies bundle for at least six months now, since we’ve had such success with them on the games side. They decided that this games+movies bundle would make for a stronger segue. They have delivered other types of media before such as music, soundtracks, audio books, and comedy records, none of which has had anywhere near the attach rate of their games bundles, but are still quite successful when compared to other digital options for those businesses. We expect films to do better than any of these other ancillary avenues they’ve tried.”

What is the split for all involved? There are several entities sharing in this Pay What You Want scenario, so is this mainly to bring awareness and publicity for all involved or is revenue typically significant?

MW: “In this particular bundle, since all the games and films are roughly $10 values, we’ve split it equally. So you have 10 artists splitting what will probably average out at $5 or $6 bucks a ‘bundle.’ But the volume will be so high, we still expect each of these filmmakers to make more money in these 10 days than they will likely make on their entire iTunes run.

And, TONS of new people watching their movies who would never have found it otherwise, which as a filmmaker, I know counts for as much as the money. I’d personally much rather have my film (and one of the films in the bundle is the last one I produced) in a bundle like this than shoveled onto subscription based VOD, and I know it’ll make more money and get more views.” [editor’s note: Those purchasing the bundle get to choose how the contribution is split between Devolver, Humble Bundle and the charitable contributions.]

Why did you decide to include a donation aspect to the Bundle? Is that an incentive to pay a higher price for the bundle?

MW: “Humble is committed to supporting charities with their platform. It’s part of the magic (other than the tremendous value) that makes their 4 million + regular customers feel really good about taking their chances on games (and other media) they’ve never heard of.

From Devolver’s standpoint, our last weekly games bundle on Humble resulted in nearly $150k for charity in addition to our developers all making a nice payday. It’s a miracle of a win-win-win. In this case, hopefully a lot of filmmakers will feel compelled to try this method out since it’s new, an incredible value, and will support TFC, who have helped so many filmmakers learn to navigate these murky waters. And there’s a very local, very specific cause on the games side, helping a champion of Indie Games like Brandon Boyer overcome his devastating personal situation of fighting cancer while battling mounting medical bills. It just feels good, and this is a big reason Devolver is such a fan of Humble Bundle.”

We can’t think of a better situation than contributing money to receive fantastic games and films while helping those who enable the creators to reach new audiences, keep rights control of their work and celebrate their creativity. Check out the Devolver Digital Double Debut on the Humble Bundle site. We thank Devolver, Humble Bundle and VHX for allowing us to partner with them on this initiative.

Sheri Candler March 7th, 2014

Posted In: Digital Distribution, Distribution

Tags: Brandon Boyer, cancer, Devolver Digital, Devolver Digital Double Debut, documentary, Evil Geniuses, Good Game, Humble Bundle, independent film, Independent Games Festival, iTunes, Mike Wilson, non profit, Selling Your Film Without Selling Your Soul, Sheri Candler, The Film Collaborative, theatrical distribution, VHX, video games, VOD

SXSW Wrap up

By Bryan Glick

Just because you didn’t premiere at Sundance or Cannes doesn’t mean you’re out of luck. Though not living up to the sales quota of last year, there are two dozen premiere films from SXSW that have sold in the U.S. Here’s a wrap up of the film sales from SXSW.

Anchor Bay stuck with their niche and took North American rights to two midnight entries Girls Against Boys and The Aggression Scale, while Cinedigm (who recently acquired New Video) went for U.S. Rights to In Our Nature and the midnight audience award winner Citadel. Pre-fest buys include Crazy Eyes which went to Strand Releasing for the U.S. and Blue Like Jazz courtesy of Roadside Attractions. Blue Like Jazz was promptly released and has since grossed close to $600,000 theatrically in North America. Lionsgate is handling DVD, VOD, and TV through their output deal. Meanwhile Crazy Eyes just started its theatrical run on two screens pulling in a little under $5,000 in its first week.

