The Evolution of the Education Market

Our guest blog author this month is Vanessa Domico, who has more than 30 years of business experience in both the corporate and non-profit sectors. In 2000, Vanessa joined the team of WMM (Women Make Movies), first as the Marketing and Distribution Director, and eventually Deputy Director. Wanting to work more closely with filmmakers, Vanessa left WMM in 2004 to start Outcast Films.

Our guest blog author this month is Vanessa Domico, who has more than 30 years of business experience in both the corporate and non-profit sectors. In 2000, Vanessa joined the team of WMM (Women Make Movies), first as the Marketing and Distribution Director, and eventually Deputy Director. Wanting to work more closely with filmmakers, Vanessa left WMM in 2004 to start Outcast Films.

As the summer winds down and the new school year approaches, Outcast Films is revving up marketing initiatives for our fall releases. Rolling around in the back of my head is how much technology has changed the business of film distribution: everything from how we position the films to our audience of teachers and librarians to how we deliver the films.

Our primary goal at Outcast is servicing our customers: teachers and librarians. These are the folks that are going to pay money to purchase and rent your film. I think you will agree with me that if teachers and librarians don’t know about the fantastic new documentary you just finished, then what’s the point?

When I started Outcast Films in 2004, we were distributing VHS tapes. A few years later, DVDs (and Blu-rays) hit the market and VHS tapes were quickly made obsolete. Now, here we are in 2018, with educational digital platforms like Kanopy, AVON (Alexander Street Press), and Hoopla, all of whom service the educational and library markets, not to mention Amazon, Netflix, iTunes and so on, digital is moving at light speed forward.

Two years ago, 95% of our income came from DVD sales. Last year that number dropped to 75% and halfway through this year DVD sales only represent approximately 45% of our total sales. By the end of 2020, I believe DVDs will be just like VHS tapes and dinosaurs. There will be some DVD/Blu-ray sales, of course, but for students, teachers, and the increased demand for on-line college classes in the U.S. digital is the future. The problem is technology should work for everyone—big and small – and it doesn’t.

For this blog, I am focusing solely on the educational market, which is Outcast Films’ area of expertise. But giant tech companies like Amazon, Netflix and Hulu also play a huge factor especially in collapsing the markets. For a couple years now, Netflix has been demanding hold back rights for up to three years from the educational platforms like Kanopy and AVON. Now other big tech companies are placing the same demands on producers: you can come with us or go with Kanopy. Most filmmakers will obviously take the bigger money contracts. (I know I would.) But ultimately, this is driving the cost down for consumers which is good for all of us who like to watch films but bad for the bank accounts of filmmakers.

Kanopy’s collection has comprised of approximately 30,000 titles and AVON has over 100,000. It is impossible for these platforms, to market all their films, all the time. That is not a knock against Kanopy or AVON, I think they have been leaders in the industry and I have a tremendous amount of respect for them. They are providing a great service that students and teachers love.

However, a recent monitoring of VIDLIB, a listserv frequented by academic librarians, reveals that many of them are beginning to rail against some platforms like Kanopy and AVON. You can access the entire discussion by signing up for the VIDLIB listserv but for your convenience, I’ve included some anonymous excerpts below:

- “We are concerned about our rising costs from Kanopy”

- “I believe many of us could not foresee just how expensive streaming, DSLs, etc. would cost us in the long run.”

- “Librarians jobs have become more accountant in nature than collection development.”

- “Trying to balance the needs of faculty/our community for access with a commitment to continue to develop and maintain a lasting collection is difficult.”

- “Our IT department is over-taxed as is and does not have the resources to devote to hosting streaming video files.”

- “We basically had to stop all collection development.”

- “The paradox of increasing production and availability of media resources and shrinking acquisition budgets, due to streaming costs is a disturbing trend, particularly when considering that 100% of our video budget went to DVD acquisitions just four years ago.”

- “(our budget for DVDs) is $20,000 and there’s no way we can purchase in-perpetuity rights for digital files; and, really, there’s no way we can ‘do it all’ or meet all needs.”

- “We love Kanopy – but when it costs $150/year to just provide access, not ownership, to one title, it’s really, really hard to justify.”

- “State legislators are beginning to put pressure on schools to find ways to reduce the cost of things like books, etc.”

- “When colleges and universities are already under fire for the cost of textbooks, etc., asking students to pay one more additional cost gets lumped into the argument about the increasing cost of higher education.”

The concerns these librarians have expressed have been on a slow simmer the last few years but it’s only a matter of time before they hit a full-on pasta boil. One of the most significant concerns, and the one that will affect filmmakers most, is the high cost of streaming.

Another factor that we need to consider is the copyright law and the “Teacher’s Exemption”. With the help of the University of Minnesota, the law is simplified below:

- The Classroom Use Exemption

- Copyright law places a high value on educational uses. The Classroom Use Exemption (17 U.S.C. §110(1)) only applies in very limited situations, but where it does apply, it gives some pretty clear rights.

- To qualify for this exemption, you must: be in a classroom (“or similar place devoted to instruction”). Be there in person, engaged in face-to-face teaching activities. Be at a nonprofit educational institution.

- If (and only if!) you meet these conditions, the exemption gives both instructors and students broad rights to perform or display any works. That means instructors can play movies for their students, at any length (though not from illegitimate copies!)

In other words, if a teacher is going to use the film in their classroom, and they teach in a public university or high school, they do not need anybody’s permission to stream the film to their students.

That’s not the best news for filmmakers but I always say: facts are your friends. Knowing that they won’t need your permission, what can you do to ensure teachers see (and love) your film?

Stay with me because I’m going to ask you to do a little math:

If a librarian has a budget of $20,000 a year for films, at an average cost of $150 for a one-year digital site license (DSL), then they can expect to rent approximately 133 DSLs a year. According to Quora, there are nearly 10,000 films currently being made each year and that number is growing (thanks in large part to technology.) The bottom line is that you have a 1.3% chance that your film will be rented by that university or college. If we increase the library’s budget 5 times, your chance increases to 6.5% which are not great odds.

Facts are our friends. If independent film producers and companies like Outcast Films are going to survive in this volatile business, we need to embrace the facts to solve the problems which means doing your homework. Filmmakers who think they have a great film for the educational market, will have to make their film available through digital platforms. But if they want to increase their odds of selling the film, you will also have to do their own marketing – or hire someone who has experience in the business to help you.

Here are a few tips to help you get started:

- Define and establish your goals as soon as possible

- Write copy for your film with your audience in mind (i.e. teachers are going to want to know how they can use this film in their class)

- Organize a college tour before you turn over the rights of the film

- In the process, find academic advocates who will present the film at conferences AND recommend it to their librarians.

The educational market is a very important audience to reach for many filmmakers. I think most folks reading this blog would agree there is not a better way to educate than by using film. The educational market can also be lucrative, but librarians cannot sustain the increase in costs for steaming over the long haul. As information flows freely through technology, teachers are becoming savvy to the business and realize they don’t need permission to stream a film in their classroom if they respect the criteria set forth in the copyright law.

Remember, facts are our friends. If you think your film is perfect for the educational market, then do your homework: research, strategize and find partners who will help you.

David Averbach August 1st, 2018

Posted In: Digital Distribution, Distribution, education, Netflix, Uncategorized

What Nobody Will Tell You About Getting Distribution For Your Film; Or: What I Wish I Knew a Year Ago.

By Smriti Mundhra

Smriti Mundhra is a Los Angeles-based director, producer and journalist. Her film A Suitable Girl premiered at the Tribeca Film Festival in 2017 and is currently playing at festivals around the world, including Sheffield Doc/Fest and AFI DOCS. Along with her filmmaking partner Sarita Khurana, Smriti won the Albert Maysles Best New Documentary Director Award at the Tribeca Film Festival.

I recently attended a panel discussion at a major film festival featuring funders from the documentary world. The question being passed around the stage was, “What are some of the biggest mistakes filmmakers make when producing their films?” The answers were fairly standard—from submitting cuts too early to waiting till the last minute to seek institutional support—until the mic was passed to one member of the panel, who said, rather condescendingly, “Filmmakers need to be aware of what their films are worth to the marketplace. Is there a wide audience for it? Is it going to premiere at Sundance? Don’t spend $5 million on your niche indie documentary, you know?”

