MAY 2025 UPDATE: A Practical Guide to Distributing Your Film Internationally: Who Else is Out There in the International Digital Space Beyond Just the Big Globals?

Mobile Phone Users: This page is best viewable by turning your phone horizontally (in landscape mode).

Note: This article was originally published in May 2020, updated in March 2021, and again in May 2024. Needless to say, things have continued to evolve at lightning speed in the digital sector, so we’ve asked our dear friend and colleague Wendy Bernfeld, founder of Rights Stuff, not only to assist with updating various international platforms in the TFC’s Digital Distribution Guide, but also to summarize, in this blog post, key changes in the international landscape and buying platforms abroad.

Note: This article was originally published in May 2020, updated in March 2021, and again in May 2024. Needless to say, things have continued to evolve at lightning speed in the digital sector, so we’ve asked our dear friend and colleague Wendy Bernfeld, founder of Rights Stuff, not only to assist with updating various international platforms in the TFC’s Digital Distribution Guide, but also to summarize, in this blog post, key changes in the international landscape and buying platforms abroad.

Which platforms closed, or radically reduced their indie buying? Which have been bought or merged, changed their content genres, altered their business models (B2B, B2C), or expanded or curtailed the regions they operate in? And which new (interesting! credible/reputable!) platforms are out there with an appetite for indie films?

As before, she looks beyond just the Big Global players to the others abroad who compete or complement them, with emphasis on the SVOD windows.

(In the future we may also request her to update her TFC blog article on FAST/AVOD in Europe, but as that is a later window and not as immediately compelling for indies with only a few films and less than 8 years old, we concentrate in this article mainly on SVOD and hybrid platforms).

Wendy specializes in Library and Original Content acquisition/distribution and international strategy / deal advice for traditional media (film, TV, pay TV), digital media (Internet/IPTV, VOD, OTT/devices), and web/cross-platform programming. She is also active on various film festival / advisory boards, such as IDFA and TFC!

Follow her on LinkedIn: Wendy Bernfeld.

So, without further ado, here is Wendy’s update:

Wendy:

I’m not a classic distributor or sales agent that takes IP, but rather an independent digital sector consultant. I have roots as a lawyer and senior buyer / in-house executive in the traditional film/tv sector, first in Canada and then since the ’90s based in Europe, increasingly focused on digital sector and streamers internationally, with emphasis on EMEA (Europe, Middle East, and Africa).

Most of the time I’m a buyer / business development executive for platforms, often before they launch (curation, sourcing, acquisition, deals), or afterwards when they roll out into new regions, genres, and business models. The rest of the time I’m on the filmmakers’ side of the table, helping rightsholders / producers / sales agents / festivals deal with distribution platforms and alternatives going beyond the usual suspects.

A) Intro

1) What’s shifted the past few years

For a few years, we were in the heyday of the streamers having hearty appetites for buying indie films, including docs and series – particularly post-COVID and during/after the writers’ strike and production slowdowns. As production stalled, and competition among streamers increased, more streamers turned to acquisitions of ready-made (current and/or library titles) to round out their programming. Non-exclusive licensing allowed multiple deals and windows, as per my last article. The sweet spot for SVOD acquisitions, aside from premium/first-run, opened up for indie films 2-5 years old, especially from curated platforms overseas, and older titles (6+ years) could also find a home in SVODs and/or AVODs.

Last year (particularly), when the choices and costs became too much for both consumers and platforms (too many SVODs, “subscription fatigue”), along with economic challenges overall, the tide turned and streaming platforms began contracting, consolidating, reorganizing, and cutting back. But this also led to an uptick of other business models (AVOD, FAST, ad-supported “tiers,” and hybrid offerings). This trend has continued, spreading further overseas. However, in this article we will focus more on the SVOD licensing opportunities still out there, with an emphasis on arthouse/indie film/festival titles, docs, and niche/genre features.

2) Approach

As before—and now more than ever—it is important, in my view, to look beyond mere traditional and “Big Global” platform buyers (Tier 1 types) to their head-on international competitors, such as telecom, cable, and pay/TV OTT services (Tier 2 types) and then to the complementary thematic or niche sites (Tier 3 types): those who also buy or fund but are lesser known and attend markets/festivals less frequently.

More recently, the free-with-ads sector, originally AVOD (Tier 4), strengthened with the addition of free linear FAST channels and combined AVOD/FAST offerings, first in the U.S. and now abroad. As mentioned before, I won’t go into this tier in too much detail, but I will give a brief update, because it may affect your deals in other tiers.

If traditional buyers or Big Globals have not led to a “Holy Grail”-type of deal for you (or you feel the film has other goals/audiences), then the Tier 2 and 3 types abroad can be a worthy pursuit, at least for those willing to dedicate time and attention to it.

Best results arise from:

- Researching the target platforms

- “Matchmaking” your film (realistically to those on their site, and/or their type of audience, kind of like online dating!)

- Doing short, personalized, tailored outreaches, not Mail Chimp-style mass mailings

i.e., contextualizing your film to their platform, so as to help do the buyers job for them

This can be either DIY (since most of these platforms will deal direct) and/or with your sales reps or agents, in a hybrid manner, to help cover all the bases in this industry-wide time of blurred windows, rights, and international audiences. 100% of zero is zero!

3) Who Are They? Snapshot the VOD/OTT Streamers

You can cross-reference the platforms below with the broader Digital Distribution Guide (updated regularly) for further info on regions, business models, and links to company sites. In this article, I focus on a key sampling of the platforms and developments since the last blog.

Types:

-

Tier 1: Mainstream “Big Global” types

i.e., global (or on their way to global)

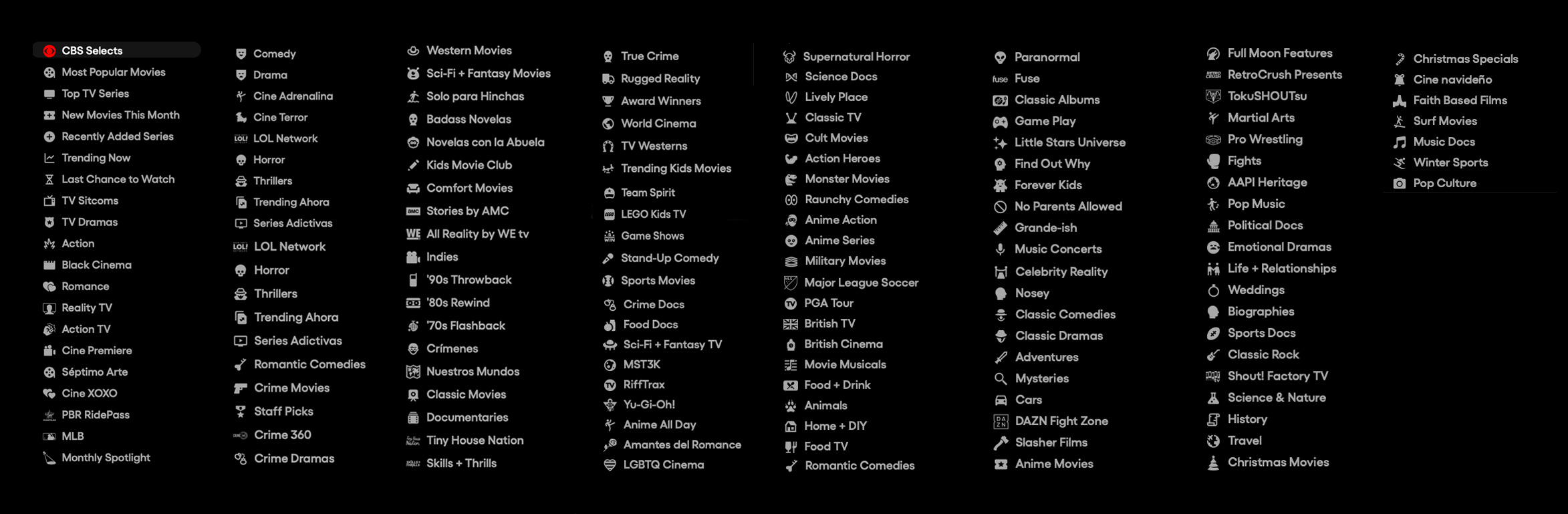

- For example, Netflix, Amazon, HBO / Warner Brothers Discovery / Max / HBO Max, AppleTV+, Disney+/Hulu, as well as other studio-backed entrants, such as Peacock, Paramount+ (in SVOD) and its Pluto.tv (in AVOD/FAST), and finally, other mainstream AVOD/FAST platforms such as Tubi, Roku, SamsungTV+, LG, YouTubeTV, and Rakuten (based in EU).

- These types are often most sought after, but as before, such deals (if/when offered) will correspondingly impact the revenues, rights, windows, holdbacks, promotion, marketing, access to audience data etc. So, one always has to balance one’s goals with the offer (money, impact, marketing, etc.)