Millennium Entertainment took the gross out comedy The Babymakers and yet another midnight film, The Tall Man was bought for the U.S. by Imagine. If you’re a midnight film at SXSW, odds are things are looking up for you. The same could be said for The Narrative Spotlight section where two thirds of the films have since been acquired including The Do-Deca Pentathlon taken by Red Flag Releasing and Fox Searchlight. Red Flag is handling the theatrical (The film grossed $10,000 in its opening weekend off of 8 screens) while Fox Searchlight will cover the other ancillary markets. The Narrative Spotlight Audience Award Winner, Fat Kid Rules the World was bought by Arc Entertainment for North America and Frankie Go Boom was the first film to reap the benefits of a partnership with Variance and Gravitas. It will be released in the U.S. on VOD Platforms in September via Gravitas followed by a theatrical in October courtesy of Variance.

And though they did not premiere at SXSW, both Dreams of a Life and Electrick Children had their U.S. premieres at the festival and have since been bought. U.S. rights to the documentary Dreams of a Life were acquired by Strand Releasing. Meanwhile, Electrick Children was snatched up for North America by Phase 4. Phase 4 also nabbed North American rights to See Girl Run.

Sony Pictures and Scott Rudin took remake rights to the crowd pleasing Brooklyn Castle while HBO acquired domestic TV rights to the doc The Central Park Effect. Meanwhile, after showing their festival prowess with their success of last year’s breakout Weekend (which was sold by The Film Collaborative’s Co President, Orly Ravid), Sundance Selects proved they were not to be outdone and got the jury prize award winner Gimme The Loot for North and Latin America. Fellow Narrative competition entry Gayby sold its U.S. rights to Wolfe Releasing, a low 6-figure deal. That deal was also negotiated by TFC’s Orly Ravid. And not to be outdone, competition entry, Starlet rounds out the Narrative Competition films to sell. It was acquired for North America by Music Box Films.

S2BN Films’ Big Easy Express became the first feature film to launch globally on iTunes. It will be released in a DVD/Blu-Ray Combo pack on July 24th by Alliance Entertainment followed by a more traditional VOD/Theatrical rollout later this year.

Other key deals include Oscilloscope Laboratories acquiring North American Rights to Tchoupitoulas, Snag Films going for the US Rights of Decoding Deepak, Image Entertainment’s One Vision Entertainment Label aiming for a touchdown with the North American rights to The Last Fall and Factory 25 partnering with Oscilloscope Labs for worldwide rights to Pavilion.

Final Thoughts: Thus far less than one third of the films to premiere at SXSW have been acquired for some form of domestic distribution. While that may seem bleak, it is a far better track record than from most festivals. In The U.S., SXSW is really second to only Sundance in getting your film out to the general public. The festival also takes a lot of music themed films and more experimental projects with each theme getting its own designated programming section at the festival. Those films were naturally far less likely to sell. The power players this year were certainly Anchor Bay and Cinedigm each taking multiple films that garnered press and/or have significant star power. Other companies with a strong presence and also securing multiple deals were Strand Releasing and Oscilloscope. Notably absent though is Mark Cuban’s own Magnolia Pictures and IFC (Though their sister division Sundance Selects made a prime acquisition). Magnolia did screen Marley at the festival, but the title was acquired out of Berlin, and IFC bought Sleepwalk With Me at its Sundance premiere.

While it is great that these films will be released, it also worth mentioning what is clearly missing from this post. There is almost no mention of how much these films were acquired for. The fact is films at SXSW don’t sell for what films at Sundance do and it is safe to assume that the majority of these deals were less than six figures with almost nothing or nothing at all getting a seven figure deal.

As for the sales agents, Ben Weiss of Paradigm and Josh Braun of Submarine were working overtime, with each negotiating multiple deals.

SUNDANCE UPDATE: Since the last Sundance post, there have been two more films acquired for distribution. Both films premiered in the World Documentary Competition. The Ambassador negotiated successfully with Drafthouse Films who acquired U.S. rights for the film which will premiere on VOD August 4th followed by a small theatrical starting August 29th. Also finding a home was A Law in These Parts which won the jury prize at this year’s festival. Cinema Guild will be releasing the film in theaters in the U.S. starting on November 14th. 75% of the films in the World Documentary Competition now have some form of distribution in the US.

