An Update on International VOD Opportunities Outside the U.S. in The Indie Film Sector

Guest blog post by Wendy Bernfeld

The Cannes Film Festival starts today, and any Cannes season would not be complete without an update from our dear friend and colleague Wendy Bernfeld, Founder and Managing Director of Rights Stuff and co-author of our second case study book in 2014 Selling Your Film Outside the U.S. (free on Amazon Kindle and Apple iBooks. Wendy specializes in Library and Original Content acquisition/distribution, international strategy / deal advice, for traditional media (film, TV, pay TV), digital media (Internet/IPTV, VOD, mobile, OTT/devices), and web/cross-platform/transmedia programming, and also active on various film festival / advisory boards, such as IDFA, Binger Film Institute, Seize the Night, Outdoor FilmFest, and others, including TFC! Follow her on Twitter: @wbernfeld.

What’s happened out there in the two years since TFC first published Selling Your Film Outside the U.S. (“The Book”)?

My introductory chapter to the book, entitle, “Digital Distribution in Europe” provided a snapshot of the evolving sector at that point in time. However, by now, the sector, particularly in the area of SVOD and AdVOD, has leaped even more forward, and includes more mature services as well as new niche and thematic services out there— as well as some services with an increased appetite for foreign language, art house and documentary films/series (finally).

A. Blurred Lines — Traditional vs. Digital — Hybrid Platforms

More recent trends 2015-16 include increasingly blurred dividing lines between so-called traditional vs digital players .

- Traditionals: Many traditional players, internationally, (like telecoms, cable and free tv) have now become more digital, by either 1) bysetting up their own competing, or complementary, multi-window VOD offerings such as SVOD services (e.g. Channel 9’s STAN in Australia or Liberty Global’s MyPrime in both Switzerland and Netherlands); or 2) electing to instead “sleep with the enemy” by just hosting digital channels like Netflix, Spotify, etc. on their set-top box (e.g. Orange, ComHem Sweden, Virgin UK). Some traditionals opt to distinguish the brand identity of the VOD service from the main service, (different names); while others unite both services under one brand, such as CanalPlay (C+) or Viasat’s VIAPLAY. Recent developments include BBC announcing it will start SVOD internationally, after also migrating its Channel 3 to digital-only online offering; and ITV starting CURIO, a nonfiction SVOD in the UK.

- Digitals: Correspondingly, the so-called formerly digital-only players like Netflix, Amazon (previously more complementary or second window) are now acting a great deal like the traditional players. Think: old-fashioned commissioning broadcasters who increasingly require first-window status and exclusivity, and who are funding “originals”, getting involved competitively commissioning films from development stage etc. and fashioning game-changing windows.

Despite the complexity, this is overall great news for creators/rights-holders since it allows even more opportunity to maximize revenues and audiences per successive window, platform and region, if one takes the time to do it right.

B. VODs Per Window:

Lets look at various platforms in each window today, from TVOD, DTO, through to SVOD, AdVOD, etc. Note that many deliberately offer MULTI-model consumer services – such as Orange, Canal Plus and BSKYB (TVOD/DTO, SVOD), Amazon (Instant and Prime, for TVOD/DTO and SVOD, respectively) and Wuaki – while others (Netflix and Curio) operate under just one consumer business model.

- TVOD/DTO:

- For the Big5 (Google, Amazon, iTunes, Xbox, PS), one still generally goes through a digital aggregator, like Juice, Cinedigm, Kinonation, and Syndicado in N.America. Outside N.America, EMEA counterparts in include one of Rights Stuff clients MOMEDIA (attractive multi-platform new biz model, lower cost for more platforms and combined with social media/marketing) – and others like DoCo/ODMedia (NL), MoviePartnership, and Under the MilkyWay.

Shop around…these aggregators they have different models and price alone shouldn’t be the only indicator. Also look at their marketing/positioning: some take your IP, others (like Rights Stuff, TFC) do not.

- Going direct to the others in TVOD/DTO:

Don’t stop at one or even all of the Big5. The play is to have multiple deals , non exclusive, staggered, in all the windows, in each region. Virtually every country has an active telecom and cable or DTH competitor in the region, as well as mobile and online /consumer electronics players who offer VOD, so licensing non-exclusive TVOD to them on top of others is a good first step in the chain.Beyond the utility companies, some other examples in TVOD/DTO include premium pay tv services or platforms like CanalPlus (France and other regions) and BSkyB, (UK, Germany, Italy, New Zealand). Also theatrical chains in some countries, such as Cineplex in Canada or Pathé in Holland, have VOD arms and thus can offer complementary marketing of films in theatrical window with the subsequent TVOD/DTO window. Also check out online VOD indie film specialist FilmDoo (well-curated indie/art house focused, now in UK/EIRE and soon expanding), and as earlier written, Curzon offers day-and-date theatrical combined with VOD in UK. Wuaki announced moves into 15 countries internationally by end of 2016, most are now TVOD/DTO but the Spain HQ is an SVOD OTT platform. The NFB in Canada started TVOD/DTO in N.America and recently in 2016 an SVOD service, and they now buy docs/films from other sources and regions, too.