- If such a deal is not forthcoming, or not the right one for you, then – don’t stop there!

- In this article, I’ll focus more on Tier 2 and 3 players.

- For example, Netflix, Amazon, HBO / Warner Brothers Discovery / Max / HBO Max, AppleTV+, Disney+/Hulu, as well as other studio-backed entrants, such as Peacock, Paramount+ (in SVOD) and its Pluto.tv (in AVOD/FAST), and finally, other mainstream AVOD/FAST platforms such as Tubi, Roku, SamsungTV+, LG, YouTubeTV, and Rakuten (based in EU).

-

Tier 2: Mainstream Competitors to Big Globals

i.e., EMEA/International multi-regional or local VODs (via telecom, cable, OTT, pay/TVs), who strive to be head on competitors (buying and funding/co-funding, though not globally.)

-

- Examples include Canal+, Crave, Sky, M-Net/Multichoice/ShowMax, Stan and Sky Showtime (Comcast / Paramount Global joint venture based in EU).

Keep in mind that aside from competing with Tier 1 types, Tier 2s also have competitors in their own regions, so you can canvas them (if non-exclusive) and/or cobble together various other deals with other Tier 2 & 3 players in different regions.

- In all Tier 1, 2, and 3 deals, windowing and holdbacks are to be balanced against traditional. Some Tier2s want to be first window, while others, and most Tier3s, are content to come in non-exclusively.

- That said, if you only do a non-exclusive deal, you’ve effectively given the platform exclusivity for the price of a non-exclusive deal.

-

-

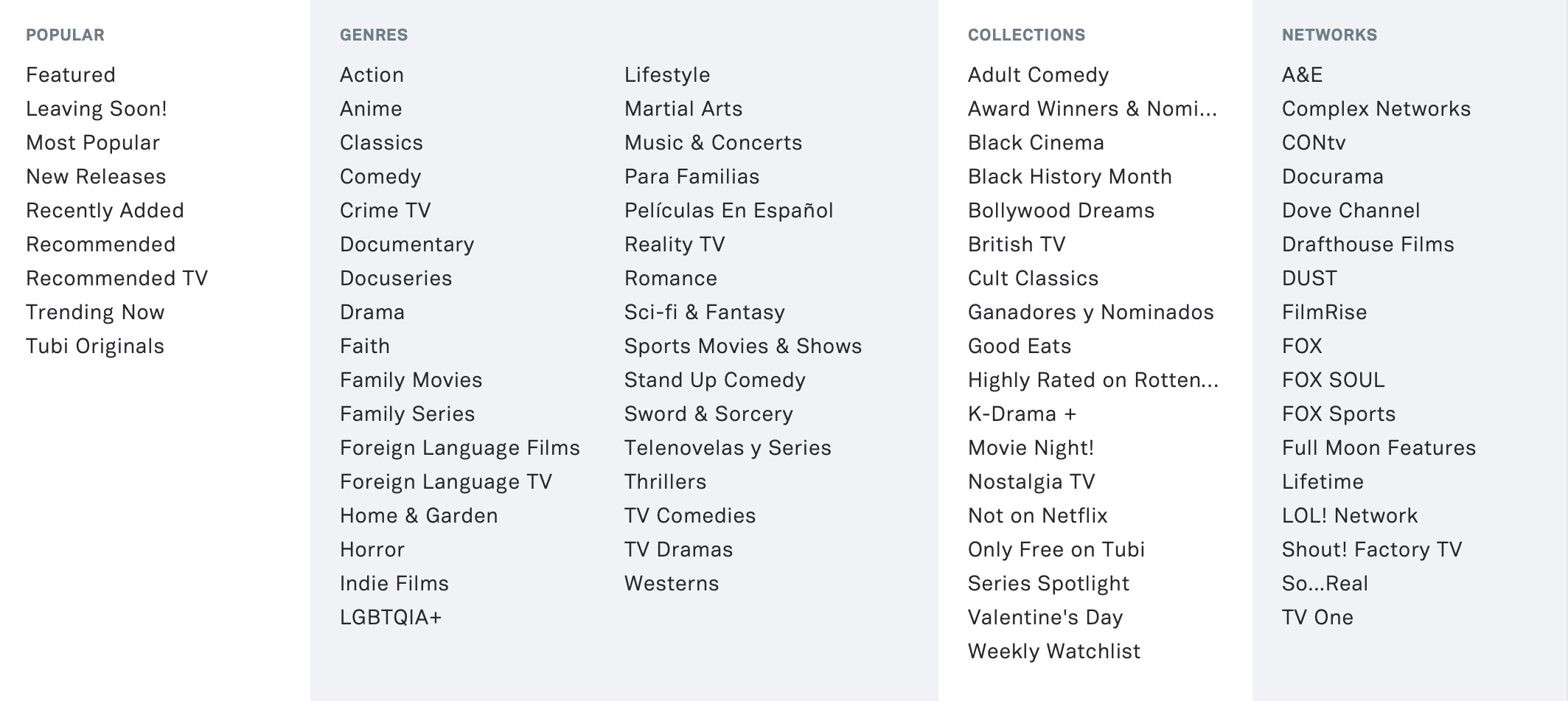

Tier 3: Complementary Thematic

i.e., many curated niche or micro niche VODs, drilling down into a specific genre, theme, or target audience. These services are lower-priced and position themselves as “stackable” add-ons for households.

-

- Examples include services dedicated entirely to art house, docs, diaspora, horror, LGBTQ+, such as Filmin, MUBI, Curiosity Stream, Britbox, Shudder, OUTtv, etc.

As above, each of these thematic types often have 5-10 competitors, with varying programming and deal offers, so one can do multiple non-exclusive deals in this sector too (unless paid very well for exclusivity).

- There are technically thousands of VODs in Europe alone, but we tend to focus on the 50 or so that are that are a good editorial fit, and ideally paying proper flat license fees or some other forms of reasonable returns (minimum guarantee / rev share).

-

-

Tier 4: AVOD/FAST Channels abroad

More AVOD/FAST channels are proliferating from mainstream to niche, including not only via global SmartTV platforms and studio-backed groups, but also those launched by big IP owners.

- Of more interest for indies, these are curated channels focused on buying movies, docs, shorts, and niche genre films.

- In 2025, more are expanding through UK and Europe (which can be the subject of a future update to my earlier blog on FAST/AVOD) but that is not the subject of this article, as they are usually rev share based for volume deals on older titles, and not buying individual titles from U.S. indies (with some exceptions, including if going through aggregators).

- One interesting 2025 read, on movies in FAST channels—including Pluto (with 12 movie channels), Samsung (with 17), Rakuten (with 30 movie channels), Chili, etc.—can be found via Marion Ranchet’s recent article in her publication Streaming Made Easy. But in brief, as above, indie docs and narrow niche titles (as opposed to commerical films) are relatively under-represented in FAST and with limited monetization.

Luckily, the overall practical advice, tips and takeaways set forth in the earlier articles—on how to approach licensing, monetization, windowing—still apply today, and I’ve repeated them at the very end of this article, just with more layers to take into consideration, methodically. But first let’s step back and summarize the changes in the market, film buying platforms, and business models since the last blog, and also table some new platforms for you to consider. Other info and platforms are in the Digital Distribution Guide.

B) CHANGES IN THE SECTOR

1) Business Models, Rights, Windows:

- Earlier COVID innovations in TVOD (such as Premium VOD, Festivals Online/Hybrid) did continue to some extent, and in some cases are still ongoing, but Virtual Cinema has largely phased out.

- AVOD vs FAST

- In brief, FAST is exhibition on Free, Ad-supported Streaming TV (usually SmartTVs/OTT devices), and programs are scheduled linearly, supported by ad revenue share, but not viewed “on demand,” (unless coupled with AVOD rights/capability).

If a FAST platform asks FAST rights from you for a rev share, look to see if it also offers its viewers fast forward and rewind capabilities, as that is more properly an AVOD right (on demand) and indies, where possible, should strive to be paid for both rights, from the viewpoint of monetization/dealmaking, instead of lumping them together.

In late 2024-25, some FAST platforms have evolved to offering a flat license fee for licensing, instead of rev share. Rev shares in FAST tend to be obtuse in calculations and with inconsistent methods of reporting between the different platforms, so in one sense it is handy that they offer flat license fees. However, with flat fees, one loses any insight into data/viewership/audience.

- In brief, FAST is exhibition on Free, Ad-supported Streaming TV (usually SmartTVs/OTT devices), and programs are scheduled linearly, supported by ad revenue share, but not viewed “on demand,” (unless coupled with AVOD rights/capability).

- SVOD with Ad-supported tiers:

- Some services, such as Netflix, Disney+, Sky Showtime, and HBO Max, offer SVOD at various priced tiers: one ad-free subscription, and then other cheaper subscriptions with ads.

- This is not to be confused with regular AVOD rights or windows (like YouTube) where viewers watch free and on-demand without any subscription, while filmmakers share in ad revenues.