A full list of SXSW Sales deals from SXSW is listed below. Box office grosses and release dates are current as of July 12th.

| Film | COMPANY | TERRITORIES | SALES COMPANY | Box Office/ |

| Release | ||||

| See Girl Run | Phase 4 | North America | Katharyn Howe and Visit Films | |

| Starlet | Music Box Films | North America | Submarine | |

| The Babymakers | Millenium | US | John Sloss and Kavanaugh-Jones | Theatrical Aug 3rd |

| DVD Sept 10th | ||||

| Citadel | Cinedigm | US | XYZ Films and | |

| UTA Independent Film Group. | ||||

| The Aggression Scale | Anchor Bay | North America Blu-ray/dvd | Epic Pictures Group | |

| Girls Against Boys | Anchor Bay | North America | Paradigm | |

| Tchoupitoulas | Oscilloscope | North America | George Rush | |

| Gimme The Loot | Sundance Selects | North and Latin America | Submarine Entertainment | |

| The Tall Man | Image Entertainment | US | CAA and Loeb & Loeb | August 31st |

| Elektrick Children | Phase 4 | North America | Katharyn Howe and Paradigm | |

| Blue Like Jazz | Roadside | US | The Panda Fund | $595,018 |

| Crazy Eyes | Strand | US | Irwin Rappaport | $4,305 |

| In Our Nature | Cinedigm | US Rights | Preferred Content | |

| Brooklyn Castle | Sony Pictures | Remake Rights | Cinetic Media | |

| Scott Rudin | ||||

| The Central Park Effect | HBO | US TV | Submarine Entertainment | |

| Gayby | Wolfe | US | The Film Collaborative | |

| The Do Decca Pentathlon | Fox Searchlight | North America | Submarine Entertainment | $10,000 |

| Red Flag Releasing | ||||

| Fat Kids Rules The World | Arc Entertainment | North America | Paradigm | |

| Decoding Deepak | Snag Films | US | N/A | October |

| Big Easy Express | Alliance Entertainmnet | Worldwide DVD/VOD | Paradigm and S2BN | July 24th DVD/Blu-Ray |

| Big Easy Express | S2bn | Worldwide Itunes | Paradigm and S2BN | Available Now |

| The Last Fall | Image Entertainment | North America | N/A | |

| Pavillion | Factory 25 | Worldwide | N/A | Jan |

| Oscilloscope Labs | ||||

| Frankie Go Boom | Gravitas | US Rights | Reder & Feig and Elsa Ramo | VOD Sept |

| Variance | Theatrical Oct | |||

| Dreams of a Life | Strand releasing | US Rights | eone films international | Aug 3rd |

Orly Ravid July 18th, 2012

Posted In: Distribution, Film Festivals, Theatrical

Tags: A Law in These Parts, Alliance Entertainment, Anchor Bay, Arc Entertainment, Ben Weiss, Big Easy Express, Blue Like Jazz, Brooklyn Castle, Bryan Glick, Cannes, Cinedigm, Cinema Guild, Citadel, Crazy Eyes, Decoding Deepak, Drafthouse Films, Dreams of a Life, Electrick Children, Factory 25, Fat Kid Rules the World, Fox Searchlight, Frankie Go Boom, Gayby, Gimme The Loot, Girls Against Boys, Gravitas, HBO, Image Entertainment, Imagine, In Our Nature, Josh Braun, Lionsgate, Millenium Entertainment, Music Box Films, Orly Ravid, Oscilloscope, Phase 4, Red Flag Releasing, S2BN Films, Scott Rudin, Snag Films, Sony Pictures, Starlet, Strand Releasing, Submarine, Sundance, SXSW, Tchoupitoulas, The Aggression Scale, The Ambassador, The Babymakers, The Central Park Effect, The Do Deca Pentathlon, The Film Collaborative, The Last Fall, The Tall Man, Variance, VOD, Wolfe Releasing

Navigating digital distribution, 11 things to consider

This post by Orly Ravid was published originally on the Sundance Artists Services blog April 15, 2012

1. CARVE OUT DIY DIGITAL:

Distributors and Foreign Sales companies alike often want ALL RIGHTS and including ALL DIGITAL DISTRIBUTION RIGHTS.