- Deals: TVOD/DTO continues to be typically a rev share model and sometimes only a loss leader, but can help drive critical awareness, especially when accompanied by social media marketing and audience engagement strategies. Sometimes, film dependent (for eg if a very niche film) it saves money to skip the big5 (who require costly specs) and license direct to the other international tvod/dto platforms, as then at least one participates from day one in revenues, vs having to recoup expensive deliverables.

- For the Big5 (Google, Amazon, iTunes, Xbox, PS), one still generally goes through a digital aggregator, like Juice, Cinedigm, Kinonation, and Syndicado in N.America. Outside N.America, EMEA counterparts in include one of Rights Stuff clients MOMEDIA (attractive multi-platform new biz model, lower cost for more platforms and combined with social media/marketing) – and others like DoCo/ODMedia (NL), MoviePartnership, and Under the MilkyWay.

- SVOD/PAY – whether first and second windows:

As predicted, this window has so far overall been most remunerative since it’s usually structured by a flat fee license fee (although smaller or niche thematic platforms in the larger USA market (such as Fandor or Indieflix) are still offering just a revenue share formula, which can make the returns lackluster). We generally favor licensing to platforms that pay even a modest flat fee, upfront. Or in some cases in the ‘’back end’’ i.e. rev share to start, then if the revenues at the end of a year (or the window) don’t reach, say, $1000, the platform pays the difference. That sort of model can be attractive for startup platforms who truly believe in the power of their SVOD service but are cash-strapped at the start. So one can license to a less remunerative platform, which does a great job of curation, editorial, placement, and

also license other SVOD platforms who may be more remunerative for you. - In the USA, you’ve finally seen growth since 2015 in the SVOD sector for documentaries, including the Curiosity Stream SVOD OTT platform (by former Discovery founder, John Hendricks), whose programs tend towards educational and traditional. They are usually on a rev-share only model, whereas competitor xive.tv (SVOD OTT) also buys docs features/series, but over a wider range of topics including more populist/reality content- and xive.com works on a flat fee and/or combo deal model. And a deal with well-curated xive.tv delivers an extra ‘lift’’ in reach by providing carriage on other platforms (Hulu, Roku, Amazon, etc.).

- In EMEA/beyond, some other SVOD OTT platforms for docs and arthouse have arisen such as CURIO in UK (via ITV), Filmin (Spain, Portugal, Mexico). Mobil has now transformed its model to a curated daily film+library, a lower price and is complete with hefty investment by Chinese backers/reach into China. They also started paying some flat fees, or MGs, for select higher-end indies, as opposed to the pure rev share SVOD model of earlier days.

There’s been a surge of local SVOD players popping up to compete or complement as Netflix or Amazon/competitors rolls into each new region. Some present outright competition, engaging in bidding wars for similar mainstream content offerings and price points. For instance, MNET South Africa, a premium pay tv operator, launched ShowMax locally and soon after announced further expansion. Other examples include: Videoland Plus (owned by free tv RTL/& SBS channels in the Netherlands) and Maxdome (owned by Prosieben in Germany).Others are complementary SVOD services, offering older library services in general interest. And still others exist at lower price points in narrow verticals/themes, like kids, anime, arthouse, etc. Hopster (UK/USA) is a buyer of purely kids programming, recently launched also in Iceland on Vodafone platform; similar to MinBIO (Nordic kids), which buys from international producers as well as from studios or locals, and Kidoodle (Canada svod ott). Cirkus in Nordic focuses on best of British programming (SVOD OTT).Recently in 2016 there’s a raft of SVOD platforms in developing regions like the MidEast and South East Asia: such as multi-region IFLIX and ICFLIX. As before Australia has pay and svod services such as Foxtel’s Presto (Australia); Lightbox (New Zealand), and Stan (channel 9).SVOD Deals: Producers should usually seek flat fee, but some platforms perform well on rev share. Particularly if you license multiple platforms in the same window and cross-promote so consumers find you from whichever entry point. In the lucky case where you can play off one against the other (e.g. traditional pay tv vs SVOD first-run) a stronger case can be argued for the license fees, as the buyer is “not the only game in town” anymore. In other cases, non-exclusive, multiple-platforms deals in smaller amounts still add up the revenues and audience. Prices can range from €250-2000 for an indie doc of film if old library and yet also up to 5- and 6-figure sums if a higher-end indie/doc or original/first-run. Pricing is also obviously affected by volume of the films in a deal, the number of regions, the awareness (platform, audience), popularity, critical acclaim, and language and cultural portability. - ADVOD:

Although TubiTV/AdRise in USA and Hulu (multi-model in AdVOD and SVOD) are strong platforms offering solid returns to producers in the AdVOD sector, there aren’t many doing the same in EMEA. Here, again, it’s worthwhile to have your films spread on other free AdVOD platforms (vs pirate sites) so the returns are cumulative and there’s cross-promotion. Sometimes a film sampled on AdVOD can help to yield revenues from DTO (e.g. if a consumer discovers a lesser known film on an AdVOD platform and decides then to buy it on iTunes, while they’d not have bought it unknown before).Some updates on the AdVOD sector in EU: Viewster.com (27 countries in EMEA) has shifted focus (since our last reference in the book) from buying arthouse/festival films, to millennial content, including edgier, fast-paced docs, some originals and anime. In 2015 they had added an SVOD anime service, but in March 2016 shut it down, as others have become more aggressive in that space. DailyMotion, EU competitor to Youtube, were sometimes paying flat fees and sometimes commissioning series, but a recent sale by Orange to Vivendi may bring changes. Channel4 (UK) recently launched WalterPresents, an AdVOD site focused specifically on dramatic series and some films strictly from outside the UK.

- HOW TO REACH THE PLATFORMS:

As before, one goes via aggregators for Big5, but your agent/representative, or distributor/sales agent, OR YOU YOURSELF can hit up the others direct.REPS: I highly recommend interviewing your potential sales agent/distributor, with new questions such as asking 1) if they’ve been active in digital lately vs just their traditional buyers; and 2) if so, then with which types of platforms—Big5-7 or also beyond to International? If not, it doesn’t have to be a barrier, if they’re willing to allow nonexclusivity in digital, and/or to allow you or digital agents to assist and collaborate alongside.

- FUNDING (including by SVODs):

Although beyond the scope of this article, note In 2015-16 there’s been increased activity in 5-6 figure prebuying/funding of originals or premieres (film, series)—not just from English regions and not only via Netflix and Amazon, but also other international and EMEA services like OneNet Poland, IcFlix, Telenet, KPNPlay, Vimeo, Vivendi/Canal+, etc.On the Amazon front, aside from bigbudget originals via Ted Hope’s division such as ChiRaq at Berlinale and Woody Allen this Cannes, they also fund weboriginals, digital series, via prototyping schemes and audience involvement/feedback. Netflix has been intensely active in funding originals, including docs and nonfiction (while a few years ago that was a rarity); more deals in arthouse, docs and foreign will be announced at or after Cannes.In Canada there is a funding for coproduction in digital programs; And in France/EU, Vivendi (owner of Canal+ and DailyMotion) just in April 2016 launched its “Studio+” initiative &,dash; funding short-form original series for mobile and telecom operators.

- TAKEAWAYS

As before in the 2014 Book, the following have intensified:

- Act quickly and work collaboratively (filmmakers + agents/distributors) to seize timing opportunities, particularly around certain countries where (s)VOD activities and platforms or hotly competing.

- Balance traditional and digital platforms, buyers and funders carefully in order to capture the cumulative and incremental revs in the nonexclusive deal sector, while also developing a longer term platform pipeline for future.

- Don’t stop at just one deal, unless exclusivity or funding elements are in play and worth it.

- Don’t be blocked per se by rights issues. Pragmatic business deals where others are “cut in” can help make those melt away

- Hybrid distribution: We as consultants/agents, aside from working direct for producers and platforms, now increasingly are retained by sales agents, distributors and even aggregators – as although they have the IP, they don’t always know all the others to sell to after going beyond the Big 5-7; this type of collaboration with producers and other reps on distribution yields good results (although time consuming at first) with each stakeholder getting a smaller piece but of a bigger pie. At the end of the day, 100% of zero is still zero.

- If not using a middleman at all, consider teaming up (especially if only selling a single film) with other producers to co-curate a mini-package of films around specific themes (e.g. eco, female, etc). This is particularly useful where the platforms don’t know you or your films, and it also helps program the service for their platform.

- Don’t abdicate distribution entirely to third parties, as in traditional past; now it is increasingly key to be aware of (if not participating more in) distribution and marketing (e.g. via social media). Help audiences know where to find your film!

Looking forward to seeing your films over here in EMEA!

Orly Ravid May 11th, 2016

Posted In: Amazon VOD & CreateSpace, book, case studies, Digital Distribution, Distribution, education, International Sales, iTunes, Netflix

Get Educated About Educational Distribution:

Part 1 of a 3-part Series

by Orly Ravid, Founder, The Film Collaborative

Orly Ravid is an entertainment attorney at Mitchell Silberberg & Knupp (MSK) and the founder of The Film Collaborative with 15-years of film industry experience in acquisitions, festival programming, sales, distribution/business affairs, and blogging and advising. She also contributed to the Sundance Artist Services initiative.