Indies should be alert when dealmaking that they are still within an SVOD window/right. Watch out for holdbacks against AVOD/FAST, if applicable.

2) PLATFORM changes – and other new buyers

A) TIER 1 TYPES

All are increasingly focused (in EU markets) on content produced/co-produced originally from EU, due to quotas (formal and informal), and regulatory, political, and cultural pressures. This means they have relatively less bandwidth operationally in 2025 for volumes of pure U.S. indie material, after factoring in their inventory and pipeline of MPA studio output deals, deals with local distributors, and local EU indies; however, there is still some room.

-

- Added linear version experiments (e.g. in France) but has not yet added FAST.

- Instead, added ad-supported tier(s) (not AVOD) in most regions (three tiers: Standard, Standard with Ads, Premium)—but note this is still SVOD in rights terms. It further cracked down on password sharing to enhance revenues.

- Initially stepped up indie feature film buying and Netflix Originals in 2021 (but reduced in 2023, a trend continuing to date, along with sad layoffs in the higher end art/indie feature film and docs staffing)

- Started limited theatrical distribution, finally open to occasional theatrical prior window (limited and selective) but is still mainly an SVOD first-run service.

- Stepped up licensing its own Netflix Originals to third-party competitors/networks. (Some other streamers (MAX, Viaplay) have followed this move)

- Also in late 2024, and ongoing in 2025, Netflix further increased its buying of new and library films and series from third parties, usually from other SVOD platforms or major/mini-major studios, so there’s still relatively less from indies. There are some exceptions where buying particularly for a region (such as Canada), or for a specific theme (e.g. indigenous docs like Yintah)—but not for global buying. Their film heads now, when buying, are reported as preferring films that are “more about the audience and less about ‘auteurs’.”

- Moved into other genres/formats (gaming, interactive experimentation), but then stopped interactive in later 2024-25. It has more steadily moved into mainstream reality, true crime, and an increased emphasis on foreign (non-US) indie series and film to support its expansion abroad.

- Diminished Africa content focus (after initial push) to concentrate more on EU.

Still in 2025, it is not always a one-stop-shop for global-style big $ license deals, and instead increasingly buying for specific (e.g. English Language) regions. This can be a double-edged sword, and as per the prior blog, one must balance the desire for ease/single deal with monetization, audience, marketing, data etc. and producer goals (impact? revenues? future pipeline?).

- Also, a deal that is US-only Netflix can limit the attractiveness for buyers from other competing platforms (in some cases) where they want more key regions, while tier 2/3 players can consider it an asset.

-

- IMDB.tv had first renamed its AVOD service “Freevee”, in U.S. and UK, and was not yet across EU. FREEVEE since closed in late 2024 as the service content migrated to within PRIME, in regions the U.S., United Kingdom, Austria, and Germany.

Licensing to any AVOD still allows multiple other AVOD licenses, also abroad, however ensure the SVOD route has been canvassed first, to not accidentally cut out the prior window for Prime or other competing SVODs (subject to a compelling deal as in some cases as in the prior blog AVOD can be a bigger revenue generator than small SVODs. Again, depends on goals of filmmaker).

- Prime Video Direct dropped self-upload capability for docs and shorts, except for TVOD/EST

- Still buying indie films selectively, with room for a limited theatrical window. but more emphasis on series, very rare docs except reality style

- Increased carriage of other SVOD’s (including niche thematics) on its platform via add-ons internationally

This means a deal an indie may have done earlier with a specific SVOD (for example with Docubay or Mubi), can end up on Amazon Prime, where it is carried to wider audiences. This can create more reach, but not necessarily more money for you, depending on the type of deal struck (consider implications if the deal is rev share vs. flat fee, or with “bump-ups,” for example).

- IMDB.tv had first renamed its AVOD service “Freevee”, in U.S. and UK, and was not yet across EU. FREEVEE since closed in late 2024 as the service content migrated to within PRIME, in regions the U.S., United Kingdom, Austria, and Germany.

-

- Wildly expanded then contracted in the past few years, via mergers (WarnerBrosDiscovery), rebrands, and various re-orgs, including the bloodbath in the indie doc/feature buying and funding sector, both in the U.S. and EU.

- HBO Max in U.S. and rolling out to more regions in EU and international markets through summer 2024-26.

- Territories are near global, and include as of 2025: Portugal, Spain, Andorra, France, Mexico, Nordics (Denmark, Norway, Sweden, Finland), Benelux (Belgium and Netherlands), CEE and Baltics (e.g., Poland, Hungary, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Moldova, Montenegro, North Macedonia, Romania, Serbia, Slovakia, Slovenia, Türkiye, as well as Australia, New Zealand, Latin America / Caribbean (39 countries) and various countries in Asia (Hong Kong, Indonesia, Malaysia, Philippines, Singapore, Taiwan, and Thailand)

- HBO Max now has 3 tiers: Premium, Basic with Ads, and Standard. All are still SVOD but at different pricing when ads and other features are included.

Buying indie films and/or docs can happen out of U.S. HQ and sometimes via separate buyers still in the international regions (EU, CEE, Benelux, Nordic). It’s not a fully consolidated picture yet, don’t give up, particularly if your theme translates culturally abroad.

- Discovery+ Service (different programming) continues, replacing d-play as OTT SVOD in UK/IE, Germany, Austria, Italy, Brazil, Canada, Netherlands, Nordics, India, Spain

- Despite HBO Max merger with Discovery Plus, Discovery+ remains still its own streaming service with separate plans, i.e. premium ad free, and ‘ad-lite’ (cheaper). Its content is also available on HBO Max.

-

- DISNEY+ expanded wider within Americas, EMEA, Indo-Pacific regions but still no separate Hulu brand site in Europe. Programming is subsumed selectively within the broader Disney+ umbrella and STAR sites.

- As with the other mainstreamers, Disney+ added various ad supported tiers as well, including in EU/international.

B) TIER 2 TYPES

-

- Viaplay had been at its high-point in earlier years; very attractive to indies (including U.S. indies) for buying and funding, as it was rolling out and spreading in regions beyond Nordic and Benelux, to CEE (Central and Eastern Europe, GAS, UK, and N. America. It was also heavily funding or coproducing 80+ Viaplay Originals per year and buying (mainly series but some English/American and local indie films and high profile docs)

- However, in late 2023, Viaplay widely contracted; shutting down expansion, closing most regions, shutting down projects in development/production stages, staff reorgs, and overall changing focus.

- CANAL+ GROUP in 2025 has a significant ownership position.

- NOTE: Today, Viaplay still remains a Tier 2 competitor in Nordic, (buying and funding mainly locally) and a complementary service in Benelux (local and sports emphasis).

- But in North America, Viaplay has become a Tier 3 thematic/niche (“Best of Nordics”) SVOD called Viaplay Select, and is carried as an add-on, such as via Amazon.

- They’re increasingly selling their Originals to other streamers afterwards.

This means U.S. indies selling film/docs should approach Nordic HQ, rather than the U.S./Canada service.

- This Paramount/Comcast JV launched in 22+ EU regions (those that are not UK, Italy, or Germany, so as not to compete with sister company SKY).

- Initially began with its own well-stocked catalogs from JV partners, (NBCU, Peacock, Paramount, Showtime, etc., so it was not buying from indies

- More recently started acquiring series and films from select higher-end indies, albeit either more commercial in nature or increasingly from EU sources (however, still buying very limited docs), sometimes buying for all regions, other times purely local flavor.

- Current emphasis is EU titles (Originals and acquisitions) for EU, but high-profile English buying can selectively come via UK office.

- In April 2024, just began an ad supported SVOD tier as well.

- Limited docs; nonfiction runs usually to reality tv, true crime, celebrities, and that sort, i.e. relatively more commercial in nature. So there are limited opportunities for single title doc individual filmmakers licensing from U.S. as the country of origin—for example, a hardhitting doc on politics, climate, social issues etc. That said, coproductions have more potential.

CANAL+ / Canal+ International / Canal+ Group

- After initial contractions a few years ago (including their shut down of SVOD and other VOD operations in favor of their core Pay-TV business channels), fast forward to 2024, they’ve since wildly expanded:

- As a Group, they currently have operations in 52 countries in Africa, France, Benelux, (including since 2024 a dedicated local Canal+ in Holland), CEE, Asia Pacific, Caribbean, Indian Ocean. These channels/services are alongside their other corporately owned channels, such as Film1 in Netherlands and related basic SPI channels (FilmBox and FilmBox Arthouse).

- Canal+ group spans production, broadcast, distribution, and aggregation activities. It owns STUDIOCANAL, a leading film and television studio with worldwide production and distribution capabilities; and other channels (e.g. Thema (diverse content production and distribution) and telecomms. It has further equity stakes across Africa, EU, and Asia (eg Multichoice, Viaplay, Viu Asia)

- They started a new dedicated Canal+ Docs channel, rolled out their Canal+ Series OTT and other thematics (C+ Horreur) and also have a “StudioCanal Presents” art house SVOD, and their Arthaus SVOD in Germany via their StudioCanal arm.