No matter what, at least CARVE OUT the ability to do DIY Digital Distribution yourself with services such as: EggUp, Distrify, Dynamo Player, and/or TopSpin, off your own site, off your Facebook page, and also directly to platforms that you can access. Platforms and services can almost always Geo-Filter thereby eliminating conflict with any territories where the film has been sold to a traditional distributor and often times a distributor will not mind that a filmmaker sells directly to his/her fans as well in any case.

2. PLATFORMS ≠ AGGREGATORS ≠ DISTRIBUTORS:

Platforms are places people go to watch or buy films. Aggregators are conduits between filmmakers/distributors and platforms. Aggregators usually focus more on converting files for and supplying metadata to platforms and that’s about it. Marketing is rarely a strong suit or focus for them but it should be for a distributor, otherwise what’s the point? Aggregators usually don’t need rights for a long term and only take limited rights they need to do the job. Distributors usually take more rights for longer terms. Sometimes distributors are DIRECT to PLATFORMS and sometimes they go through AGGREGATORS. It makes a difference because FEES are taken out every time there is a middleman. Filmmakers should want to know the FEE that the PLATFORM is taking (because it’s not always the same for all content providers though usually it is other than for Cable VOD, for example) and know if a distributor is direct with platforms or goes through an aggregator. Also, filmmakers should have an understanding what each middleman is doing to justify the fee. On the aggregator/distributor side, we think 15% is a better fee than 50%, so have an understanding of what services are included in the fee. If a distributor is not devoting any time or money to marketing and simply dumping films onto platforms, then one should be aware of that. Ask for a description in writing of what activities will be performed.

3. THINK OF DIGITAL PLATFORMS AS STORES AND CUSTOMIZE A PLAN THAT IS RIGHT FOR YOUR FILM:

A film should try to be available everywhere however sometimes that is too costly or not possible and when that is the case one should prioritize according to where the film’s audience consumes media. Think of digital platforms as retail stores. Back in the DVD days (which are almost gone), one would want a DVD of an indie film in big US chains such as Blockbuster and Hollywood Video but especially a cool, award winning indie would do well in a 20/20 or Kim’s Video store because those outlets were targeting a core audience. With digital, it’s the same. While many filmmakers want to see their films on Cable VOD, some films just don’t work well there and delivery is expensive. Some films make most of their money via Netflix these days and won’t do a lick of business on Comcast. Other films do well on iTunes and some die there whereas they might actually bring in some business via Hulu or SNAG. Docs are different from narrative and niches vary. Know your film, its audience’s habits and resolve a digital strategy that makes sense. If money or access is an issue, then be strategic in picking your “stores” and make your film available where it’s most likely to perform. It may not be in Walmart’s digital store or Best Buy’s. Above all, if you dear filmmaker have a community around you (followers, a brand), your site(s) and networks may be your best platform stores of all. Though there is something to be said for viewing habits so I do recommend always picking at least a couple other key digital storefronts that are known and trusted by your audience.

4. TIP FOR CABLE VOD LISTINGS:

By now many of you may have heard that it’s hard to get films marketed well on Cable VOD platforms. Often the metadata either isn’t entered or entered incorrectly and it’s nearly impossible to fix after it goes live. Hence, oversee the metatags submitted for your film and check immediately upon release. Also, since genre/category folders and trailer promotion are not always an option for every film, it is the case that films with names starting in early letters of the alphabet (A-G) or numbers can perform better. Then again, there’s a glut of folks trying that now so the cable operators are getting wise to this and not falling for it. All the more reason to focus on marketing, marketing, marketing your title, so audiences are looking for it and not just stumbling upon your film in the VOD menu. There are only going to be more films to choose from in the future, not fewer.

5. ART for SMALL:

Filmmakers, if there is one thing I must impart to you once and for all it’s this: TAKE GOOD PHOTOGRAPHY!!! Take it when making your film. Remember, most marketing imagery if not all for digital distribution (which will be all of “home entertainment”) must work SMALL so create key art and publicity images that also work well small and in concert with the rest of your campaign. Look at your key art as a thumbnail image and make sure it is still clearly identifiable.