Immediately, my eyebrow shot up, followed by my hand. I told the panelist that I agreed with him that documentaries—really, all independent films—should be budgeted responsibly, but asked if he could step outside his hyperbolic example of spending $5 million on an indie documentary (side note: if you know someone who did that, I have a bridge to sell them) and provide any tools or insight for the rest of us who genuinely strive to keep the marketplace in mind when planning our films. After all, documentaries in particular take five years on average to make, during which time the “marketplace” can change drastically. For example, when I started making my feature-length documentary A Suitable Girl, which had its world premiere in the Documentary Competition section of this year’s Tribeca Film Festival, Netflix was still a mail-order DVD service and Amazon was where you went to buy toilet paper. What’s more, film festival admissions—a key deciding factor in the fate of your sales, I’ve learned—are a crapshoot, and there is frustratingly little transparency from distributors and other filmmakers when it comes to figuring out “what your film is worth to the marketplace.”

Sadly, I did not get a suitable answer to my questions from the panelist. Instead, I was told glibly to “make the best film I could and it will find a home.”

Not acceptable. The lack of transparency and insight into sales and distribution could be the single most important reason most filmmakers don’t go on to make second or third films. While the landscape does, indeed, shift dramatically year to year, any insight would make a big difference to other filmmakers who can emulate successes and avoid mistakes. In that spirit, here’s what I learned about sales and distribution that I wish I knew a year ago.

As any filmmaker who has experienced the dizzying high of getting accepted to a world-class film festival, followed by the sobering reality of watching the hours, days, weeks and months pass with nary a distribution deal in sight can tell you, bringing your film to market is an emotional experience. This is where your dreams come to die. A Suitable Girl went to the Tribeca Film Festival represented by one of the best agent/lawyers in the business: The Film Collaborative’s own Orly Ravid (who is also an attorney at MSK). Orly was both supportive and brutally honest when she assessed our film’s worth before we headed into our world premiere. She also helped us read between the lines in trade announcements to understand what was really going on with the deals that were being made – because, let’s face it, who among us hasn’t gone down the rabbit hole of Deadline.com or Variety looking for news of the great deals other films in our “class” are getting? Orly kept reminding us that perception is not reality, and that many of these envy-inducing deals, upon closer examination, are not as lucrative or glamorous as they may seem. Sometimes filmmakers take bad deals because they just don’t want to deal with distribution, have no other options, and can’t pursue DIY, and by taking the deal they get that sense of validation that comes with being able to say their film was picked up. Peek under the hood of some of these trade announcements, and you’ll often find that the money offered to filmmakers was shockingly low, or the deal was comprised of mostly soft money, or—even worse—filmmakers are paying the distributors for a service deal to get their film into theaters. There is nothing wrong with any of those scenarios, of course, if that’s what’s right for you and your film. But, there is often an incorrect perception that other filmmakers are somehow realizing their dreams while you’re sitting by the phone waiting for your agent to call.

Depressed yet? Don’t be, because here’s the good news: there are options, and once you figure out what yours are, making decisions becomes that much easier and more empowering.

Start by asking yourself the hard questions. Here are 12+ things Orly says she considers before crafting a distribution strategy for the films she represents, and why each one is important.

- At which festival did you have your premiere? “Your film will find a home” is a beautiful sentiment and true in many ways, but distributors care about one thing above all others: Sundance. If your film didn’t beat the odds to land a slot at the festival, you can already start lowering your expectations. That’s not to say great deals don’t come out of SXSW, Tribeca, Los Angeles Film Festival and others, but the hard truth is that Sundance still means a lot to buyers. Orly also noted that not all films are even right for festivals or will have a life that way, but they can still do great broadcast sales or great direct distribution business – but that’s a specific and separate analysis, often related to niche, genre, and/or cast.

- What is your film’s budget? How much of that is soft money that does not have to be paid back, or even equity where investors are okay with not being paid back? In other words, what do you need to net to consider the deal a success? Orly, of course, shot for the stars when working on sales for our film, but it was helpful for her to know what was the most modest version of success we could define, so that if we didn’t get a huge worldwide rights offer from a single buyer she could think creatively about how to make us “whole.”

- What kind of press and reviews did you receive? We hired a publicist for the Tribeca Film Festival (the incomparable Falco Ink), and it was the best money we could have spent. Falco was able to raise a ton of awareness around the film, making it as “review-proof” as possible (buyers pay attention if they see that press is inclined to write about your film, which in many cases is more important to them than how a trade publication reviews it). We got coverage in New York Magazine, Jezebel, the Washington Post and dozens of other sites, blogs, and magazines. Thankfully, we also got great reviews in Variety and The Hollywood Reporter, and even won the Albert Maysles Prize for Best New Documentary Director at Tribeca. Regardless of how this affected our distribution offers, we know for sure we can use all this press to reignite excitement for our film even if we self-distribute. On the other hand, if you’re struggling to get attention outside of the trades and your reviews are less than stellar, that’s another reason to lower expectations.

- What are your goals, in order of priority? Are you more concerned with recouping your budget? Raising awareness about the issues in your film (impact)? Or gaining exposure for your next project/ongoing career? And don’t say “all three”—or, if you do, list these in priority order and start to think about which one you’re willing to let go.

- How long can you spend on this film? If your film is designed for social impact, do you intend to run an impact/grassroots campaign? And can you hire someone to handle that, if you cannot? Do you see your impact campaign working hand in hand with your profit objectives, or separately from them? The longer you can dedicate to staying with your film following its premiere, the more revenue you can squeeze out of it through the educational circuit, transactional sales, and more. But that time comes at a personal cost and you need to ask yourself if it’s worth it to you. Side note: touring with your film and self-distributing are also great ways to stay visible between projects, and could lead to opportunities for future work.

- Does your film have sufficient international appeal to attract a worldwide deal or significant territory sales outside of the United States? If you think yes, what’s your evidence for that? Are you being realistic? By the way, feeling strongly that your film has a global appeal (as I do for my film) doesn’t guarantee sales. I believe my film will have strong appeal in the countries where there is a large South Asian diaspora—but many of those territories command pretty small sales. Ask your agent which territories around the world you think your film might do well in, and what kinds of licensing deals those territories tend to offer. It’s a sobering conversation.

- Does your film fit into key niches that work well for film festival monetization and robust educational distribution? For example, TFC has great success with LGBTQ, social justice, environmental, Latin American, African American, Women’s issues, mental health. Sports, music, and food-related can work well too.

- Does your film, either because of subjects or issues or both, have the ability to command a significant social media following? A “significant” social media following is ideally in the hundreds of thousands or millions of followers, but is at least in the high five figures. We know the last thing you want to think about when you’re trying to lock picture, run a crowdfunding campaign, deal with festival logistics, and all the other stress of preparing for your big debut is social media. But don’t sleep on it. Social media is important not only to show buyers that there is interest in your film, but also ideas on how to position your film and which audiences are engaging with it already. Truth be told, unless you’re in the hundreds of thousands or millions of followers range, social media probably won’t make or break your distribution options, but it can’t hurt. And, in our case, it actually helped us get a lot of interest from educational distributors, who were inspired by the dialogue they saw brewing on our Facebook page.

- How likely is your film to get great critic reviews, and thus get a good Rotten Tomatoes score? Yeah, not much you can do to predict this one. However, a good publicist will have relationships with critics who can give you some insight into what the critical reaction to your film might be, before you have to read it in print. They also reach out to press who they think will like your film, keep tabs on reactions during your press and industry screenings, and monitor any press who attend your public screenings. This data is super useful for your sales representatives.

- How likely is your film to perform theatrically (knowing that very few do), sell to broadcasters (some do but it’s very competitive), sell to SVOD platforms (as competitive as TV), and sell transactionally on iTunes and other similar services (since so many docs do not demand to be purchased)? While these questions are easy to pose and hard to answer, start by doing realistic comparisons to other films based on the subject, name recognition of filmmakers, subject, budget, festival premiere status, and other factors indicating popularity or lack thereof. Also adjust for industry changes and changes to the market if the film you are comparing to was distributed years before. Furthermore, adjust for changes to platform and broadcaster’s buying habits. Get real data about performance of like-films and adjust for and analyze how much money and what else it took to get there.

- Can your film be monetized via merchandise? Not all docs can do this, but it can help generate revenue. So, go for the bulk orders of t-shirts, mugs, and tote bags during your crowdfunding campaign and sell that merch! Even if it just adds up to a few hundred extra dollars, for most people it’s pretty easy to put a few products up on their website.