- Recent corporate acquisitions which affect your sales include:

- Takeover/merger of Orange Telecom’s OCS (Orange Cinema Series) SVOD, which was formerly a separate buyer and funder for mainstream and indie film, and now is subsumed operationally within Canal+ Group.

Thus, buying of films/series and docs for OCS, now Cine+OCS, will go via Canal+ group buyers and/or SPI buyers in CEE.

- Takeover/merger of Orange Telecom’s OCS (Orange Cinema Series) SVOD, which was formerly a separate buyer and funder for mainstream and indie film, and now is subsumed operationally within Canal+ Group.

- Since April 2024, corporate buyout underway with Multichoice Africa (affecting, among others, indie film channel buyers and programming from M-Net Movies and Showmax channels and SVOD’s). As per spring 2025, the Canal+ merger approval is further delayed till October 2025 at earliest.

Only some of the prior buyers are still in place in Multichoice group channels but may be impacted by the Canal+ broader group (more on this below).

- Dutch Filmworks (local distributor in Benelux and sales agent) is now in a merged cooperation/integration with Studio Canal.

- SPI International (thematic pay and basic channels like Film1, FilmBox, FilmBox Arthouse, Docustream, Filmstream etc. as per the last blogs)

Vodafone/Ziggo’s “MOVIES and SERIES” SVOD

- Sadly, Ziggo is no longer an SVOD service buying individually from international/US indies. Their SVOD is now superseded by carriage of Sky Showtime brand brand streamer, as of 2024, and other carriage deals like Viaplay etc. (so indies lost another Tier 2 competitor buyer).

One would now go to Sky Showtime buyers (UK, NL (Netherlands), or other region-specific) in order to be seen on VodafoneZiggo, along with the potential 20+ other regions.

MNET / Showmax / Multichoice Group

- Since 2023 various buyers from MNET South Africa (mainstream pay/SVOD) and Showmax (African themed OTT service) left the Group, some for Tier 1 streamers.

- MNET/Showmax also announced a cooperation with Sky/NBCU/Comcast groups re a joint streaming approach to production and service offerings in Africa.

- Now, due to the April 2024 announced merger with Canal+ International, buying is still, as of 2025, being consolidated further (and at time of writing, indie one-off buying appears frozen for the moment).

- As of spring 2025, the merger approval was announced to be delayed further pending regulatory challenges and is not anticipated to be completed before late autumn 2025.

- Spain, Portugal Pay-TV, TVOD, and SVOD buyer and Originals funder, usually mainstream/commercial and local fare, but appetite for Spanish/Portuguese language indie content as well.

- Occasionally they still buy from indie sources including U.S. (such as a non-current SXSW Audience Award winning feature drama, and sports-themed nonfiction content).

- Channel 4 rebranded its All4/4oD in UK, consolidating digital and traditional all into one place; “4.” Still buying and sometimes funding indie film and docs on a flat-fee basis generally but more heavily still emphasizing series and UK creators, with some exceptions. For non-UK based indies, series are favored over feature films.

- And Channel 4’s AVOD/SVOD for foreign (non-UK) series, Walter Presents, expanded to more regions (including as Walter’s Choice in U.S.). Walter Presents is only buying, not funding.

- Added BINGE SVOD and FOXTEL DOCOS, now called FAMOUS, which focuses on broadcasting documentary films and docuseries. (100% docs, usually character/personality driven.) Usually flat fee deals.

- Mainstreamer, the SVOD arm of Channel 9 TV in Australia. The service offers a broad range of film and television content from both local and foreign productions, particularly from the U.S. and UK. Stan also includes a growing library of their own Originals. With over 2.6 million subscribers, as of now Stan is the fourth largest streamer in Australia, behind Disney+, Amazon Prime, and Netflix.

- OSN (Orbit Showtime Network) and its SVOD streamer OSN+ are mainstreamers based in and serving MENA (Middle East and North Africa) regions. Mainly MPA studio and brand international content (such as BBC) along with Arabic, Turkish, etc. local content. Open to some international indie buying as well. Competes with Shahid.

- Market leader—Saudi Arabian content-streaming platform, the most watched Arabic streaming service in MENA. Operated by MBC group and offering a wide range of entertainment content, including movies, TV shows, Originals, sports, etc.

- MPA studio and other American programming partnerships, some indie buying for select docs and films with profile.

C) TIER 3 TYPES – Changes and new buyers

Although some of the earlier indie film and doc services profiled in my last blog sadly fell away, others have stabilized, morphed, and matured, and new services have also launched. CAVEATS: This list and the DDG is NOT exhaustive, but an illustrative snapshot at this time. To help bring it down to earth, I’ve focused only on services that have done a deal with a niche indie/doc filmmaker from the U.S. in the recent past.

As before, most deals are non-exclusive, which allows you to ripple the film to genre competitors as well. For example, if dealing with a horror site such as Shudder, one can explore the other various competitors in horror; if dealing in art house, e.g. MUBI or Filmin, one can explore deals with 10 others, and similarly with documentary and niche/micro niche sites.

I can’t stress enough the necessity to matchmake the film to the platform. For example, if looking at 10 docs sites for your film, go deeper into the programming; is the character of the site you are about to pitch millennial/reality docs, fast paced (e.g. like an Insight.tv) or educational/tv/science type docs (e.g. like a Curiosity Stream) or character-driven features (e.g. like a GuideDoc or Docsville)? Can you identify or reference films already on their site that are comparable, so that when crafting your pitch you help the programmer/buyer see the fit?

In terms of business models, all of the below are still SVOD buyers, not funders (unless specified).

I first list some key indie movie sites which also buy different multiple formats and genres (e.g. docs, shorts). I then list some niche, genre-specific sites (e.g. docs only, horror only, shorts only); refer to the DDG for more.

i) INDIE MOVIE SITES

-

MUBI • Art house—around for more than a decade—is now global and has moved additionally into limited theatrical high-end acquisitions/distribution as well as adding more library titles (MUBI Releasing, MUBI Collections). Generally, a high-quality editorial prestige site, but not historically known to be the best paying site for indie filmmakers licensing titles, (with some key high-profile exceptions). Not funding.

-

FILMIN • Spain and Portugal SVOD, no longer buying for Mexico. Also going strong for more than a decade, lovely curation, with a wide catalog across different regions of sourcing and different genres. Often buying from North American indies (not just world cinema or European), in both features and docs, current and library titles. Sometimes flat fee, other times MG plus rev share, increasingly rev-share only, for non EU indies. It is also connected to festival and theatrical in the region. Occasional Originals/funding (but not with U.S. indies).

-

SOONER • The former niche art house sites UnCut and Universcine consolidated/became SOONER SVOD in Benelux and GAS (Germany, Austria, Switzerland) regions (and the parent group is still continuing as Universcine for VOD/SVOD in France). Buys films, indie series, and shorts from abroad as well, but with smaller flat fee or most of the time rev share. However it markets content well and sometimes event cinema screenings or other promotional approaches are supported, e.g. road shows of filmmakers, particularly around festivals.

-

FILMO (formerly FilmoTV) • Rebranded to FILMO and comprises TVOD/SVOD art house/France region (originally via its founder Wild Bunch sales agent, with similar calibre films, no series). Flat fee or rev share/MG. Wildbunch also started a related AVOD/FAST called Wild Side TV for older library titles of that genre.

-

SBS / SBS On Demand / SBS World Movies • networks (Australia): World Movies was first SVOD/PAY but now changed to AVOD and free tv, like SBS network with flat fee deals. They still focus on films, and some docs, from outside Australia (emphasis on world cinema, diversity themed). Flat fee.

-

Starz Play • As part of the severe contractions and shutdowns in former Starz International and Lionsgate+ SVODs, MENA (Middle East and North Africa) region still remains and thrives, thus if your film or doc deals with MENA, they can still be a buyer. Flat fee. Their mainstream competitors include SHAHID.

-

Rakuten TV • Mainstream and niches. Since last blog, it changed its TVOD/SVOD business model and programming emphasis across 40+ EU regions, to be almost entirely AVOD/FAST channels (rev share mainly, or sometimes MG). They are still selectively buying, including from U.S. indies, but one-off titles are not favored against packages or thematics. Occasional funding (Originals) but not U.S.-sourced, rather EU and mainstream.

…and some NEWER INDIE MOVIE SITES (not in the last blog)

-

Rialto • (NZ) – Indie film tv channel and also SVOD in NZ, Australia, Japan. Flat fee. Buyers however are increasingly less responsive to indie film suppliers from abroad, occasional deals possible on flat fee.

-

Studio Canal Presents and MK2 Curiosity • These two unrelated newer sites are each art house SVODs in France but generally for films they’ve picked up for distribution, with very limited third party licensing. Similarly, StudioCanal has added its StudioCanal ARTHAUS SVOD site in Germany.