6. KNOW YOUR DIGITAL DISTRO GOALS AND PLAN AHEAD:

I have seen distribution plans wasted because a vision for the film’s path was not resolved in time to actualize it properly. If your film is ripe for NGO or corporate sponsorship and you want to try that, you will need loads of lead time (6-12 months at least!) and a clear distribution plan to present to potential sponsors (who will always need to know that before agreeing). If making money is a top concern, then know how YOUR FILM’s release is mostly likely to do that and plan accordingly. It may be by collapsing windows or it may be by expanding them. All films are different and that’s why it’s best to look at case studies of films with similar appeal to yours. And if showing the industry that your film is on iTunes matters to you for professional reasons more than financial then know that is your motivator but know that getting a film onto iTunes does not automatically lead to transactions, marketing does.

7. TIMING IS EVERYTHING | WINDOW WATCHING:

Digital distribution often has to be done in a certain order if accessing Cable VOD is part of your plan. That is not the only reason to consider an order and an order is not always needed, but it can be a consideration. Sometimes Cable VOD is not an option for a film (films often need a strong theatrical run before they can access Cable VOD) and, in this case, the order of digital is more flexible and one can be creative or experiment with timing and different types of digital. However, Cable VOD’s percentage share of digital distribution revenues is still around 70% (it used to be nearer to 80%) so if it’s an option for your film, it’s worth doing, at least for now.

It is very often the case that if your film is in the digital distribution window before Cable VOD (on Netflix for example), that will eliminate or at least dramatically diminish the potential that Cable MSO’s (Multi System Operators) will take the film or even that an intermediate aggregator will accept it. There is more flexibility with transactional EST (electronic sell through) / DTO (download to own) / DTR (download to rent) services such as iTunes but much less flexibility with YouTube (even a rental channel) or subscription or ad-supported services such as Netflix (subscription) or Hulu (which is both). Films that opted to be part of the YouTube/Sundance rental channel initiative (such as Children of Invention) could not get onto Cable VOD after. The Film Collaborative has to hold off on putting films in its YouTube Rental Channel if cable VOD is part of the plan. Of course, there are exceptions to every rule due to relationships or a film proving itself in the marketplace, but better to plan ahead than be disappointed.

Companies such as Gravitas are also programmers for some of the MSOs so they have greater access to VOD, but they too discourage YouTube rental channel distribution before the Cable VOD window and they do Netflix SVOD (Subscription Video on Demand), distribution after. In general, people often do transactional platforms first and ad-supported last with Netflix being in the middle unless it’s delayed because of a TV deal for example. This is not always the case and some distributors have experienced that one platform can drive sales on another but in my opinion it depends on the film and habits of its audience. You should know that Broadcasters such as Showtime will pay more if you do your Netflix SVOD after their window rather than before.

WINDOW WATCHING: If you stream or distribute digitally before Cable VOD for example, you will often lose that opportunity so timing is key. And of course festivals will often not program a film if it’s available digital or at all commercially. For documentaries, one has to be mindful about the EDUCATIONAL window (though this usually most relates to DVD). Broadcast and SVOD are competitive with each other so compare options in terms of fees and timing for best distribution results and maximum benefits. Sometimes VOD is best BEFORE theatrical (it’s called Reverse Windowing and Magnolia does that for example, sometimes). Sometimes Ad Supported VOD (AVOD or FOD (free VOD)) (e.g. regular HULU) or Broadcast airings are seen as useful for maximum awareness, relatively significantly revenue generating, and/or good for driving transactional VOD. Whereas sometimes AVOD or FOD is seen as cannibalizing business and is delayed. So again, know your strategy based on both your audience / consumer and your goals.

8. THE DEVIL IS IN THE DEFINITIONS

DEVIL IS IN THE DEFINITION: Remember that the term VOD means or includes different things to different users. The terms in the space are becoming more customary but they are not fully standardized so be sure to have ALL terms related to digital rights DEFINED. And the space keeps changing so be sure to stay current.

There is no standard yet for definitions of digital rights. IFTA (formerly known as AFMA) has its rights definitions and for that organization’s signatories there is therefore a standard. But many distributors use their own contracts with a range of definitions that are not uniform. When analyzing distribution options, be aware that terms such as VOD can mean different things to different people and include more or fewer distribution rights and govern more or fewer platforms.