- Does your film lend itself to getting outreach/distribution grants, or corporate sponsorship/underwriting? With the traditional models of both film distribution and advertising breaking down, a new possibility emerges: finding a brand with a similar value set or mission as your film to underwrite some portion of your distribution campaign. I recently spoke to a documentary filmmaker who sold licenses to his film about veterans to a small regional banking chain, who then screened the film in local communities as part of their outreach effort. The bank paid the filmmakers $1000 per license for ten separate licenses without asking them to give up any rights or conflict with any of their other deals—that’s $10,000 with virtually no strings attached. Not bad!

Sadly, Netflix is no longer the blank check it once was (or that I imagined it to be) and the streaming giant is taking fewer and fewer risks on independent films. Thankfully, Amazon is sweeping in to fill the gap, and their most aggressive play has been their Festival Stars program. If you’re lucky enough to premiere in competition at one of the top-tier festivals (Sundance, SXSW, and Tribeca for now, but presumably more to come), then you already have a distribution deal on the table: Amazon will give you a $100,000 non-recoupable licensing fee ($75,000 for documentaries) and a more generous (double) revenue share than usual per hour your film is streamed on their platform for a term of two years. For many independent films, this could already mean recouping a big chunk of your budget. It also provides an important clue as to “what your film is worth to the marketplace”—$100,000 seems to be the benchmark for films that can cross that first hurdle of landing a competition slot at an A-list festival.

I’ll admit, I was a snob about the Amazon deal when I first heard about it. I couldn’t make myself get excited about a deal that was being offered to at least dozen other films, sight unseen, with no guarantee of publicity or marketing. A Facebook post by a fellow filmmaker (who had recent sold her film to a “legit” distributor) blasting the deal as “just a steep and quick path to devalue the film” left me shaken. But again, appearances proved to be deceiving.

I discussed my concerns with Orly, and she helped me see that with so few broadcast and financially meaningful SVOD options for docs, having a guaranteed significant platform deal with a financial commitment and additional revenue share is actually a great thing. Plus, one can build in lots of other distribution around the Amazon deal and end up with as robust a release as ever there could be. Orly says one should treat Amazon as a platform (online store) but as a distributor and that can provide for all the distribution potential. If one does manage to secure an all-rights deal from a “legit” distributor (we won’t name names, but it’s the companies you might see your friends selling their films to), oftentimes that distributor is just taking the Amazon deal on your behalf anyway, and shaving off up to 30% of it for themselves. So the analysis needs to be what is that distributor doing, if anything, to create additional value that merits taking a piece of a deal you can get on your own? Is it that much more money? Is it a commitment to do a significant impactful release? Are the terms sensible in light of the added value and your recoupment needs? Can you accomplish the same via DIY? Perhaps you can, but don’t want to bother. That’s your choice. But know what you are choosing and why.

Independent filmmakers are, yet again, in uncharted territory when it comes to distribution. Small distributors are closing up shop at a rapid pace. Netflix and Hulu are buying less content out of festivals, and creating more of it in house. Amazon’s Festival Stars program was just announced at Sundance this year (2017) and doesn’t launch until next Spring, so the jury is out as to whether it will really be the wonderful opportunity for filmmakers that it claims to be. By this time next year, several dozen films will have inaugurated the program and will be in a position to share their experiences with others. I hope my fellow filmmakers will be willing to do so. Given the sheer variety of films slated to debut on the platform, this data can be our first real chance to answer the question that the funder on the panel I attended refused to: “What is my film worth to the marketplace?”

Orly adds that the lack of transparency is, of course, in great part attributable to the distributors and buyers, who maintain a stranglehold on their data, but it’s also due to filmmakers’ willful blindness and simple unwillingness to share details about their deals in an effort to keep up appearances. That’s totally understandable, but if we can break the cycle of competing with each other and open up our books, we will not only have more leverage in our negotiations with buyers, but will be equipped to make better decisions for our investors and our careers. Knowledge is power, and if we all get real and share, we’ll all be informed to make the best choices we can.

admin July 5th, 2017

Posted In: Amazon VOD & CreateSpace, Digital Distribution, Distribution, Distribution Platforms, DIY, education, Film Festivals, Hulu, International Sales, iTunes, Marketing, Netflix, Publicity, Theatrical

How viable is DIY Digital Distribution? The Case Study of Tab Hunter Confidential

David Averbach is Creative Director and Director of Digital Distribution Initiatives at The Film Collaborative.

When distributing your film, a lot of time is spent waiting for answers. Validation can come only intermittently, and the constant string of “no”s is an anxiety-ridden game of process of elimination. Which doors open for your film and which doors remain closed determines the trajectory of its distribution, whether it’s festival, theatrical, digital, education or home video (until that’s dead for good).

I work with filmmakers, way down-wind of this long and drawn-out process, who, after exhausting all other possibilities, have “chosen” DIY digital distribution as a last resort.

TFC’s DIY digital distribution program has helped almost 50 filmmakers go through the process of releasing their film digitally over the past 5 years and with most of them, I have often felt as though I were giving a pep-talk to the kid who got picked last for the dodgeball team. “Hang in there, just stick to it…you’ll show them all.”

Is DIY Digital Distribution anything more than a last resort? Perhaps not…

DIY vs. DOA

Since TFC was formed over six and a half years ago, we have optimistically used “DIY” as a term of empowerment, where access and transparency had finally reached a point where one could act as one’s own distributor. After all, we tell these (literally) poor, exhausted filmmakers, “no one knows your film better than you do”, so “no one can do a better job of marketing it.” With a little gumption, a few newsletters and handful of paid Facebook posts, you, too, might prove all the haters wrong and net even more earnings than Johnny next door who sold his film to what he thought was a reputable distributor but never saw a dime past the MG (minimum guarantee) in his distribution agreement. We even wrote two case study books about it.

It’s not that I’m being untruthful with these filmmakers. Nor is it the case that these films are necessarily of poor quality. What they have in common is a lack of visibility. Most had some sort of festival run, and only a handful were released theatrically, usually with one- or two-day engagements in a handful of cities. Occasionally, we’ll get a film that has four-walled in New York or Los Angeles for a week. Or sometimes ones that have played on local PBS affiliates or even on Showtime. But their films are not even close to being household brand names. So without the exposure or the marketing budget, they can do little more than to deliver their film to TVOD platforms like iTunes and hope for the best.

So what happens to these films? The news, as a whole, is not good. Based on what I’ve seen from these films in the aggregate, and all things being equal, if you DIY/dump your film onto only iTunes/Amazon/GooglePlay with moderate festival distribution but no real money left for marketing, you will be lucky to net more than $10K on TVOD platforms in your film’s digital life.

And the poorer the filmmaking quality of your film, or the less recognizable the cast, or the less “niche” your film is, the more likely it will be that you won’t even earn much more revenue than what is required to pay off the encoding and delivery fees to get your film onto these platforms in the first place (which is around $2-3K).

Which is why, as of late, I’ve been aggressively suggesting to filmmakers that holding off on high profile TVOD platforms and instead trying to drive traffic to their websites and offering sales and rentals of their film via Vimeo On Demand or VHX, two much cheaper options, might be a better use of their limited remaining funds.

But am I down on DIY? Not necessarily.

Risky Business

Granted, there are a lot of films out there for which The Film Collaborative can do very little for in the area of digital distribution other than hold filmmakers’ hands. But what about for films working at the “next level up” from last-resort-DIY? Films who have either gotten a no-MG or modest-MG distribution offer?

Many distributors and aggregators working at this level will informally promise some sort of marketing, but many times those marketing efforts are not specifically listed contractually in the agreement. So when filmmakers ask me whether going with a no-MG aggregator is better than doing DIY, this is my answer…

It’s important to remember that, once a film is on iTunes, no one will care how it got there. And by this I mean with no featured placement, just getting it on to the platform. So, if that’s all a distributor/aggregator is doing, this is not the kind of deal that a filmmaker can dump into someone else’s hands and move on to their next project. In fact, many aggregators will send you a welcome packet with tips and suggestions on how to market your film on social media, such as Facebook. In other words, they are literally expecting you to do your own marketing. Not just do but pay for. So, it is entirely possible that all that an aggregator or distributor is doing is fronting your encoding costs, which they will later recoup from your gross earnings, but only after they take their cut off the top. And if your distributor is offering you a modest MG, you must be prepared for the possibility that that MG may be all the earnings you are ever going to see. Certainly, we have seen many, many filmmakers in this position.