-

Highball TV • Acquires indies films and docs for SVOD and sometimes other models. Programmed by a former longtime TIFF festival programming head. Curation criteria are basically films that played in festivals, but with monetization (even though it is an SVOD) mainly on a rev share basis.

ii) DOCUMENTARY (100%) SITES

-

Curiosity Stream • A global SVOD founded by original Discovery founder. This mainstream SVOD is across 200 countries, and has since added an AVOD/FAST business model (Curiosity Now) to SVOD Curiosity, and has also continued to fund Originals selectively. Flat fee deals. In 2023-24, buyers changed frequently, however, and acquisitions were more limited as of time of writing, hopefully opening up later this summer. By late 2024/25 there were more changes in buyers again and sadly, buying from indies was put on hold, for budget reasons. It has resumed somewhat as of spring 2025, but sometimes only on a rev share basis, not the usual prior higher flat fees.

-

Docsville • SVOD of curated and character-driven docs. After being dormant a few years since the time of last blog, was reborn, and is now actively curating and buying (after the corporate investment by Lightning International (Asia) in 2023). Now they seek global rights, not just in UK; however, sadly, switched generally to a rev share model for SVOD/AVOD/FAST. They also have Docsville Studios for Originals/funding. They started adding FAST (FAST channels) to their rights ‘ask’ (but caution on your windowing and price-value relationship as revenues may not be exciting.)

-

Docubay • (India, SVOD, linear) They’ve added linear (a sort of FAST but without ads/monetization!) to their rights “ask” in acquisitions, but disappointingly moved from earlier higher flat fees to a lower flat fee or rev share with MG. They ask now for more regions (global or at least English abroad) and the service is often carried on other platforms like Amazon as an add on. They frequently buy from U.S. indies, but preferably in volume packages via distributors (or sometimes via producers joining together in a common deal).

When pitching, try to already matchmake your doc to the categories/types of docs they offer on the site: topics include crime, nature, biography, culture, travel, history, music, sports, humanity, adventure, and politics.

-

Insight.tv • (SVOD/Pay-tv, linear, FAST/AVOD) Global, UHD (Ultra High Definition) offerings (linear) but also SVOD, AVOD/FAST channels globally. Healthy flat fee deals, and fund Originals and coproductions. Completely different style, i.e. commercial and very fast paced nonfiction/reality/lifestyle/millenials and increasingly mainly series, but some one-off feature doc buying is possible.

And some NEWER DOC SITES (not in prior blog):

-

GuideDoc • (Spain) Curated site with flexible deal terms (contract posted on their website, transparent), multi region and avid docs buyer from makers abroad and in EMEA (but can carve out regions). Rev share. Pleased they’ve been buying a lot in 2024-25. Good editorial curation, profile and presentations of producer’s packages of films (instead of just buying one- offs); we’ve seen many packages acquired lately from indies including not only Current titles but selectively their older library (80s-2010s) titles as well, thus profiling the filmmaker (or theme) not just the film.

-

DocPlay • (Australia) An SVOD platform run by Madman Entertainment (the local Oz distributor), they show films in their own catalog of course, but also acquire various from third parties and international markets (including U.S.) not represented by Madman. Usually licensed on a flat fee basis for the Docplay platform. In late 2024-5, however, they have reduced their third party buying significantly and their buyers are less responsive to internationals who are not already signed with them for all-rights Distribution…that’s a disappointing shift.

-

Tënk • (Docs-only SVOD) Expanded beyond France roots to Quebec and English Canada. However, although highly reputed in editorial quality it is still very low “rev share” or flat-fee monetization.

iii) Some NICHE OR MICRONICHE AUDIENCE SITES

-

Shudder • Horror leader, expanded its SVOD regions to UK/IE, U.S., Canada, Australia, New Zealand, and some other EU. Occasionally still funding Originals.

Keep in mind in nonexclusive deals can also be suitable for other competitors in the sector such as Planet Horror, Cine+ Horreur, Screambox, etc., and this approach applies to all Tier3 niches and genres. As above, look not only at the more known sites but also its competitor buyers.

-

Britbox • Although Britbox is still available in the rest of the world, this “Best of British” site, as of April 2024, has ceased in the UK and its content there is now rolled into ITVX Premium (SVOD) (now owned by BBC). It still continues internationally, in North America, Australia, South Africa, and Nordic region (Sweden, Denmark, Finland, Norway). The opportunities for indies are more for licensing works that were co-produced with or connected to the UK. Flat fee.

-

Acorn TV • SVOD, also a “Best of British/Colonies” thematic, lately more series than film, expanded so it can buy for U.S., Canada, UK, Latin America, Spain, Australia, New Zealand, and the Nordics. But has since pulled back from other regions like the Netherlands and South Africa, and in 2025 pulled back from (stopped its service in) Portugal and LatAm. Flat fee.

-

Shorts.tv • (Shorts) Market leader in shorts licensing. Flat fee. Pay-TV, TV, SVOD, including Oscar shorts. Multi-region.

-

discover.film • (Shorts) SVOD/AVOD buyer, aimed more at B2B travel sites and exploitation. Rev share.

-

Out.TV and OUTTV • (LGBTQ+) Despite having similar names, these are two unrelated/different sites. They are the main European- and Canadian-based services who compete against each other in LGBTQ+ content for SVOD/AVOD/FAST across different regions. They pay flat fees, and sometimes fund Originals. They also have multiple other competitors in the space.

-

Soft.tv • A shorts SVOD based out of Switzerland, well curated, subscription and free offerings.

-

Weshort.com • A shorts SVOD based out of Italy (with weekly, monthly or annual plans) and a related free site (weshort4free)- the latter is without monetization but can be used for marketing/upselling to the SVOD.

iv) Other

Note there are many other international micro-niche sites (SVOD and also AVOD/FAST) that you can sell to non-exclusively, each of which have multiple competitors around the world, such as kids (Hopster), wildlife (Love Nature), expats/diaspora (Afroland, Zee TV, and their many competitors), lifestyle, performing arts (Marquee.tv), dance, millennials/nonfiction reality (Insight.tv), hobbies, and series

C) Stepping Back: Considerations and Takeaways

1) Considerations

- Platforms’ tastes, needs, and appetites (and competitive positioning) are always changing.

- So, on the plus side, even if a title is rejected now, one can circle back 6 months later (if the rejection reason was more that the platform was overstocked in a category or bad budget timing).

- But obviously do not circle back if they rejected the film because they didn’t like it/ it’s not suitable for them.

- Your film benefits most overseas if it travels well culturally, has strong acclaim, or is particularly topical and/or has other marketable appeal.

- Language is very relevant but does not have to be a barrier:

- English OV films generally travel easiest first to other English regions/sites (Canada, UK, IE, AU, NZ, South Africa).

- Then next easiest, is subtitling-friendly regions (like Nordic, Benelux) as well as the pure cinephile arthouse and documentary sites (where audiences are accustomed to subtitles).

- In other regions such as Germany, Italy, Portugal, Spain, and Brazil, dubbing requirements have to be factored in. That said, if you have a few potentially interested platforms in one region/language, it is easier to assess the value of dubbing costs. No need to do so in advance.

- Sometimes a platform will arrange the foreign versions for you as “money’s worth” instead of offering as high a license fee, then you can seek access to those foreign versions for licensing to other platforms.

- Politically: U.S. films are, frankly, not at the top of some EU platform priorities at the moment—so be realistic in your expectations.

- For example, EU platforms now have content country of origin quotas (official and unofficial) to balance, ranging from 20-50% in practice.

- This means after a platform has 1) bought its MPAA (Motion Picture Association of America) studio, major output deals (if applicable), 2) bought from its own EU or local minimajor and indie distributors, and 3) bought its own direct local indie filmmakers, then and only then can they have room for ad hoc cherrypicked U.S. indie sector films.

2) Takeaways

As before, our basic rules have not changed:

- Act quickly and work collaboratively (filmmakers + agents/distributors) to seize timing opportunities.

- Balance traditional and digital to best capture cumulative and incremental revs in the non-exclusive deal sector, while also developing a longer-term platform pipeline.

- Be aware many platform buyers rarely attend markets/festivals and instead work virtually (even pre COVID-19, as I did) to better allocate their leaner budgets towards programming spend, rather than markets.

- Don’t stop at just one deal unless exclusivity or funding elements are in play and worth it.

- Don’t be blocked per se by rights issues. Pragmatic business deals where others are “cut in” can help make those melt away.

- Consider hybrid distribution; traditional and digital specialists sharing the job (or after the first year or two of exclusivity to your rep) for maximum bang for your buck. “100% of Zero is still Zero.”

- After the deal is done, help audiences know where to find your film!

I look forward to seeing more of your films and docs here and in other parts of the world!

—Wendy Bernfeld, Rights StuffDavid Averbach May 29th, 2025

Posted In: Uncategorized

TFC’s Distribution Days is upon us!