Filmmakers usually think selling their film to distributors means that they will handle the whole release including theatrical, home video, and of course now digital/VOD. One category of distribution that is often overlooked, or not fully understood, however, is educational distribution. It can be a critical class of distribution for certain films, both in terms of reaching wider audiences and making additional revenue. For a certain type of film, educational distribution can be the biggest source of distribution revenue.

What is it?

When a film screens in a classroom, for campus instruction, or for any educational purpose in schools (K-university), for organizations (civic, religious, etc.), at museums or science centers or other institutions which are usually non-profits but they can be corporations too.

This is different from streaming a film via Netflix or Amazon or renting or buying a commercial DVD. Any film used for classes / campus instruction / educational purposes is a part of educational distribution and must be licensed legally. Simply exhibiting an entire film off of a consumer DVD or streaming it all from a Netflix or Amazon account to a class or group is not lawful without the licensor’s permission unless it meets certain criteria under the Copyright Act.

Initially, this was done via 16mm films, then various forms of video, and now streaming. These days, it can be selling the DVD (physical copy) to the institution/organization to keep in its library/collection, selling the streaming in perpetuity, renting out the film via DVD or streaming for a one-time screening, or exposing the content to view and at some point (certain number of views) it is deemed purchased (a/k/a the “Patron Acquisition Model”).

What type of films do well on the educational market?

In general, best selling films for educational distribution cover topics most relevant to contemporary campus life or evergreen issues such as: multiculturalism, black history, Hispanic studies, race issues, LGBTQ, World War II, women’s studies, sexual assault, and gun violence; in general films that cover social and political issues (international and national); health and disability (e.g. autism); and cinema and the arts. A great title with strong community appeal and solid perception of need in the academic community will do best (and the academic needs are different from typical consumer/commercial tastes).

At The Film Collaborative, we often notice that the films that do the best in this space sometimes do less well via commercial DVD and VOD. This is true of films with a more historic and academic and less commercial bent. Of course, sometimes films break out and do great across the board. Overall, the more exposure via film festivals, theatrical, and/or social media, the better potential for educational bookings though a film speaking directly to particular issues may also do very well in fulfilling academic needs.

Sourcing content

Across the board the companies doing educational distribution get their content from film festivals but also simply direct from the producers. Passion River and Kanopy, for example, note that film festival exhibition, awards, and theatrical help raise awareness of the film so films doing well on that front will generally perform better and faster but that does not mean that films that do not have a good festival run won’t perform well over time. Services such as Kanopy, Alexander Press, and Films Media Group collect libraries and get their films from all rights distributors and those with more of an educational distribution focus as well as direct from producers. These services have created their own platforms allowing librarians etc. to access content directly.

Windowing & Revenue

There are about 4,000 colleges in the US and about 132,000 schools, just to give you a sense of the breadth of outlets but one is also competing with huge libraries of films. Educational distributors such as ro*co films has a database of 30,000 buyers that have acquired at least one film and ro*co reached beyond its 30,000 base for organizations, institutions, and professors that might be aligned with a film. All rights distributors often take these rights and handle them either directly, through certain educational distribution services such as Alexander Press (publisher and distributor of multimedia content to the libraries worldwide), Films Media Group / Info Base (academic streaming service), or Kanopy (a global on-demand streaming video service for educational institutions), or a combination of both. There are also companies that focus on and are particularly known for educational distribution (even if they in some cases also handle other distribution) such as: Bullfrog Films (with focus on environmental), California Newsreel (African American / Social Justice), Frameline Distribution (LGBTQ), New Day Films (a filmmaker collective), Passion River (range of independent film/documentaries and it also handles consumer VOD and some DVD), roc*co films (educational distributor of several Sundance / high profile documentaries), Third World Newsreel (people of color / social justice), Women Make Movies (cinema by and about women and also covers consumer distribution), and Swank (doing educational/non-theatrical distribution for studios and other larger film distributors). Cinema Guild, First Run Features, Kino Lober, Strand, and Zeitgeist are a few all rights distributors who also focus on educational distribution.

Not every film has the same revenue potential from the same classes of distribution (i.e. some films are bound to do better on Cable VOD (documentaries usually do not do great that way). Some films are likely to do more consumer business via sales than rentals. Some do well theatrically and some not. So it is no surprise that distributors’ windowing decisions are based on where the film’s strongest revenue potential per distribution categories. Sometimes an educational distribution window becomes long and sales in that division will determine the film’s course of marketing. But if a film has a theatrical release, distributors have certain time restrictions relative to digital opportunities, so that often determines the windowing strategy, including how soon the film goes to home video.

The film being commercially available will limit the potential for educational distribution, and at the same time, the SVOD services may pay less for those rights if too much time goes by since the premiere. Hence it is critical to properly evaluate a film’s potential for each rights category.