So the question remains: Is DIY still too risky for all but films that have run out of options?

It’s a hard question to answer, mostly because there is no ONE answer. Undoubtedly, some films will be helped with such an arrangement and some films will not.

A View from the Other Side…

Distributors, of course, will stick to the sunny side of the street. They will tell you that DIY is too risky for the vast majority of films, and remind you that distribution is more than getting a film on to one or two platforms.

When I asked Gravitas Ventures founder Nolan Gallagher, a veteran in distribution and whose co-execs have a combined 50+ years in distribution experience, about his feelings regarding DIY, he was quick to point out that the main difference between a proven distributor and DIY is that while much of the work in DIY happens in year 1, distributors can help in year 3 or year 5 or beyond. He believes that DIY individual filmmakers will be shut out from new revenue opportunities (i.e. the VOD platforms of the future) that will be launched by major media companies or venture capital backed entrepreneurs in the years to come because these platforms will turn to established companies with hundreds or thousands of titles on offer.

This is a fair point, in theory, but I honestly cannot recall a single instance of one of our filmmakers from 2010-2013 jumping for joy over that fact that his or her distributor had suddenly found a meaningful new VOD opportunity in years 3-5, nor have we heard of any specific efforts or successes down the line. But it’s good to know one can expect this if signing with a distributor.

He also mentioned that many of Gravitas’ documentarians receive multiple 5 figures in annual revenue over 5 years after a film first debuted.

That’s nice for those filmmakers…But what about the ones that don’t? It would be ludicrous to suggest that any decent film, with the proper marketing and industry connections, can become a respectable grosser on iTunes.

By no means am I singling out Gravitas in order to pick on them in any way. For many films, clearly they do a terrific job.

But does that mean that there aren’t a handful of filmmakers that have gone through aggregators like Gravitas or other smaller distributors that many TFC films have worked with, such as The Orchard, A24, Oscilloscope, Virgil, Wolfe, Freestyle Digital Media, Breaking Glass Pictures, Amplify, Wolfe, Zeitgeist Films, Dark Sky Films, Tribeca Films, Sundance Selects, who are not entirely convinced that they were well served by their distributor? Of course not.

The Million Dollar Question…

The question I really wanted to know was more of a hypothetical one than one that assigns blame: if these so-called “borderline films” that went through aggregators/distributors had done DIY instead, how close could they have come netting the same amount of earnings in the end? Is it possible that they could have gotten more?

This is a hard question—or, should I say, a nearly impossible question—to answer, because no one has a crystal ball. But also because of the continued lack of transparency surrounding digital earnings, despite initiatives like Sundance Institute’s The Transparency Project, and because the landscape is continually evolving.

A recent article in Filmmaker Magazine, entitled “The Digital Lowdown,” discusses how independent filmmakers struggle to survive in an overcrowded digital marketplace and “admits” that niche-less festival films will only gross in the range of $100K-$200K, and that, in fact, talks about a “six-figure goal.” But in almost the same breath, there is a caveat. Sundance Artist Services warns that “…if a filmmaker spends about $100,000 in P&A to finance a theatrical run, they’re probably going to be making that much from digital sources.”

I have heard many stories of distributors and filmmakers alike, who put “X” dollars combined into P&A for both theatrical and digital only to make a similar amount back in the end. So what’s the point? If you look at distribution from the perspective of paying back investors, are a good portion of filmmakers netting close to nothing, no matter whether they do DIY or whether they gear up for a theatrical and digital distribution via a distributor? If a film does not succeed monetarily, is the consolation prize merely visibility and exposure? (Which is not nothing, but it’s not $$ either).

Sweet/Talk

A few months ago, my colleague Bryan Glick posted a terrific piece on our blog that questioned the ROI of an Oscar®-qualifying run, given the unlikelihood of being shortlisted. Bryan implies that because filmmakers like hearing “yes,” and like having their egos stroked, when publicists, publications, screening series, cinemas, and private venues all lure filmmakers with a possibility of an Oscar®, something takes over and they lose perspective at the very moment they need it most.

Could the same be true for a distribution strategy? Are filmmakers so happy to be offered a distribution deal at all that they are unable to walk away from that distribution deal, even if they suspect that it undervalues their film? And could a viable DIY option change that?

Evaluating Success with DIY

Last fall, I began to think about what a “successful” DIY digital release could look like. On the low end, we’ve heard about a magical $10K figure that I discussed above…in the context of MGs paid to Toronto official selections via Vimeo on Demand, and Netflix offers to Sundance films via Sundance Artists Services. So it would have to be at least greater than $10K. And on the high end, it would have to be at least $100K that the filmmaker gets to net over a 10-year period.

Working backwards, how can this be achieved and is it possible to recreate that strategy via DIY?

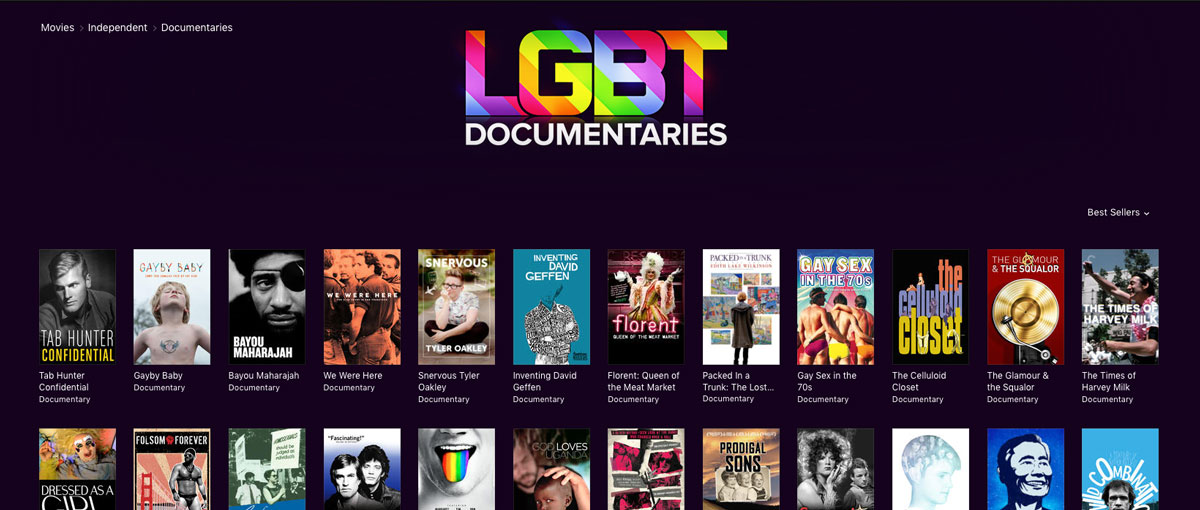

One thing that gave me hope was when my colleague Orly Ravid, acting as sales agent, negotiated a licensing low-six-figure deal with Netflix for the film Game Face, about LGBTQ athletes coming out. The film won numerous audience awards at film festivals, but had no theatrical release. Timing, as well as the sports and LGBT niche, made this film perfect for a DIY release. The only catch was the Netflix insisted on a simultaneous SVOD & TVOD window, so Netflix and iTunes releases started within one day of each other. TFC serviced the deal through our flat-fee program via Premiere Digital Services.

Lessons Learned from the DIY Release of Tab Hunter Confidential

This past Spring, TFC spearheaded the digital release of Tab Hunter Confidential, a film for which we also handled festival and theatrical distribution, as well as sales. Truth be told, this film almost went through a distributor. In the end, however, after a protracted period of negotiation, an offer was made, but knowing how much Netflix was willing to offer, Orly advised the filmmaker to walk away from the deal and try our hand at a DIY release. The filmmaker agreed, and we serviced the Netflix deal via Premiere. However, as Netflix wanted the film for June, which is Gay Pride Month, we had a limited amount of time in which to do iTunes, and I was determined to make the most of it.

This past Spring, TFC spearheaded the digital release of Tab Hunter Confidential, a film for which we also handled festival and theatrical distribution, as well as sales. Truth be told, this film almost went through a distributor. In the end, however, after a protracted period of negotiation, an offer was made, but knowing how much Netflix was willing to offer, Orly advised the filmmaker to walk away from the deal and try our hand at a DIY release. The filmmaker agreed, and we serviced the Netflix deal via Premiere. However, as Netflix wanted the film for June, which is Gay Pride Month, we had a limited amount of time in which to do iTunes, and I was determined to make the most of it.