Next week, The Film Collaborative is holding a free virtual distribution conference, Distribution Days, which will offer concrete takeaways on the state of indie distribution and how filmmakers can navigate it. Attendees will hear from exhibitors, distributors, consultants, and filmmakers, some with case studies, as they describe and reflect on the landscape.

This conference hopes to help filmmakers develop critical thinking skills around distribution by looking at what is and what is not viable within a traditional distribution framework. It will also offer some alternative approaches. Willful blindness or a doomsday mindset are equally unproductive.

So, we are offering this pre-conference primer to set the tone, take stock of what myths are out there, and talk about what thought leaders in this space are coming up with as ways to deal with the current landscape.

Here we go!

Remember the days when creators and distributors were lying back in their easy chairs, proclaiming their satisfaction with how independent cinema has been evaluated by the marketplace? Yeah, we don’t either…and we’ve been in the industry (in the U.S.) for more than two decades. Nevertheless, there is a pervading sense that the state of independent film has never been worse—and that we’ve been going downhill from this mythic “better place” ever since Sundance was founded in 1978.

Why do we insist on bemoaning a Paradise Lost when the truth is that being a filmmaker has never been a paradise? Filmmakers have always been confronted with predatory distributors, dense and confusing contract language, onerous term lengths, noncollaborative partners, lack of transparency, and anemic support, if any (just to name a few). For an industry that prides itself on creating and shaping stories that speak to diverse audiences, we should be better at articulating truer narratives about our field.

It doesn’t help that, at Sundance this past year, all one could talk about was how streamers were “less interested in independent film than a few years ago, preferring [instead] to fund movie production internally or lean on movies that they’ve licensed” and how Sundance itself was “financially struggling, presenting fewer films than in previous years and using fewer venues.” (https://www.thewrap.com/sundance-indie-film-struggles-working-business-model) Still others like Megan Gilbride and Rebecca Green in their Dear Producer blog have put forth ideas how Sundance should be reinvented completely.

But we all know that independent film isn’t just about Sundance. We have heard a lot of discussion recently about the need to reshape the narratives we tell ourselves regarding the state of the independent film industry.

Distribution Advocates, which is also doing great work chasing the myths vs. the realities of the field, also believes that we must all question “some of our deepest-held beliefs about how independent films get made and released, and who profits from them.”

In their podcast episode about Exhibition, economist Matt Stoller remarked how “weird” it is that even with all the technology we possess connect audiences, we’re still so “atomized” that all that rises to the top is whatever appears in the algorithm Netflix chooses for us in the first few lines of key art when we log in (and we will note that even the version of the key art you see is itself based on an algorithm).

But is it really all that strange? One of the main reasons that myths exist is that someone is profiting from perpetuating them. The same with networks and platforms and algorithms. And the more layers of middlemen and gatekeepers there are, the harder it is for us to see the forest for the trees. Keeping us in our algorithmically determined silos numbs us into not minding (actually preferring) that we are watching things—or bingeing things—from the safety and comfort of our living rooms. The ability to discover on our own content that aligns with our true interests or consuming content in a communal space has disappeared the same way that the act of handwriting has…we used to be able to do it but haven’t done it in so long that it feels unnatural and too time-consuming to deal with.

Brian Newman / Sub-Genre Media acknowledges that the problems remain real, but that what everyone is calling crisis levels seems to him merely a return to norms that were in place before the bubble burst. No one, he says, is coming to rescue “independent film”—certainly not the streaming platforms, which merely used it as necessary to build a consumer base.

Many have posited myriad ideas about how to bypass the gatekeepers. Newman echoed what TFC has been recently discussion internally: that instead of many competing ideas, we need them to be merged into one bigger idea/solution. Like, for example, an overarching solution layer run by a nonprofit on top of each public exhibition avenue that will aggregate data and help filmmakers connect audiences to their content. A similar idea was also discussed at the last meeting of the Filmmaker Distribution Collective in the context of getting audiences into theaters.

By exclaiming that “No one is coming to the rescue,” Brian really means that we are all in this together, and that it’s going to take a village.

We agree, but a finer point needs to be made.

Every choice we make moving forward—whether you are a filmmaker, distributor, theater owner, or festival programmer, what have you—could possibly be distilled into either a decision for the independent filmmaking public good…or for one’s own professional interest. Saying that a non-profit should come in and offer a solution layer to aggregate data is all well and good until it threatens to put out of business someone whose livelihood is based on acquiring and trafficking in that data. How refreshing was it to be reminded at Getting Real by Mads K. Mikkelsen of CPH:DOX that his festival has no World Premiere requirements? It reminds us of the horrible posturing and gatekeeping film festivals do in the name of remaining relevant and innovative. For us to truly grow out of the predicament we are in, some of us are going to have to voluntarily release some of the controls to which we are so tightly clutching.

Keri Putnam & Barbara Twist have an excellent presentation on the progress of a dataset they are putting together of who is watching documentaries from 2017 – 2022. They provide some other data that was very sobering:

Film festivals: comparing 2019 numbers to 2023 – there was a 40% drop in attendance;

Theatrical: most docs are not released in theaters and attendance is down even for those that are released.But they also note that there is really great work being done in the non-theatrical space— community centers, museums, libraries – that is not tracked by data. TFC’s Distribution Days offers two sessions on event theatrical and impact distribution, so we’ll be able to see a tiny bit of that data during the conference.

We also know that the educational market is still healthy, and that so many have remarked of the importance of getting young people interested in film…so we have three sessions where we hear from the Acquisitions Directors of 11 different educational distributors.

We also have a panel from folks in the EU who will provide advice on the landscape and how best to exploit films internationally and carve our rights and territories per partner. And we’ll speak to all-rights distributors about what kinds of films they see doing well, what they are doing to support filmmakers—and what their value proposition is in this marketplace.

We have a great panel on accessibility, and two others that relate to festivals and legal agreements.

Starting off with a keynote from noted distribution consultant and impact strategist Mia Bruno, the 2-day conference aims to summarize the state of the industry while providing thought provoking conversations to inspire disruption, facilitate effective collaboration, and to aid broken hearts.

Regardless of whether current days are better or worse than the heydays of Sundance and the independent film of yesteryear, Distribution Days will identify the current obstacles of the independent film distribution landscape, and what we can hold on to—as a commonality—to evolve the landscape together in the future.

If you look a little deeper, you will see that, despite all the challenges, filmmakers have and can still achieve “success” when they understand the terrain, (sometimes) work with multiple partners with a bifurcated strategy, protect themselves contractually, and maintain and grow their own personal audience.

We hope you will join us. And for those of you that cannot make all of the sessions we are offering live on May 2 & 3, you’ll be able to catch up on what you missed via The Film Collaborative website after the conference is over.

We look forward to seeing you next week! And if you have not registered yet, you can do so for free at this link.

David Averbach April 25th, 2024

Posted In: case studies, Digital Distribution, Distribution, Distribution Platforms, DIY, Documentaries, education, Film Festivals, International Sales, Legal, Marketing, Theatrical

The Implosion of Distributor Passion River… And What it Means for You

by Pat Murphy

Pat Murphy is a documentary filmmaker and editor. His latest film, Psychedelia, uncovers the history and resurgence of psychedelic research. It was sold to universities, nonprofits, international broadcasters, and the streaming service Gaia.

Passion River Films was one of those rare distributors. In an industry with plenty of shady companies, they had a reputation for honesty. Some of the most influential figures in the independent documentary distribution space referred their colleagues to them. And yet under the hood, in that nondescript office building in New Jersey, the operation at Passion River was in serious trouble. And it had been for some time.

Founded in 1998 by Allen Chou, Passion River’s catalog focused on educational documentaries, which they sold to universities, libraries, nonprofits, and the DVD/VOD market. Unlike a lot of distributors, they were flexible with filmmakers. They allowed them to put a cap on distribution expenses and reserve certain rights for themselves. I signed my film Psychedelia with them in 2021 and got the feeling that it was in good hands.

Yet for the past few years, Passion River had been withholding accounting reports and payments to filmmakers. Communication slowly dropped off and eventually went completely silent. Requests for information were ignored. And then earlier this year, they announced—in an unexpected, evasive, and self-serving manner—that they were insolvent. Hundreds of filmmakers lost many thousands of dollars, and some are still dealing with the logistical nightmare it caused for their films.

What happened at Passion River? How did it slip by undetected? We may never know. But Passion River’s collapse should serve as a stark warning to all filmmakers of the precarious nature of film distribution. It comes during a tumultuous time for the industry and the larger economy. It’s a bombshell story that demonstrates the inadequacy of systems to deal with this situation. And it shows how the hardship lands squarely on the creatives who make this industry possible.

What We Know

If you’re pressed for time, here’s a summary of the situation:

- In January, Passion River announced that they had become insolvent, and were selling the “majority of their assets” to another distributor called BayView Entertainment.