Revenue ranges widely. On the one hand, some films may make just $1,000 a year or just $10,000 total from the services such as Kanopy and Alexander Street. On the other hand, Kanopy notes that a good film with a lot of awareness and relevance would be offered to stream to over 1,500 institutions in the US alone (totaling over 2,500 globally), retailing at $150/year per institution, over a 3-year period, and that film should be triggering about 25% – 50% of the 1,500 institutions. Licensors get 55% of that revenue. On average, a documentary with a smaller profile and more niche would trigger about 5-10% of the institutions over 3 years.

More extreme in the range, ro*co notes that its highest grossing film reached $1,000,000, but on average ro*co aims to sell about 500 educational licenses.

If the film has global appeal then it will do additional business outside the U.S. All rights and educational distributors comment that on average, good revenue is in the 5-figures range and tops out at $100,000 +/- over the life of the film for the most successful titles. The Film Collaborative, for example, can generate lower to mid 5-figures of revenue through universities as well (not including film festival or theatrical distribution). Bullfrog notes that these days $35,000 in royalties to licensors is the higher end, going down to $10,000 and as low as $3,000. For those with volume content, Alexander Street noted that a library of 100-125 titles could earn $750,000 in 3 years with most of the revenue being attributable to 20% of the content in that library. Tugg (non-theatrical (single screenings) & educational distribution) estimates $0-$10,000 on the low end, $10,000 – $75,000 in the mid-range, and $75,000 and above (can reach and exceed $100,000) on the high end. Factors that help get to the higher end include current topicality, mounting public awareness of the film or its subject(s), and speaking to already existing academic questions and interest. Tugg emphasizes the need for windowing noting the need for at least a 6-month window if exclusivity before the digital / home video release. First Run Features (an all-rights distributor that also handles educational distribution both directly and by licensing to services) had similar revenue estimates with low at below $5,000, mid-range being $25,000 – $50,000, and high also above $75,000.

Back to windowing and its impact on revenue—Bullfrog notes it used to not worry so much about Netflix and iTunes because they “didn’t think that conscientious librarians would consider Netflix a substitute for collection building, or that instructors would require their students to buy Netflix subscriptions, but [they] have been proved wrong. Some films are just so popular that they can withstand that kind of competition, but for many others it can kill the educational market pretty much stone dead.” Yet, theatrical release is usually not a problem, rather a benefit because of the publicity and awareness it generates.

Passion River explains that filmmakers should not be blinded by the sex appeal of VOD / digital distribution—those platforms (Amazon, Hulu, iTunes, Netflix) can and will wait for hotter films on their radar. An example Passion River offers is Race to Nowhere which sold to over 6,000 educational institutions by staying out of the consumer market for at least 3 years. This type of success in the educational space requires having the right contacts lists and doing the marketing. But I would say, consider the film, its revenue potential per rights category, the offers on-hand, and then decide accordingly.

Stay tuned for Parts 2 & 3, which will go into the nitty gritty details of educational distribution.

The legal information provided in this publication is general in nature and should not be construed as advice applicable to any particular individual, entity or situation. Except as otherwise noted, the views expressed in this publication are those of the author(s). This alert may be considered a solicitation for certain purposes.

Orly Ravid February 18th, 2016

Posted In: Distribution, education, Legal

Tags: Alexander Press, Amazon, Bullfrog Films, California Newsreel, Cinema Guild, classroom films, educational distribution for films, educational market for films, film distribution, film library, Films Media Group, First Run Features, Frameline Distribution, Kanopy, Kino Lorber, Netflix, New Day Films, Orly Ravid, Passion River, ro*co, Strand Releasing, The Film Collaborative, Third World Newsreel, Women Make Movies, Zeitgeist Films

Wonk/Fest 2015: Exhibition and Deliverables for the Contemporary Age

This post is part 4 of an ongoing series of posts chronicling how rapid technological change is impacting the exhibition side of independent film, and how this affects filmmakers and their post-production and delivery choices. The prior three can be found at the following links: January 2013 • August 2013 • October 2014

DCPs can be proprietary hard drives. Alternatively (not shown), then can look virtually identical to external hard drives

When I started this series back in 2013, a fairly new exhibition format called DCP was starting to significantly impact independent exhibition and distribution, and I was very afraid. I was sure that the higher costs associated with production, the higher encryption threshold, and the higher cost of shipping would significantly impact the independents, and heavily favor the studios.

Flash forward to today, and of course DCP has taken over the world. And thankfully we independents are still here. Don’t get me wrong…I still kinda hate DCP…especially for the increased shipping price and their often bulky complicated cases and how they are so easily confused with other kinds of hard drives…but they are a fact of life that we can adapt to. Prices for initial DCP creation have dropped to more manageable rates in the last two years, and creating additional DCPs off the master are downright cheap. And most importantly, they don’t fail nearly as often as they used to…apparently the technology and our understanding of it has improved to the point where the DCP fail rate is relatively similar to every other format we’ve ever used.

While DCPs rule on the elite level….at all top festivals and all major theatrical chains…filmmakers still need to recognize that a wide array of other formats are being requested by venues and distributors every day. Those include BluRays, ProRes Files on Portable Hard Drives, and, most significantly, more and more requests for downloadable files from the cloud.