So what were the goals? And how could we get there?

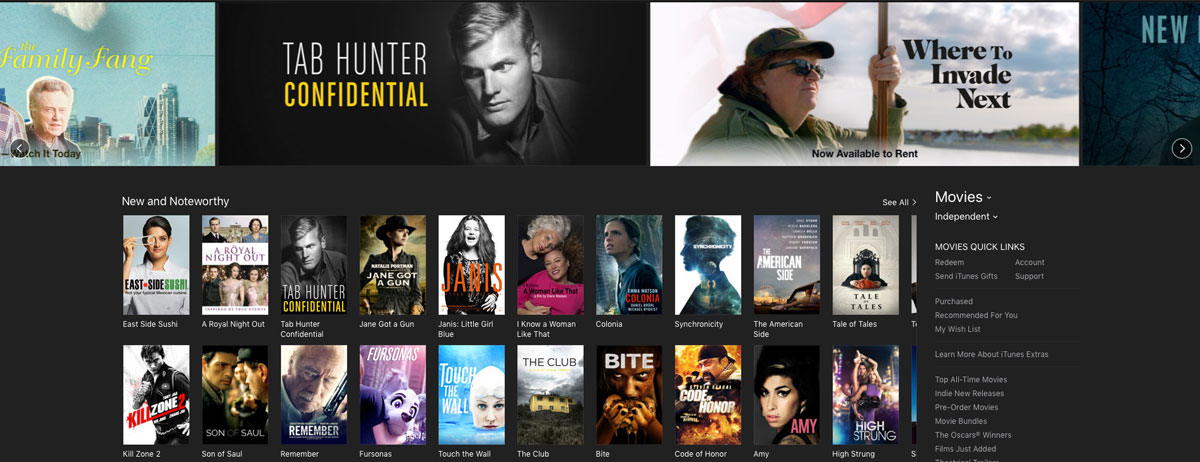

I had been trolling both the “Independent” and “Documentary” sections on iTunes for months in preparation for what has now become this article on DIY. I had been noticing that while it is easy to get a film into the “New & Noteworthy” section in “Documentaries,” which contains at hundreds of films, the similar section in “Independent” is limited to about 32. So how could one get there? And how could one’s film be featured in the top carousel in “Independent” or in any of the genre categories? Would it help to offer iTunes exclusivity? Would it help to do iTunes Extras? Could we contact Apple and try and schedule something? What else could be done? These are the questions that I set out figure out on my own, or to ask our aggregator, Premiere Digital Services.

How can I get my film to be one of the 30+ films in the “Independent” Section of iTunes? This section is populated at Apple’s discretion. Their iTunes division is based in L.A., not Silicon Valley, and they attend film festivals and are very up-to-date on the indie film landscape. It’s clear, however, that while they do speak with distributors and aggregators about what’s coming down the pipeline, most of the decisions about what is to receive placement in this section occur within a week or two of the release date in question, and are decided ultimately by iTunes. I informed Premiere Digital that we were very interested in being placed in Independent, and they told me that they have weekly calls with iTunes and that—closer to the date of release—they would mention the film to them. In the end—spoiler alert—we did manage to get Tab into this section. But there were no back room deals to get that to happen…so I can hereby confirm that it is possible to be featured on the iTunes store based solely on your film and the specifics of its release.

Rotten Tomatoes Score: Out of approximately 100 films that appeared from late November 2015 to early February 2016 (which I kept track of manually, so the following is not completely scientific), about 50 of those had a “fresh” rotten tomatoes score. About 40 of those 50 had RT scores over 80%, and many of those were Certified as Fresh. Of the remaining 50 films, about 20 had “rotten” RT scores, and about 30 had no score at all. Luckily, Tab Hunter Confidential has an RT score of 87%, so I knew I was safe from that perspective. But while I was investigating, I was particularly interested in those films without a score. I noticed that many of them had star power attached, and a few of them were holiday-themed. A few of them were Lionsgate titles. And a few sports-related and horror titles, which always seem to rise to the top. I glanced at the Independent section for this week (third week in August), and these numbers pretty much bear out, save the holiday ones. The takeaway here was that if your film did not have a theatrical (and therefore perhaps does not have a RT score), if it doesn’t have famous people in it, it’s not about sports or is not in the horror genre, your chances of appearing in this section as a DIY film going through an aggregator seem pretty slim.

Check in, check out dates. As many of you know, films always end up in one of Apple’s genre sections. They stay there a few weeks or even a few months until they are bumped out of that category by newer items. But those sections are very glutted. The “Independent” section is a second placement, one that is curated by Apple, of only three rows of films. One thing that I became acutely aware of was the high turnaround in this section. Films seemed to be refreshed twice a week: once on Tuesdays (release day), and then again on Fridays. This was more or less consistent, although I got the feeling that on a few occasions things were a bit early or a bit late.

At any rate, it was very clear that if films were not pulling their weight, they would be booted from the “Independent” section for something else. At least 1/3 of the films were gone after only a few days. After all, Apple is in the business of making money off these films too. What occurred to me is that if filmmakers are doing distribution deals to get placement, and their films only last 3 days in the “Independent” section, and that measly placement is what amounts to the big perk/payoff of going through a distributor, it’s a pretty sad day for either the filmmaker, the distributor, or both.

How can I get my film featured in the top carousel? It turned out to be the same answer as for the Independent section in general, but I can admit it now…I was a pest: I asked multiple people at Premiere this question. I was told over and over that Apple will make a request for layered artwork if they are interested in featuring the film. Two weeks before the release date I had not heard anything. But less than a week before, Premiere received the request for artwork from Apple. We ended up being featured in both the “Independent” and “Documentary” sections.

Why did they pick us? I am not completely sure, but here are my guesses: We had a great film festival run. The film was based on a bestselling book. We had a high RT score; we did a 40+ city theatrical; we had a lot of press, and we had a publicist; the film was apparently not doing terribly in the iTunes Pre-Order section, Tab Hunter did many interviews when the theatrical came out; Tab Hunter is freaking Tab Hunter; the film spans both LGBT genres and the genre of women of a certain age who came of age in the 1950s and still remember Tab’s poster on their bedroom walls; the artwork was classy; it was almost June; we gave them an exclusive (although I don’t think they ever advertised it as such); we did an international release on iTunes (we were told that Apple likes films to have more than one territory to be featured, which is kind of strange, because it wasn’t featured in any other iTunes store, like Canada or UK); and lastly, we did some iTunes custom artwork and iTunes Extras.

Walking the walk. Speaking of customization, one thing that I noticed about every film in the “Independent” section was that most detail pages contained customized promotion background artwork. Apple likes this. It gives the film branding, credibility. Apple has two different kinds of background art one for the iTunes store and one for AppleTV. We opted to do just the iTunes store art, which is an extra $75 conformance fee at Premiere. We also did iTunes Extras basic package, for about $700 extra, which offers a chance to include bonus features, such as outtakes and other exclusive video. Since we were planning on including bonus interviews on our DVD, we included that file, as well as 10 minutes of interviews for which iTunes is the only place that they are available. I’m not sure if Extras helped the featured placement, since we were literally down to the wire on having them appear on the store in time for the release. (At the last minute, we needed a looping background audio for iTunes, which we didn’t realize was mandatory, so if you go the Extras route, don’t forget that that audio file is needed).

Results. All in all, we did everything we could, and it paid off. We were featured in both the carousels of the “Independent” and “Documentary” genre sections, and stayed in the “Independent” carousel for a full week and in “Documentary” carousel for two weeks. We stayed in the “New & Noteworthy” part of “Independent” for several weeks. At its peak, we reached #2 in Documentaries, being surpassed only by Michael Moore’s Where to Invade Next, which months later is still in the “New & Noteworthy” part of “Independent.” We made sure Tab Hunter Confidential shows up in both the iTunes Extras section and the “LGBT Movies” Collection section. The more places to find the film, after all, the more chance of it being rented or purchased.

After over 3 months, around the third week of August, Tab Hunter Confidential was the 12th All-Time Bestselling LGBT Doc in the iTunes store. As of the date of this blog, it has dipped down the 14th. It is still in the “New & Noteworthy” part of “Documentaries,” although to be fair that section contains hundreds of films.