- Once filmmakers were connected with BayView, they were told that they had purchased the “assets, but not the liabilities” of Passion River.

- Passion River had been withholding accounting statements and payments to producers in 2022 and earlier, leaving producers without any record of the money they were owed. BayView said they were not responsible for these payments.

- Filmmakers had nobody to contact. Passion River abandoned its offices, shut down their phone lines and email domains, and transitioned their employees to new positions at BayView.

- The total damage in lost payments, although difficult to determine, is likely in the multiple six figures. There appears to be no accountability on the part of Passion River.

Keep reading to get the full story, as well as distribution strategist Peter Broderick’s key takeaway.

Announcing Their Insolvency

On January 31, 2023, Josh Levin (Head of Sales and Acquisitions at Passion River), sent the following note to most (but not all) of the filmmakers that had contracts with the company:

I have some news to share – the parent company of Passion River Films lost the ability to meet its obligations and has sold the majority of its Passion River assets to BayView Entertainment, LLC. BayView is a venerable, much larger film distributor with an outstanding 20+ year reputation in film distribution.

I am sure you have questions about what this transition means for you and your films. These questions can best be answered by speaking directly with Peter Castro, the VP of Acquisitions at BayView. Please email Peter at ***** to set up a call. Peter is looking forward to speaking with you.

According to their contract with filmmakers, Passion River was supposed to send accounting statements and payment 60 days after the end of each quarter. This meant that all sales that Passion River made in the fourth quarter of 2022 (October-December) were supposed to be reported and paid by March 1, 2023.

This timing was particularly unfortunate for me and my film, which had been released in Summer 2022. We secured a streaming deal with Gaia and it was released on TVOD. Gaia pays their licensing fee in two installments. So, I was waiting on the second payment ($9,750) plus all the TVOD and educational sales from my film’s release. Those payments came in the fourth quarter 2022, so I was waiting for that statement and payment to come by March 1, 2023.

Naively, I responded by asking Josh Levin about his own well-being. While I found Passion River’s work a bit sloppy and frustrating, I took Josh to be an honest broker. I was relieved to hear that he was going to work for BayView as Vice President of Sales [LinkedIn account required to view]. To me, the whole thing was portrayed as a standard acquisition. I thought that I would work with Josh as before, but this time under a new company name. I assumed my payment of over $10,000 would come from the new company.

But by the time I was able to get through to Peter Castro (VP of Acquisitions at BayView), it was already March 3, 2023. Neither my accounting statement nor my payment had arrived. My conversation with Peter turned out to be extremely unsettling. This was no ordinary acquisition. BayView had purchased the “assets but not the liabilities” of Passion River.

Yes, that’s a thing. Apparently BayView did not actually purchase the rights to our films, and therefore they were not responsible for any outstanding payments from Passion River. And they had no way of collecting that money or telling us what happened to it. We had the option to sign new contracts with them, at a less favorable split than we had with Passion River.

As for getting answers on what happened over at Passion River, such as why they became insolvent or what they did with the money that was due to us? There was no avenue to explore those questions. Josh Levin, now employed by BayView, said he was forbidden to talk about anything that happened at Passion River. Allen Chou, the president of Passion River, whom most people had never met, was elusive. The voicemail boxes at Passion River were full and their email domains would bounce.

I was devastated. And furious. Like most folks, my film was an independent labor of love over several years. What made it sting even more was the fact that Passion River did not actually secure my streaming deal with Gaia. Gaia heard about my film through my own marketing efforts, and as a good faith move towards Josh Levin, I decided to give Passion River their 25% commission on that deal.

As it turns out, I was not alone.

Finding the Others

Without any helpful information, we began finding each other through online forums like The D-Word and the Facebook group, Protect Yourself from Predatory Film Distributors [Facebook account required and one must join the group to view]. Eventually, we gathered on a private channel, so we could share information and piece together whatever we could from our own investigations and experiences.

Each film’s situation was different, but pretty much everybody reported the same experience working with Passion River: disorganized workflows, poor communication, improper accounting, missed payments, and even downright deception.

Filmmaker Jacob Bricca of Finding Tatanka said, “They were responsive at first, informing me of sales they had made and giving me regular statements showing that I was slowly paying off the charges associated with creating the DVD and distributing the film. This communication dropped off as the years went on. I finally contacted them again in mid 2022. These inquiries went unanswered. Finally, after repeated attempts to get a reply, I got a statement in early 2023 that I was owed over $1,400… I have never seen a penny from Passion River.”

Jacob was the only filmmaker I ever spoke to that had received an accounting statement for the fourth quarter of 2022. The rest of the filmmakers did not receive any accounting statements for that quarter, leaving them without a written document of what they were owed. Many reported incomplete accounting prior to the 4th quarter as well. Time and again, filmmakers were told by Josh Levin that he would “ping accounting” about their issue. However, filmmakers received no response or follow through.

While all this was happening, Passion River was still actively marketing their catalog. In March of 2023, I found an End of the Semester Sale on their website, which was active from December 1, 2022 to January 31, 2023. My film was featured prominently on the page, even though I had never received a single report of an educational sale. The fact that they would deliberately run a sale as late as December (when the sale to BayView must have been known), raises serious ethical questions.

“Passion River is not the first, or last, film company to go out of business,” said Emmy-and Peabody-winning and Oscar-nominated producer Amy Hobby. “But the lack of transparency, failed reporting, and missed payments simultaneous to continued recoupment off filmmakers’ backs is egregiously unethical.”

Attempts at a Resolution

Besides dealing with the financial fallout from Passion River, our other big question was about what to do with our films moving forward. They were still up on VOD platforms, but where was that money going? And what do we do now that we don’t have a distributor?

Director Kim Laureen, of Selfless, signed with Passion River in 2020: “Since day one I have had to chase reports and payments.” Unlike me, she was never notified of the sale to BayView. With nobody to contact about her pending payments, Kim sent a tweet out to Passion River. That got the attention of Peter Castro, VP of Acquisitions at BayView. Kim had a conversation with Peter, in which she explained why people were frustrated. Peter agreed to host a Zoom call with Kim and any other filmmaker who felt mistreated. Kim and I put out notices to the group of filmmakers about a “virtual town hall” on March 17, 2023.

Peter must have been surprised when he logged on to zoom and found dozens of angry filmmakers asking tough questions and demanding answers. Consultant Jon Reiss also joined and was instrumental in getting straight answers. The conversation went on for almost an hour and a half. We were able to confirm the following during that meeting:

- It’s unclear exactly what BayView purchased from Passion River, but it allowed them to collect revenue off of our films without a contract.

- Since BayView was currently collecting revenue on our films, they would send us payment for 2023 sales whether or not we signed new contracts with them.

- For those of us who wanted to move on to new distributors, BayView would facilitate that.

It sounds like many people ended up signing with BayView. But most of the people I’ve spoken to decided to move on to new distributors or go a DIY route without any distributor. Figuring out how to do all this and getting Allen Chou to cooperate was full of complexities over the ensuing months:

- Many distributors required an official release from Passion River. Through a collective effort led by producer Amy Hobby, Allen Chou wrote an official letter on May 9, 2023. This was his first communication to us, more than four months after the transition.

- Passion River had used an aggregator called Filmhub to upload many of our films to TVOD platforms. We were able to transition accounts with a representative there. In this scenario, the filmmaker keeps 80% of TVOD revenue, rather than giving Passion River or BayView their commission.

- BayView sent us accounting statements for Q1, as promised, on May 15, 2023.

Legal Recourse

One of the biggest revelations for me was the inadequacy of the legal system to deal with this situation. When I signed my deal with Passion River, I went back and forth on the legal language endlessly. I did everything I thought I could to protect myself and spent thousands of dollars in legal fees to do so. And when Passion River blatantly breached the contract? There was no good answer on what to do.

One avenue the legal system provides is small claims court. It’s designed to get your case heard in front of a judge without the need for an attorney. One filmmaker, who wishes to remain anonymous, decided to go this route. Their lawyer told them it was a “clear-cut case.” The filmmaker and their partner had painstakingly put together a Statement of Reasons, outlining their relationship with Passion River and what they were owed. In New Jersey, the maximum allowance is $5K.

Small claims court was on Zoom, and Allen Chou was there with his attorney, Spencer B Robbins. When it came time to present, Robbins interjected with an arbitration clause that was in Passion River’s contract, stating that any dispute between the parties should be brought in front of an arbitrator. With that, the judge threw out the case. The filmmakers tried to make a rebuttal but felt they were not given a proper chance to speak.

The filmmakers were so distraught that they decided to cut their losses and move on. “It’s why people lose faith in the justice system,” said one of them. While it’s difficult to say how much Passion River withheld from filmmakers, we can make a general estimate. Passion River had around 400 films in their catalog. So even if each film was only owed $1k that would aggregate to $400k. Almost half a million dollars. Where all that money went remains unknown. And as far as we can tell, nobody involved has been held accountable.