Consider the term “VOD”. In some contracts, it’s not explicitly defined and hence can mean anything and everything. IFTA is clear to categorize it as a PayPerView Right (Demand View Right) and limit it to: “transmission by means of encoded signal for television reception in homes and similar living spaces where a charge is made to the viewer for the rights to use a decoding device to view the Motion Picture at a time selected by the viewer for each viewing”.

However in some contracts, it’s defined as “Video-on-Demand Rights,” meaning a function or service distributed and/or made available to a viewer by any and all means of transmission, telecommunication, and/or network system(s) whether now known or hereafter devised (including, without limitation, television, cable, satellite, wire, fiber, radio communication signal, internet, intranet, or other means of electronic delivery and whether employing analogue and/or digital technologies and whether encrypted or encoded) whereby the viewer is using information storage, retrieval and management techniques capable of accessing, selecting, downloading (whether temporarily or permanently) and viewing programming whether on a per program/movie basis or as a package of programs/movies) at a time selected by the viewer, in his/her discretion whether or not the transmission is scheduled by the operator(s)/provider(s), and whether or not a fee is paid by the viewer for such function/service to view on the screen of a television receiver, computer, handheld device or other receiving device (fixed or mobile) of any type whether now known or hereafter devised. Video-on-Demand includes without limitation Near VOD (“NVOD”,) Subscription Video-on-Demand (“SVOD”,) “Download to burn”, “Download to Own”, “Electronic Sell Through” and “Electronic Rental,” for example. This example includes everything and your kitchen sink.

One has to ask if a definition of VOD or another type of digital right includes “SVOD” (Subscription Video on Demand) and includes subscription services such as Netflix and Hulu Plus. Why does this matter? Well if the fee to the distributor and/or to you is the same either way then it may not matter. If there’s a difference in fees depending on the nature of distribution, then it will. Recently an issue in a deal came up with respect to distinguishing ad-supported specifically from general “free-streaming”. Is ad-supported governed by a “free-streaming” rights reference? Why wonder, Just spell it all out; better to be safe than _____.

Another example, if a contract notes a distributor has purchased “VOD Rights” but does not define them, or defines them broadly, then do they have mobile device distribution rights as well? The words “Video-on-Demand” sometimes are used only to refer to Cable Video on Demand and other times much more generally. In a “TV Everywhere” (and hence film everywhere) multi-platform all-device playable universe, the content creator needs to know.

The devil is in the definition that you must read carefully BEFORE you sign on the dotted line. Know what you want for and can do for your film in terms of distribution and carve it up and spell it out.

9. PLAN FOR FUTURE: Digital distribution in Europe is not as mature as it is in the US but it’s growing. The key platforms and categories of VOD now may not be key down the road. Again, do deals wisely and plan for the future. One way may be to set revenue thresholds for contract terms to continue. Or allow for terms to be reviewable and adjustable into the Term.

10. IF YOU CANNOT MAKE PIRACY YOUR FRIEND by lets say monetizing it or using it to drive awareness… then think about shortening the time between your release windows and when you first start handing out DVDs and getting a lot of buzz for your film. Many folks would happily consume your film legitimately if given the opportunity in time. Some piracy cannot be helped and can either be monetized or just enjoyed. There are anti-piracy services one can employ as well. In my experience, DVD is a bigger source of piracy than digital.

11. KNOW YOUR RIGHTS / OTHER WAYS TO PROTECT YOURSELF IN A DEAL: Before giving rights away for longer periods of time think about the future. For example, the category of DTR (download-to-rent) is growing as is SVOD (Subscription VOD). So you will want to make sure your splits are strong in your favor, especially for growing categories, and Cable VOD and transactional DTO (download-to-own) or EST (electronic sell through) are strong too and btw, some of these terms include each other. Instead of merely focusing on rights classes even within the category of VOD one may also want to address gross revenues so that one can get an appropriate share of revenues at certain gross revenue thresholds. You may want to have terms of a deal be reviewable for contracts with a longer Term.