Regrets? Could we have stayed longer in the iTunes carousels? Two things worked against us. First, although there was a social media push when the film was released, it was pretty limited, as we had only a small P&A budget. With more of a spend, we could have gotten more attention during the second week, and perhaps sales would have warranted the film sticking around for longer. Other films, such as Gravitas’ Requiem for the American Dream, for which TFC handled the Theatrical, featuring Noam Chomsky, have done a much better job surfing this wave. Fortuitous timing with Bernie Sanders, but that is a story for another day.

Although we offered TVOD exclusivity to Apple until June, it was unclear whether they really cared about that, as they never promoted it as such, and we probably should have released on Amazon, GooglePlay and Vudu on the same day as iTunes.

(Speaking of Amazon and GooglePlay, I once asked someone who used to work at Premiere how one gets featured on those other platforms’ stores. What they told me was shocking: Amazon and GooglePlay basically copy content ideas from the iTunes store. This was about a year ago, so who knows if this is still happening, or if it was even true at all. But I was kind of blown away by this.)

Conclusion. There are undoubtedly things one could immediately try and recreate from the steps that were taken with Tab Hunter Confidential. However, who is to know if they could work a second time, with a different film and different timeframe?

I am not suggesting in this article that distribution deals are unnecessary. Many companies have a ton of industry connections and experience that one might not be able to recreate with DIY.

But in this case, the filmmaker is thrilled, and my TFC team believes that dollar for dollar, the filmmaker walked away with a guaranteed net that is more than they would have received had they taken the distribution deal that was offered to them by a distributor.

So should DIY be considered a dirty word? Only you can decide if it is right for you film. As a whole, the jury might still be out, but, at the very least, I suspect that we’re going to get more filmmakers interested in iTunes background art.

Be sure to look out for Tab Hunter Confidential, on digital platforms, and now on DVD and Blu-Ray, which have recently been released by our friends at FilmRise.

David Averbach September 6th, 2016

Posted In: Amazon VOD & CreateSpace, case studies, Digital Distribution, Distribution, Distribution Platforms, DIY, education, iTunes, Marketing, Netflix

An Update on International VOD Opportunities Outside the U.S. in The Indie Film Sector

Guest blog post by Wendy Bernfeld

The Cannes Film Festival starts today, and any Cannes season would not be complete without an update from our dear friend and colleague Wendy Bernfeld, Founder and Managing Director of Rights Stuff and co-author of our second case study book in 2014 Selling Your Film Outside the U.S. (free on Amazon Kindle and Apple iBooks. Wendy specializes in Library and Original Content acquisition/distribution, international strategy / deal advice, for traditional media (film, TV, pay TV), digital media (Internet/IPTV, VOD, mobile, OTT/devices), and web/cross-platform/transmedia programming, and also active on various film festival / advisory boards, such as IDFA, Binger Film Institute, Seize the Night, Outdoor FilmFest, and others, including TFC! Follow her on Twitter: @wbernfeld.

What’s happened out there in the two years since TFC first published Selling Your Film Outside the U.S. (“The Book”)?

My introductory chapter to the book, entitle, “Digital Distribution in Europe” provided a snapshot of the evolving sector at that point in time. However, by now, the sector, particularly in the area of SVOD and AdVOD, has leaped even more forward, and includes more mature services as well as new niche and thematic services out there— as well as some services with an increased appetite for foreign language, art house and documentary films/series (finally).

A. Blurred Lines — Traditional vs. Digital — Hybrid Platforms

More recent trends 2015-16 include increasingly blurred dividing lines between so-called traditional vs digital players .

- Traditionals: Many traditional players, internationally, (like telecoms, cable and free tv) have now become more digital, by either 1) bysetting up their own competing, or complementary, multi-window VOD offerings such as SVOD services (e.g. Channel 9’s STAN in Australia or Liberty Global’s MyPrime in both Switzerland and Netherlands); or 2) electing to instead “sleep with the enemy” by just hosting digital channels like Netflix, Spotify, etc. on their set-top box (e.g. Orange, ComHem Sweden, Virgin UK). Some traditionals opt to distinguish the brand identity of the VOD service from the main service, (different names); while others unite both services under one brand, such as CanalPlay (C+) or Viasat’s VIAPLAY. Recent developments include BBC announcing it will start SVOD internationally, after also migrating its Channel 3 to digital-only online offering; and ITV starting CURIO, a nonfiction SVOD in the UK.

- Digitals: Correspondingly, the so-called formerly digital-only players like Netflix, Amazon (previously more complementary or second window) are now acting a great deal like the traditional players. Think: old-fashioned commissioning broadcasters who increasingly require first-window status and exclusivity, and who are funding “originals”, getting involved competitively commissioning films from development stage etc. and fashioning game-changing windows.

Despite the complexity, this is overall great news for creators/rights-holders since it allows even more opportunity to maximize revenues and audiences per successive window, platform and region, if one takes the time to do it right.

B. VODs Per Window:

Lets look at various platforms in each window today, from TVOD, DTO, through to SVOD, AdVOD, etc. Note that many deliberately offer MULTI-model consumer services – such as Orange, Canal Plus and BSKYB (TVOD/DTO, SVOD), Amazon (Instant and Prime, for TVOD/DTO and SVOD, respectively) and Wuaki – while others (Netflix and Curio) operate under just one consumer business model.

- TVOD/DTO:

- For the Big5 (Google, Amazon, iTunes, Xbox, PS), one still generally goes through a digital aggregator, like Juice, Cinedigm, Kinonation, and Syndicado in N.America. Outside N.America, EMEA counterparts in include one of Rights Stuff clients MOMEDIA (attractive multi-platform new biz model, lower cost for more platforms and combined with social media/marketing) – and others like DoCo/ODMedia (NL), MoviePartnership, and Under the MilkyWay.

Shop around…these aggregators they have different models and price alone shouldn’t be the only indicator. Also look at their marketing/positioning: some take your IP, others (like Rights Stuff, TFC) do not.

- Going direct to the others in TVOD/DTO:

Don’t stop at one or even all of the Big5. The play is to have multiple deals , non exclusive, staggered, in all the windows, in each region. Virtually every country has an active telecom and cable or DTH competitor in the region, as well as mobile and online /consumer electronics players who offer VOD, so licensing non-exclusive TVOD to them on top of others is a good first step in the chain.Beyond the utility companies, some other examples in TVOD/DTO include premium pay tv services or platforms like CanalPlus (France and other regions) and BSkyB, (UK, Germany, Italy, New Zealand). Also theatrical chains in some countries, such as Cineplex in Canada or Pathé in Holland, have VOD arms and thus can offer complementary marketing of films in theatrical window with the subsequent TVOD/DTO window. Also check out online VOD indie film specialist FilmDoo (well-curated indie/art house focused, now in UK/EIRE and soon expanding), and as earlier written, Curzon offers day-and-date theatrical combined with VOD in UK. Wuaki announced moves into 15 countries internationally by end of 2016, most are now TVOD/DTO but the Spain HQ is an SVOD OTT platform. The NFB in Canada started TVOD/DTO in N.America and recently in 2016 an SVOD service, and they now buy docs/films from other sources and regions, too.

- Deals: TVOD/DTO continues to be typically a rev share model and sometimes only a loss leader, but can help drive critical awareness, especially when accompanied by social media marketing and audience engagement strategies. Sometimes, film dependent (for eg if a very niche film) it saves money to skip the big5 (who require costly specs) and license direct to the other international tvod/dto platforms, as then at least one participates from day one in revenues, vs having to recoup expensive deliverables.

- For the Big5 (Google, Amazon, iTunes, Xbox, PS), one still generally goes through a digital aggregator, like Juice, Cinedigm, Kinonation, and Syndicado in N.America. Outside N.America, EMEA counterparts in include one of Rights Stuff clients MOMEDIA (attractive multi-platform new biz model, lower cost for more platforms and combined with social media/marketing) – and others like DoCo/ODMedia (NL), MoviePartnership, and Under the MilkyWay.