Key Takeaways

Here we are almost a year later. Many have expressed anger and depressed feelings around the whole situation. Writing this article has brought up a lot of emotions. But it’s also made me determined to not give in to cynicism. We need to turn this awful situation into something productive. In an attempt to do so, the following are some key takeaways from the experience.

1) The Importance of Due Diligence

“The best way that independent filmmakers can protect themselves from bad distributors is to do due diligence,” said distribution strategist Peter Broderick. “Due diligence should involve speaking to 3-5 filmmakers who are currently, or recently, in business with that distributor. The filmmaker should not ask the distributor for referrals, they should look up which films the company is working with and have confidential conversations with them about their experience. Is the distributor sending reports regularly and paying on time? Are they easily accessible to their filmmakers? Have the results matched the expectations created by the distributor? If the filmmaker isn’t comfortable sharing numbers, that’s fine. You just need a clear sense of whether working with this distributor is an opportunity or could be a disaster.”

It’s true that if I had done proper due diligence in 2021, when I was considering signing with Passion River, I probably would have avoided disaster. It seems that Passion River had been withholding payments even back then. But we also need some sort of institution where we can centralize our experience and knowledge around distributors. The issue is that everybody exists in their own silo and they don’t speak up out of fear. We need some sort of centralized way to create accountability.

2) The Filmmaker Suffers Most

It’s clear that the filmmakers bore the brunt of this entire fiasco. We were the ones who invested in our films. We are the ones who suffered the financial fallout. The employees at Passion River got new positions at BayView. Josh Levin maintains a faculty position at American University. There’s not much revenue in independent documentaries, and there is a layer of professionals who scrape whatever exists up top, leaving little to nothing for the filmmaker. So be careful where you spend your resources.

3) A Warning of What’s Ahead

The collapse of Passion River happened at an uncertain time for the industry at large. 2023 started off with the Sundance Film Festival, which saw the worst sales of documentaries in years. There will continue to be more disruptions as new technology and viewing habits change the way films are made and seen. This is also happening in a tumultuous macroeconomic environment. I would not be surprised if more distributors start to become insolvent or if they sell off their assets in the same manner Passion River did. In fact, there’s a thread on the Protect Yourself Facebook Group [Facebook account required and one must join the group to view] about filmmakers not getting paid by 1091 Pictures. If you have a contract with a film distributor, be on high alert. Stay on top of payments and reports. Ask the difficult questions. Be vigilant. If Passion River gets away with all of this, it could become a blueprint for other distributors to follow.

Thank you for reading. If you have any questions or comments, please reach out to me at pat@hardrainfilms.com.

admin October 31st, 2023

Posted In: Distribution, DIY, Documentaries, Facebook, Legal

Don’t Just “Take the Plunge” in a Distribution Deal

Part 1: Know What You Are Saying “Yes” To • by Orly Ravid

Part 2: Thank U (4 Nothing), Next • by David Averbach

Part 3: Goals, Goals, Goals • by Orly Ravid and David Averbach — COMING SOONPart 1: Know What You Are Saying “Yes” To

by Orly Ravid

We know from filmmakers the reasons they often choose all rights distribution deals, even when there is no money up front and no significant distribution or marketing commitment made by the distributor. Regardless of whether the offer includes money up front, or a material distribution/marketing commitment, we think filmmakers should consider the following issues before granting their rights.

The list below is not anything we have not said before, and it’s not exhaustive. It’s also not legal advice (we are not a law firm and do not give legal advice). It is another reminder of what to be mindful of because independent film distribution is in a state of crisis, and we are seeing a lot of filmmakers be harmed by traditional distributors.

Questions to ask, research to do, and pitfalls to avoid

- Is this deal worth doing?: Before spending time, money, and energy on the contract presented to you by the distributor, ask other filmmakers who have recently worked with the distributor if they had a good (or at least a decent) experience. Did the distributor do what it said it would do? Did it timely account to the filmmakers? These threshold questions are key because once a deal is done, rights will have been conveyed. So ask that filmmaker (and also decide for yourself) whether they would have been better served by either just working with an aggregator or doing DIY, rather than having conveyed the rights only to be totally screwed over later.

- Get a Guaranteed Release By Date (not exact date but a “no later than” commitment): If you do not get a “no later than” release commitment, your film may or may not be timely released and, if not, the point of the deal would be undermined.

- Get express specific distribution & marketing commitments and limitations / controls on recoupable expenses: To the extent filmmakers are making the choice to license rights because of certain distribution promises or assumptions about what will happen, all of that should be part of the contract. If expenses are not delineated and/or capped, they could balloon and that will impact any revenues that might otherwise flow to the filmmakers. There is a lot more to say about this including marketing fees (not actual costs, but just fees) and also middlemen and distribution fees. But since we are really not trying to give legal advice, this is more to raise the issues so that filmmakers have an idea of what to think about.

- Getting Rights back if distributor breaches, becomes insolvent, or files for bankruptcy: Again, lots to say about this which we will avoid here, but raising the issue that if one does not have the ability to get their rights back (and their materials back) in case a distributor materially breaches the contract, does not cure it, becomes insolvent, or files for bankruptcy, then filmmakers will be left having their rights tied up without any recourse or access to their due revenues. It’s a horrible situation to be in and is avoidable with the right legal review of the agreement. Of course, technically having rights back and having the delivery materials back does not cancel already done broadcasting, SVOD, AVOD and/or other licensing agreements, nor can one just direct to themselves the revenues from platforms or any licensees of the sales agent or distributor (short of an agreement to that end by the parties and the sub-licensees)…but we will cover what is and is not possible in terms of films on VOD platforms in the next installment of this blog.

- Can you sue in case of material breach? Another issue is, when there is material breach, does the contract allow for a lawsuit to get rights back and/or sums due? Often sales agents and distributors have an arbitration clause which means that the filmmakers have to spend money not only on their lawyer(s) but also on the arbitrator. Again, there is much more to say about this, but we just wanted to raise the issue here. There are legal solutions for this, but distributors also push back on them, which gets us back to the first point, is this deal worth doing? Because if the distributor’s reputation is not great or even just good, and, on top of that, if it will not accommodate reasonable comments (changes) to the distribution deal that would contractually commit the distributor to some basic promises and therefore make the deal worth doing and protect the filmmaker from uncured material breach by the distributor, then why would you do that deal?

Filmmakers too often just sign distribution agreements without understanding what they are signing or without hiring a lawyer who knows distribution well enough to review the agreement. This is foolish because once the contract is signed and the delivery is done, the film is out of the filmmakers’ hands and they will have to live with the deal they made. If that deal was not carefully vetted and negotiated, then the odds are that it will not be good for the filmmaker. Filmmakers can make their own decisions, but we urge them to be informed.

How to best be informed:

- Get a lawyer who knows distribution

- Check out our Case Studies

- Read the Distributor ReportCard to see what other filmmakers have said about a distributor and/or find filmmakers to talk to on your own who have used them recently. If we haven’t covered a certain distributor in the DRC but one of our films has used them, just contact us. We could be happy to ask them if they’d be willing to speak with you, and, if so, make an introduction.

Part 2: Thank U (4 Nothing), Next

By David Averbach

When TFC started our digital aggregation program[1] in 2012, there was a palpable sense of possibility, that things were changing–access was opening up, and filmmakers were finally being given a more even playing field. Who needed middlemen when one could go direct [2]!?

In many ways, going direct, choosing to self-distribute, was (and maybe still is) viewed a bit like electing to be single, as opposed to the “security” of a relationship and/or a marriage. When your film gets distribution, it’s a little bit like, “They said, ‘yes!’ Somebody loves me. I don’t have to go it alone.” Less stigma, more legitimacy.

Relationships and distribution deals have a lot in common. If you are breaking up with your distributor, it can get messy. That’s why TFC Founder Orly Ravid has outlined above some of the basic concepts and things you can do with your lawyer to make sure that if you choose to do a deal, you protect yourself as you enter into a binding relationship. Like a pre-nup. So that you get to keep everything you brought with you into said relationship when you part ways.

Good News, Bad News

So, let’s say there is good news in the sense that you are able to hang on to whatever belongings you brought into the relationship.

But there’s bad news, too. Your ex is keeping all the stuff you bought together.

At least it’s going to feel like that. I know…you would rather kick your ex out and stay in your apartment. Really, I get it. But it’s not going to happen. It’s going to feel like your ex has all your stuff and won’t give it back. Because you are not going to feel grateful like Ariana; you will want someone to blame. But that’s not really fair. Because it’s more like you are both getting kicked out of the apartment and technically your partner still owns all the stuff that’s still inside, but also that they changed the locks and neither one of you can get back inside and access it. And, also, you are now homeless. Good times.

OK, let’s back up for anyone confused by the breakup metaphor: You got the rights to your film back.[3] Yay! Your film is up on all these platforms. All you want to do is keep it up on those platforms. Sorry, not gonna happen. You’re going to have to start again from scratch.