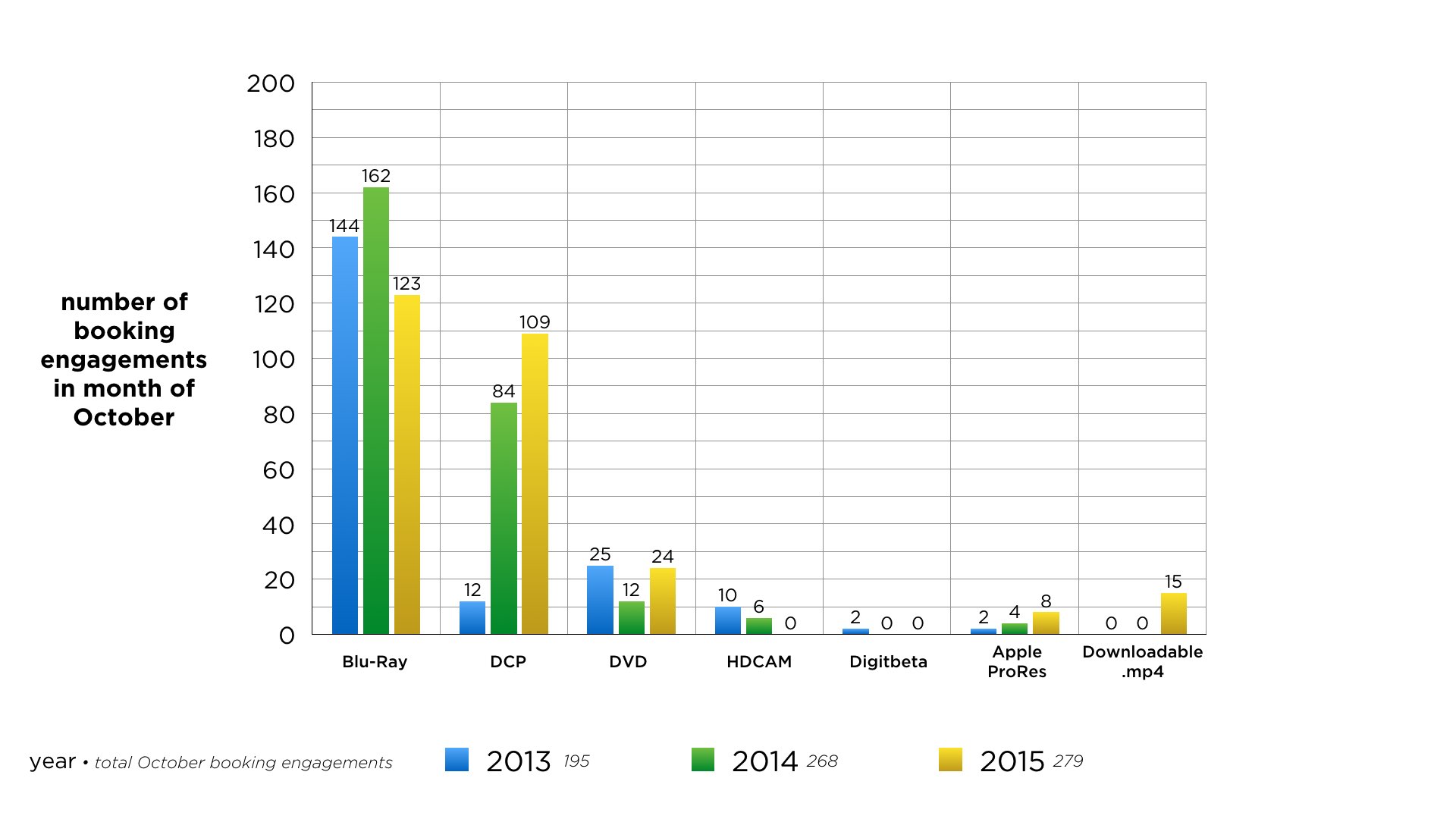

To track the evolution of formats over the last two years, please refer to the booking charts of Film Collaborative films below. Of the many things that The Film Collaborative does, one of our core services is booking our clients’ films in public venues all over the world – including everything from film festivals, traditional theatrical venues, universities, art galleries, etc. October is always the busiest month of the year…as it is the month of the year with the most film festivals. By comparing the last three Octobers, we can see quite clearly how venue deliverables have changed over the last two years.

Quick observations of the above include:

- Bluray use for exhibition has remained relatively constant over the last three years in terms of total Blurays used, although its percentage rate has declined by about 23% from last year.

- DCP use for exhibition has increased from 6.1 percent in 2013 to 31% in 2014 to 39% in 2015. It should be noted that the vast majority of high-end bookings such as top festivals or top theatrical chains require DCP now, and the vast majority of Bluray bookings are at the smaller venues.