- SVOD/PAY – whether first and second windows:

As predicted, this window has so far overall been most remunerative since it’s usually structured by a flat fee license fee (although smaller or niche thematic platforms in the larger USA market (such as Fandor or Indieflix) are still offering just a revenue share formula, which can make the returns lackluster). We generally favor licensing to platforms that pay even a modest flat fee, upfront. Or in some cases in the ‘’back end’’ i.e. rev share to start, then if the revenues at the end of a year (or the window) don’t reach, say, $1000, the platform pays the difference. That sort of model can be attractive for startup platforms who truly believe in the power of their SVOD service but are cash-strapped at the start. So one can license to a less remunerative platform, which does a great job of curation, editorial, placement, and

also license other SVOD platforms who may be more remunerative for you. - In the USA, you’ve finally seen growth since 2015 in the SVOD sector for documentaries, including the Curiosity Stream SVOD OTT platform (by former Discovery founder, John Hendricks), whose programs tend towards educational and traditional. They are usually on a rev-share only model, whereas competitor xive.tv (SVOD OTT) also buys docs features/series, but over a wider range of topics including more populist/reality content- and xive.com works on a flat fee and/or combo deal model. And a deal with well-curated xive.tv delivers an extra ‘lift’’ in reach by providing carriage on other platforms (Hulu, Roku, Amazon, etc.).

- In EMEA/beyond, some other SVOD OTT platforms for docs and arthouse have arisen such as CURIO in UK (via ITV), Filmin (Spain, Portugal, Mexico). Mobil has now transformed its model to a curated daily film+library, a lower price and is complete with hefty investment by Chinese backers/reach into China. They also started paying some flat fees, or MGs, for select higher-end indies, as opposed to the pure rev share SVOD model of earlier days.

There’s been a surge of local SVOD players popping up to compete or complement as Netflix or Amazon/competitors rolls into each new region. Some present outright competition, engaging in bidding wars for similar mainstream content offerings and price points. For instance, MNET South Africa, a premium pay tv operator, launched ShowMax locally and soon after announced further expansion. Other examples include: Videoland Plus (owned by free tv RTL/& SBS channels in the Netherlands) and Maxdome (owned by Prosieben in Germany).Others are complementary SVOD services, offering older library services in general interest. And still others exist at lower price points in narrow verticals/themes, like kids, anime, arthouse, etc. Hopster (UK/USA) is a buyer of purely kids programming, recently launched also in Iceland on Vodafone platform; similar to MinBIO (Nordic kids), which buys from international producers as well as from studios or locals, and Kidoodle (Canada svod ott). Cirkus in Nordic focuses on best of British programming (SVOD OTT).Recently in 2016 there’s a raft of SVOD platforms in developing regions like the MidEast and South East Asia: such as multi-region IFLIX and ICFLIX. As before Australia has pay and svod services such as Foxtel’s Presto (Australia); Lightbox (New Zealand), and Stan (channel 9).SVOD Deals: Producers should usually seek flat fee, but some platforms perform well on rev share. Particularly if you license multiple platforms in the same window and cross-promote so consumers find you from whichever entry point. In the lucky case where you can play off one against the other (e.g. traditional pay tv vs SVOD first-run) a stronger case can be argued for the license fees, as the buyer is “not the only game in town” anymore. In other cases, non-exclusive, multiple-platforms deals in smaller amounts still add up the revenues and audience. Prices can range from €250-2000 for an indie doc of film if old library and yet also up to 5- and 6-figure sums if a higher-end indie/doc or original/first-run. Pricing is also obviously affected by volume of the films in a deal, the number of regions, the awareness (platform, audience), popularity, critical acclaim, and language and cultural portability. - ADVOD:

Although TubiTV/AdRise in USA and Hulu (multi-model in AdVOD and SVOD) are strong platforms offering solid returns to producers in the AdVOD sector, there aren’t many doing the same in EMEA. Here, again, it’s worthwhile to have your films spread on other free AdVOD platforms (vs pirate sites) so the returns are cumulative and there’s cross-promotion. Sometimes a film sampled on AdVOD can help to yield revenues from DTO (e.g. if a consumer discovers a lesser known film on an AdVOD platform and decides then to buy it on iTunes, while they’d not have bought it unknown before).Some updates on the AdVOD sector in EU: Viewster.com (27 countries in EMEA) has shifted focus (since our last reference in the book) from buying arthouse/festival films, to millennial content, including edgier, fast-paced docs, some originals and anime. In 2015 they had added an SVOD anime service, but in March 2016 shut it down, as others have become more aggressive in that space. DailyMotion, EU competitor to Youtube, were sometimes paying flat fees and sometimes commissioning series, but a recent sale by Orange to Vivendi may bring changes. Channel4 (UK) recently launched WalterPresents, an AdVOD site focused specifically on dramatic series and some films strictly from outside the UK.

- HOW TO REACH THE PLATFORMS:

As before, one goes via aggregators for Big5, but your agent/representative, or distributor/sales agent, OR YOU YOURSELF can hit up the others direct.REPS: I highly recommend interviewing your potential sales agent/distributor, with new questions such as asking 1) if they’ve been active in digital lately vs just their traditional buyers; and 2) if so, then with which types of platforms—Big5-7 or also beyond to International? If not, it doesn’t have to be a barrier, if they’re willing to allow nonexclusivity in digital, and/or to allow you or digital agents to assist and collaborate alongside.

- FUNDING (including by SVODs):

Although beyond the scope of this article, note In 2015-16 there’s been increased activity in 5-6 figure prebuying/funding of originals or premieres (film, series)—not just from English regions and not only via Netflix and Amazon, but also other international and EMEA services like OneNet Poland, IcFlix, Telenet, KPNPlay, Vimeo, Vivendi/Canal+, etc.On the Amazon front, aside from bigbudget originals via Ted Hope’s division such as ChiRaq at Berlinale and Woody Allen this Cannes, they also fund weboriginals, digital series, via prototyping schemes and audience involvement/feedback. Netflix has been intensely active in funding originals, including docs and nonfiction (while a few years ago that was a rarity); more deals in arthouse, docs and foreign will be announced at or after Cannes.In Canada there is a funding for coproduction in digital programs; And in France/EU, Vivendi (owner of Canal+ and DailyMotion) just in April 2016 launched its “Studio+” initiative &,dash; funding short-form original series for mobile and telecom operators.

- TAKEAWAYS

As before in the 2014 Book, the following have intensified:

- Act quickly and work collaboratively (filmmakers + agents/distributors) to seize timing opportunities, particularly around certain countries where (s)VOD activities and platforms or hotly competing.

- Balance traditional and digital platforms, buyers and funders carefully in order to capture the cumulative and incremental revs in the nonexclusive deal sector, while also developing a longer term platform pipeline for future.

- Don’t stop at just one deal, unless exclusivity or funding elements are in play and worth it.

- Don’t be blocked per se by rights issues. Pragmatic business deals where others are “cut in” can help make those melt away

- Hybrid distribution: We as consultants/agents, aside from working direct for producers and platforms, now increasingly are retained by sales agents, distributors and even aggregators – as although they have the IP, they don’t always know all the others to sell to after going beyond the Big 5-7; this type of collaboration with producers and other reps on distribution yields good results (although time consuming at first) with each stakeholder getting a smaller piece but of a bigger pie. At the end of the day, 100% of zero is still zero.

- If not using a middleman at all, consider teaming up (especially if only selling a single film) with other producers to co-curate a mini-package of films around specific themes (e.g. eco, female, etc). This is particularly useful where the platforms don’t know you or your films, and it also helps program the service for their platform.

- Don’t abdicate distribution entirely to third parties, as in traditional past; now it is increasingly key to be aware of (if not participating more in) distribution and marketing (e.g. via social media). Help audiences know where to find your film!

Looking forward to seeing your films over here in EMEA!

Orly Ravid May 11th, 2016

Posted In: Amazon VOD & CreateSpace, book, case studies, Digital Distribution, Distribution, education, International Sales, iTunes, Netflix

Self financed Film Distribution in the Context of European Territories

Last May, TFC released the second book in our series called Selling Your Film Outside the US. As with everything in the digital space, we are trying to keep track of a moving target. Netflix has now launched in France, Germany, Austria, Switzerland, Belgium and Luxembourg. iTunes continues its transactional VOD domination by partnering with Middle East film distributor Front Row Filmed Entertainment to give Arabic and Bollywood films a chance to have simultaneous releases in eight countries: UAE, Egypt, Bahrain, Qatar, Oman, Lebanon, Jordan and Kuwait. Amazon has just launched several new original series in the US and UK, including critical darling Transparent, to a line up that includes returning series Alpha House and Betas.