Access to individual consultations for your film is available to members of The Film Collaborative starting at the Conspirator level. We also offer a menu of low cost festival and digital distribution services, marketing education and services, and graphic design for key art and websites. The Film Collaborative is dedicated to helping independent filmmakers receive the maximum benefit from their dedicated and creative work without the need to own rights. Send us a message to discuss your needs.

Orly Ravid May 8th, 2012

Posted In: Digital Distribution, Distribution, Distribution Platforms, DIY, Marketing

Tags: aggregators, definitions, Digital Distribution, digital platforms, digital rights, digital services, fees, goals, key art, Orly Ravid, piracy, protect yourself, The Film Collaborative, VOD, windows

Subtitles in Digital America

Recently I was invited to be on a panel at the International Film Festival Rotterdam (IFFR) and participate in their mentoring sessions and the lab at Cinemart. Great experience. I am always amazed by the difference between the US and Europe. The whole government funding of films and new media initiatives as our government is about to shut down. Well, their policies and practices do take their own financial toll too but one I think is worth it. For all my europhileness I have to note that the Europeans can be just as guilty of not wanting to watch subtitles in fact some countries dub films instead. And of course we know that Hollywood is big business in Europe too. But all in all, art house cinema seems to reach more broadly in Europe and even some parts of Asia than it does in the US. Films in Cannes and other top fests can sell all over Europe and never in the US or success in opening theatrically only in NY and maybe LA and overall it seems to me box office is generally down for foreign language cinema.

International filmmakers want US distribution and it was painful for me to discuss their prospects at IFFR because for so many, the prospects are slim. But this one’s for you! (Please note this blog is focused on digital distribution and not healthy categories for foreign language cinema such as Non Theatrical including Museums, Films Festival, Colleges, Educational / Institutional).

Cable VOD was 80% of the digital revenue in the US in 2009 but it’s now declining little by little, now estimated to be in the high 70’s (approx 77%) and may decline further still. The reason for this change, which is expected to continue, is that Internet based platforms are growing. Regarding FOREIGN LANGUAGE ON CABLE VOD: Distributors and aggregators agree that foreign language cinema is very hard to get onto Cable VOD platforms and slots for non-English cinema are reserved generally for marquee driven films and/or films with a real hook (name cast/director, highly acclaimed, genre hook). A big independent Cable VOD aggregator notes a real struggle in getting foreign language films to perform on Cable VOD and even Bollywood titles that had wide theatrical distribution and a box office of upwards of $1,000,000 still perform poorly (poorly means 4-figure revenue, 5-figure tops). They have had some success with foreign martial arts films and will continue with those in the foreseeable future. Time Warner Cable (TWC) remains more open to foreign language cinema though it plays the fewest films, a range between 190 – 246 at any given time (with a shelf life usually of 60 days and with 2/3rd of the content seeming to be bigger studio product, and the rest indie). By comparison Charter and AT&T play about 1,000 and Verizon plays 2,000, and Comcast plays about 4,000. [See below for the 2010 breakdown of Cable subscription numbers.] Hence, individual titles may perform better on Time Warner Cable for obvious reasons, Comcast may have more subscribers but there’s less competition and TWC is in New York, the best demographic for art house cinema.

Generally speaking, platforms overall are far more receptive to foreign films following the recent success of DRAGON TATTOO, TELL NO ONE, IP MAN, etc. than they have ever been before. However as one can see from the titles noted, foreign genre films are preferred because they have the opportunity to reach broader audiences than the usual foreign film. Genres that reportedly work include: sci-fi, thriller/crime, action, and sophisticated horror. Dramas have had limited success, and comedies often don’t translate, nor does most children’s content. In regard to Cable VOD – foreign box office is becoming an important proxy, because the marketing and pr tend to build US awareness on the larger titles prior to being available here. Many companies have built very successful VOD businesses pursuing a day and date theatrical or DVD strategy. Again, genre films work best, with horror and sci fi being the top performers. 3 of the top 10 non-studio titles in 2010 were foreign language subtitled releases. Small art house distributors say that at most it’s a small dependable revenue stream via services such as INDEMAND http://www.indemand.com (iN DEMAND’s owners are and it services Comcast iN DEMAND Holdings, Inc., Cox Communications Holdings, Inc., and Time Warner Entertainment – Advance/Newhouse Partnership.) Distributors and aggregators all site Time Warner as being far more open to foreign language cinema than Comcast, because it’s urban focused (NY, LA, etc) not heartland focused as Comcast is.