- Digital tape formats, such as HDCAM and Digibeta, have entirely disappeared to 0. As we said in our last post to this effect….stop making these entirely!

- Requests for Quicktime files on hard drive format are on the rise…and the only reason their numbers above seem so low is because we resist booking them whenever we can—because they are an additional cost. So the 8 listed for October 2015 means in those cases we determined we had no other choice. We should discuss this further in this post.

- For the first year ever, our company is now offering downloadable vimeo links to festivals to show the film from electronic files delivered over the internet. This is a radical direction that has much to be discussed, and we shall do so later in this post. To date we are only offering these in extraordinary situations….mostly for emergency purposes.

While DCP is certainly the dominant format at major venues for now and the foreseeable future, I still maintain my caution in advising filmmakers to make them before they are needed. Nowadays, I hear filmmakers talk about making their DCP master as part of their post process, well before they actually know how their film will be received by programmers and venue bookers. Lets face it, a lot of films, even a lot of TFC member films, never play major festivals or theatrical venues, and their real life is on digital platforms. Remember that DCP is a theatrical format, so if your film is never going to have life in theatrical venues, you do not need to spend the money on a DCP.

If and when you do make your DCP(s), know that DCPs still do on occasion fail. Sometimes you send it and the drive gets inexplicably wiped in transit. Sometimes there is a problem with the ingest equipment in the venue, which you can’t control. Film festivals in particular know this the hard way….even just a year ago DCP failure was happening all the time. A lot (most) festivals got spooked, so now they ask for a DCP plus a Bluray backup. That can be a significant problem for distributors such as TFC, since it can mean multiple shipments per booking which is expensive and time-consuming. However for individual filmmakers this should be quite do-able….just make a Bluray and a DVD for each DCP and stick them in the DCP case so they travel with the drive (yes I know they will probably eventually get separated…sigh). And the Golden Rule remains….that is never ever ever travel to a festival without at least a Bluray and a DVD backup on your person. It never ceases to amaze me how many (most) filmmakers will fly to a foreign country for a big screening of their film and simply trust that their film safely arrived and has been tech checked and ready to go. If your DCP fails at a screening that you are not at…well that sucks but you’ll live. If you travel to present your film at a festival and you are standing in a crowded theater and your film doesn’t play and everyone has to go home disappointed, that, in fact, is a disaster.

As mentioned previously, more and more venues that cannot afford to upgrade to DCP projection are choosing to ask for films to be delivered as an Apple ProRes 422 HQ on a hard drive. Since this is not a traditional exhibition format, a lot of filmmakers do not think they need to have this ready and are caught unawares when a venue cannot or will not accept anything else. At The Film Collaborative, we keep a hard drive of each of our films ready to go at our lab…as mentioned we do not prefer to use them because of the extra shipping cost (DCPs are trafficked from festival to festival so at no shipping cost to us, while hard drives are not used often enough to keep them moving like this). However we do find we often need them in a pinch. So do keep one handy and ready to go out. This should not be a big deal for filmmakers, since the Apple ProRes 422 HQ spec is the most important format you’ll need for nearly all types of distribution deliveries, whether it be to distributors or digital aggregators or direct to digital platforms. So, if you plan to have any kind of distribution at all, this is a format you are almost certainly going to need. Make a couple to be safe.

Is the Future in the Cloud?

As I have touched on before, the Holy Grail of independent film distribution would seem to live in the cloud, wherein we could leave physical distribution formats behind and simply make our films available electronically via the internet anywhere in the world. This would change the economics of independent film radically, if we could take the P out of Prints & Advertising and save dramatically on both format creation and format shipping. Unfortunately today’s reality is far more complicated, and is not certain to change any time soon.

I can’t begin to tell you how often…nearly every day…small festivals looking to save on time and shipping will ask me if I can send them the film via Dropbox or WeTransfer or the like. The simple answer is no, not really. So every time they ask me, I ask them back…exactly how do you think I can do that? What spec do you need? What is the exact way you think this can work? And they invariably answer back…“We don’t know…we just hoped you’d be able to.” It is utterly maddening.

Here’s the tech-heavy problem. Anyone can get a professional-sized Dropbox these days…ours is over 5,100 gigs (short for Gigabytes, or GB) and an average 90 minute Apple ProRes 422 HQ is around 150 gigs…so that doesn’t seem like a problem. Clearly our Dropbox can fit multiple films.

The current problem is in the upload/download speed. At current upload speeds, a Apple ProRes 422 HQ is going to take several days to upload, with the computer processing the upload uninterrupted all the time (running day and night). Even this upload time doesn’t seem too daunting, after all you could just upload a film once and then it would be available to download by sending your Dropbox info. However, the real problem is the download…that will also take more than a day on the download side (running day and night) and I have yet to ever come across a festival or venue even close to sophisticated enough to handle this. Not even close. Think of the computing power at current speeds that one would need to handle the many films at each festival that this would require. And to be clear, I am told that WeTransfer is even slower.