Last May, TFC released the second book in our series called Selling Your Film Outside the US. As with everything in the digital space, we are trying to keep track of a moving target. Netflix has now launched in France, Germany, Austria, Switzerland, Belgium and Luxembourg. iTunes continues its transactional VOD domination by partnering with Middle East film distributor Front Row Filmed Entertainment to give Arabic and Bollywood films a chance to have simultaneous releases in eight countries: UAE, Egypt, Bahrain, Qatar, Oman, Lebanon, Jordan and Kuwait. Amazon has just launched several new original series in the US and UK, including critical darling Transparent, to a line up that includes returning series Alpha House and Betas.

But what does DIY Distribution mean in the context of European territories? The following is an excerpt included in the book:

Here are a few tips for any filmmaker who is thinking about doing digital distribution in general, but especially in multiple territories:

-If your film is showing at an international film festival, ask if they are producing subtitles, and, if so, negotiate that the produced file be part of your festival fee. It may need to be proofed again or adjusted at a subtitling and transcription lab later on, but as a first pass it could prove very valuable down the road. See more about the kind of file you need in this post;

-When you are producing your master, create a textless version of your feature. Apple and probably other platforms will not allow external subtitles on any films that already have burn-ins. If your film, for example, has a few non-English lines of dialogue, instead of burning-in English subtitles into your film, a better method would be to create an external English-language subtitle file (separate from closed captioning) in a proper format and submit it with your master. Different aggregators may require different formats, and if you are going to a Captioning/Transcription/Translation Lab to do your closed captioning and subtitling work, be smart about which questions you ask and negotiate a price for everything, including transcoding from one format to another because you may not know exactly what you will need for all your deals right away.

Subtitles need to be timed to masters, so make sure your time code is consistent. When choosing a lab, ascertain whether they are capable of fulfilling all your current and future closed captioning and subtitling needs by verifying that they can output in the major formats, including (but not limited to) SubRip (.srt), SubViewer 1 & 2 (.sub), SubStation Alpha (.ssa/.ass), Spruce (.stl), Scenarist (.scc) and iTunes Timed Text (.itt);

-You may want to band together with films that are similar in theme or audience and shop your products around as bundled packages. Many digital services, including cable VOD, have thematic channels and your bundle of films may be more attractive as a package rather than just one film;

-Put the time in toward building your brand and your fanbase. Marketing still is the missing piece of the puzzle here. As it gets easier and easier to get onto platforms, so too does it get more difficult for audiences to find the films that are perfectly suited to their interests. This is especially true when talking about marketing one’s film outside one’s home territory. If you are accessing platforms for your film on your own, YOU are the distributor and the responsibility of marketing the film falls entirely to you.

To download a FREE copy of the entire book, complete with case studies of films distributed in Europe, visit sellingyourfilm.com.

Sheri Candler October 15th, 2014

Posted In: Amazon VOD & CreateSpace, book, case studies, Digital Distribution, DIY, iTunes, Netflix

Tags: Amazon, Digital Distribution, Europe, film bundles, independent film, iTunes, Middle East, Netflix, Selling Your Film Outside the US, Sheri Candler

Distribution roundup from SXSW 2013

HELLO SXSW! It’s hard to believe that it’s been a whole year since SXSW 2013. The film festival (and all the other things that happen) has consistently been on the cutting edge of distribution options. It is truly a one of a kind festival for a number of reasons and while they won’t pay for filmmaker travel, they do provide huge opportunity for the savvy filmmaker.

With 125+ films and the literally hundreds of panels, it can be daunting trying to get the attention of eyeballs. That said, over 2/3 of the films that world premiered here last year have secured some form of domestic distribution (on par with Tribeca and second only to Sundance).

The Film Collaborative world premiered I Am Divine at the festival last year and our release strategy is a prime example of how the fest can be a launching pad. The film went on to play over 200 festivals in less than a year (more than any other film in the world) racking up screening fee revenue. TFC also managed its theatrical release starting last October. The entire operating budget for the theatrical release was less than $10k and the film has grossed over $80,000 theatrically to date. As impressive as that is, the festival revenue surpassed the theatrical total. Meanwhile, despite never paying for a single print ad, we just passed our 50th theatrical engagement. The film has almost 40,000 Facebook Fans and will be released on DVD/Digital in April through Wolfe Releasing, and a TV premiere is scheduled for October.

SXSW produced two clear narrative breakouts last year, neither from a first time filmmaker. Joe Swanberg’s Drinking Buddies was a day and date release and managed to gross $300k+, his highest grossing film to date. It has chartered quite well on iTunes and other digital platforms and is likely quite profitable for Magnolia (hence why they acquired Swanberg’s follow up out of Sundance this year).

The other narrative breakout was the critically acclaimed Short Term 12. Sundance’s loss was SXSW’s gain and the film grossed over $1 million at the US Box Office, won multiple audience and jury awards and is the highest grossing film ever for Cinedigm. The film has been in theaters non stop for over ½ a year!

12 O’Clock Boys was released day and date and is Oscilloscope’s highest grossing release in over a year. It also topped iTunes and, to date, the film has managed over $80k in revenue. In fact, the day and date strategy has not appeared to hurt other top performing SXSW Docs.

Magnolia grossed $138k with Good ‘Ol Freda Also passing the $100k mark was Spark: A Burning Man Story. The film managed over $120k with a self financed theatrical handled by Paladin. What stood out wasn’t the total, but the fact that 70%+ came from Tugg Screenings! FilmBuff handled the digital rights where the doc performed equally as well. Meanwhile IFC’s The Punk Singer was a more standard release, but still a solid success passing the $120k gross mark.

Fall and Winter, Euphonia and Some Girls all opted for digital releases via the newly established Vimeo on Demand service. This year, Vimeo is investing $10,000,000 into its service and offering $10,000 minimum guarantees in exchange for an exclusive digital distribution window to any film that has premiered at one of the 20 leading global film festivals throughout 2014. Filmmakers also may apply for marketing support. The huge thing though is that the filmmaker gets to keep 90% of the revenue, which is far better than any other notable digital platform.

Also popular amongst the filmmakers was FilmBuff. No fewer than eight world premieres were distributed digitally by them. A few of those films also had small DIY theatrical releases.

It should be noted that DIY releases cost money which might be a problem for those who did not budget ahead of time for such a release. However, cash strapped filmmakers have raised DIY funds via Kickstarter to aid in such releases. TFC helped Big Joy: The Adventures of James Broughton raise over $50k. Loves Her Gun, This is Where We Live, and Love and Air Sex (AKA The Bounceback ) all raised distribution funds via crowdfunding.

Netflix took The Short Game as their first documentary acquisition and the film had a modest theatrical run via The Samuel Goldwyn Company. Pantelion passed $50k with Hours which has been a top digital performer following the death of its star, Paul Walker. First Run Features is approaching $40k with Maidentrip and companies like IFC, Magnolia, Oscilloscope, Breaking Glass, FilmBuff, and Variance all took multiple films.

On the TV side, SXSW films have premiered on Al Jazeera, CNN, Showtime, PBS, and VH1. Many of those films had some form of theatrical too. Documentaries continue to be the bulk of the festival highlights though the top two grossing films were narratives. The festival is second only to Sundance for world premiering a doc.

As we look to what the 2014 crop will offer, there are already some game changing situations. BFI is repeating their marketing match offer of up to $41k for any distributor who acquires one of their five UK based SXSW premiere films for distribution. As pointed out earlier, Vimeo’s offer extends beyond SXSW to 19 other upcoming festivals. I encourage you to keep an open mind and craft your film strategies now! The $10K MG that Vimeo offers for such a short exclusive digital window (plus you get to keep 90% of any revenue after the MG is recouped!) is better than many advance offers made by lower profile distributors. You can always pull your title off after the MG is recouped and seek more traditional distribution routes as Cinemanovels did out of Toronto last year.

SXSW is a great place to showcase your film, but without a formal market and with all the craziness that surrounds the festival from the interactive and music sides, it is unlikely that seven figure deals will pop up like they do at Sundance. Despite this, deals are still made, some choose to go into the DIY space and a few (like our release of I Am Divine) succeed in both arenas. The possibilities are endless.

Bryan Glick March 10th, 2014

Posted In: Distribution, Film Festivals, iTunes, Netflix, Theatrical, Uncategorized, Vimeo

Tags: 12 O'Clock Boys, BFI, Bryan Glick, crowdfunding, DIY release, Drinking Buddies, I am Divine, Short Term 12, SXSW, The Film Collaborative, Vimeo

Should you make a horror film?

The month of October seems a good time to look at films in the horror genre and we will be releasing a series of posts all month long that addresses the business of releasing these films.