In terms of these titles finding their audiences on Cable VOD, Comcast announced improved search functionality by being able to search by title and Cable VOD is aware of its deficiencies and is said to be improving in terms of marketing to consumers but Cable VOD is still infamous for its lack of recommendation engines and discovery tools. Key aggregators work to have films profiled in several categories and not just the A-Z listing.

Top 25 Multichannel Video Programming Distributors as of Sept. 2010 – Source NCTA (National Cable Television Association)

| Rank | MSO | BasicVideoSubscribers |

| 1 | Comcast Corporation | 22,937,000 |

| 2 | DirecTV | 18,934,000 |

| 3 | Dish Network Corporation | 14,289,000 |

| 4 | Time Warner Cable, Inc. | 12,551,000 |

| 5 | Cox Communications, Inc.1 | 4,968,000 |

| 6 | Charter Communications, Inc. | 4,653,000 |

| 7 | Verizon Communications, Inc. | 3,290,000 |

| 8 | Cablevision Systems Corporation | 3,043,000 |

| 9 | AT&T, Inc. | 2,739,000 |

| 10 | Bright House Networks LLC1 | 2,194,000 |

| 11 | Suddenlink Communications1 | 1,228,000 |

| 12 | Mediacom Communications Corporation | 1,203,000 |

| 13 | Insight Communications Company, Inc. | 699,000 |

| 14 | CableOne, Inc. | 651,000 |

| 15 | WideOpenWest Networks, LLC1 | 391,000 |

| 16 | RCN Corp. | 354,000 |

| 17 | Bresnan Communications1 | 297,000 |

| 18 | Atlantic Broadband Group, LLC | 269,000 |

| 19 | Armstrong Cable Services | 245,000 |

| 20 | Knology Holdings | 231,000 |

| 21 | Service Electric Cable TV Incorporated1 | 222,000 |

| 22 | Midcontinent Communications | 210,000 |

| 23 | MetroCast Cablevision | 186,000 |

| 24 | Blue Ridge Communications1 | 172,000 |

| 25 | General Communications | 148,000 |

FOREIGN LANGUAGE CINEMA VIA OTHER DIGITAL PLATFORMS and REVENUE MODELS:

DTO (Digital Download to Own (such as Apple’s iTunes which rents and sells films digitally) – this space has been challenging for foreign films in the past, and most services do not have dedicated merchandise sections. Thus, the only promo placement available is on genre pages, so the films need to have compelling art and trailer assets to compete. iTunes and Vudu (now owned by WALMART – see below) are really interested in upping the ante on foreign films over the next 12 months. Special consideration will need to be made for the quality of technical materials, as distributors have encountered numerous problems making subtitled content work on these providers.

SVOD (Subscription VOD such as NETFLIX’s WATCH INSTANTLY) – this space is probably the best source of revenue for foreign content because the audience demos skew more sophisticated and also end users are more inclined to experiment with new content niches. Content in this space should have great assets and superior international profile (awards, box office), and overall should evoke a “premium feel” for the right titles, license fees can be comparable to high end American indies. Appetite for foreign titles will increase as the price for domestic studio content continues to accelerate. Genres are a bit broader than VOD/DTO, but thrillers, sci fi and action still will command larger sums ($). Good Festival pedigree (especially Cannes, Berlin, Venice, Sundance, etc.) will also command higher prices. Overall, it’s a great opportunity as long as platforms keep doing exclusive deals. NETFLIX has surpassed 20,000,000 subscribers and a strong stock price and is in a very competitive space and mood again. (See more below). Hulu expects to soon reach 1,000,000 subscribers “to approach” half a billion in total revenues (advertising and subscription combined) in 2011, up from $263 million in 2010. That’s from $108 million in 2009. (see more below)