To make this (hopefully) a little clearer…I would point out four major specs that one might consider for digital delivery for exhibition.

- Uncompressed Quicktime File (90 mins). This would be approx. 500 gigs. Given the upload/download math I’ve given you above, you can see why 500 gigs is a non-starter.

- Apple ProRes 422 HQ (90 mins). Approx 150 gigs. Problematic uploaded/download math given above. Doesn’t seem currently viable with today’s technology.

- HD Vimeo File made available to download (90 mins). Approx 1.5 – 3 gigs. This format is entirely doable—and we now make all our films available this way if needed. This format looks essentially the same as Bluray on an HD TV, but not as good when projected onto a large screen. This can be instantaneously emailed to venues and they can quickly download and play from a laptop or thumb-drive or even make a disc-based format relatively inexpensively. However, there are two major problems…a) most professional venues that value excellent presentation values and have large screens find this to be sub-par projection quality and b) this is a file that is incredibly easy to pirate and make available online. For these reasons, we currently use these only for emergency purposes…when we get last minute word that a package hasn’t arrived or an exhibition format has failed. It is quite a shame…because this is incredibly easy to do, so if we could find the right balance of quality and security…we would be on this in a heart-beat.

- Blu-Ray-Quality File (Made available via Dropbox)(90 mins). This spec would be just around the same quality as a Bluray (which is quality-wise good enough for nearly all venues) and made available via Dropbox or the like. It is estimated that this file would be around 22 – 25 gigs. This would be slow, but potentially doable according to our current upload/download calculations. This is the spec we at TFC are currently looking at…but to be clear we have NOT ever done this yet. Right now it is our pipe dream…and our plan to implement in 2016. I will follow up on this in further posts!

To conclude, where we stand now, we have yet to find a spec that is reasonably made available to venues via the internet, both in terms of quality and safety protocols…but a girl can dream.

It is critical to note that the folks I am talking to recently are saying this may NOT change in the foreseeable future…because internet speeds worldwide might need to quintuple (or so) in speed to make this a more feasible proposition. Nobody that I know is necessarily projecting this right now. And that’s a sobering prospect that might leave us with physical deliverables for quite a while now. And for now, that would be the DCP with Bluray back-up. If this changes, you can be sure we will write about it here.

But hey, maybe that Quantum Computer I’ve heard about will sudden manifest itself? Gosh, that would be cool. In the meantime…how about a long-range battery that runs an affordable electric car and is easy to recharge? That would be super cool too. We can save the world and independent film at the same time.

In the meantime…if you think I am missing the point on any of the nerdy details included in this post, or you know anything about how digital delivery of exhibition materials that I might have missed, please email me. Trust me….we want to hear from you!

Jeffrey Winter November 24th, 2015

Posted In: Digital Distribution, Distribution, Film Festivals, Theatrical, Uncategorized

Tags: Apple Pro-res, BluRay, DCP, Digital Cinema Package, digital film delivery, DVD, film deliverables, film distribution, film exhibition, HDCam, Jeffrey Winter, Prints and Advertising, The Film Collaborative

The Face-to-Face Teaching Exemption and Fair Use in Education Distribution: Clearing up some misconceptions

Written by Orly Ravid and Guest co-Author Jessica Rosner, who has been a booker in the educational, nontheatrical and theatrical markets since the days of 16mm. Recent projects include Jafar Panahi’s This Is Not a Film and John Boorman’s Queen and Country.

A recent blog by Orly Ravid covered just a little bit about educational rights and distribution. This blog is intended to develop that in response to a comment about the “Face-to-Face” teaching exception. This exception defines what films can be shown for no license or permission by the producers or rights holders.

A recent blog by Orly Ravid covered just a little bit about educational rights and distribution. This blog is intended to develop that in response to a comment about the “Face-to-Face” teaching exception. This exception defines what films can be shown for no license or permission by the producers or rights holders.

The Copyright Act provides for an exception to needing a copyright holder’s permission to exhibit a copyrighted such as a film. That exception, however, is only for “face-to-face teaching” activities of a nonprofit educational institution, in a classroom. That’s why it’s called the “face-to-face” exemption.

I emphasized the key words to clarify that this exception does NOT apply to social club or recreational screenings of films or any exhibition that is not in “classroom” or “similar space devoted to instruction” where there is face-to-face instruction between teacher and student and where the exhibition relates to the educational instruction. Second, not all institutions or places of learning are non-profits. All this to say, the “face-to-face” exemption is not a carte blanche free-for-all to show any copyrighted work in any context as long as there are books around within a mile radius. This is important because educators and distributors are often unclear about what can and cannot be done under this exception to proper permission to distribute or exhibit a film without permission (which often includes a fee).

Below is some key information about the state of educational distribution in 2015 and can be done lawfully without the licensor’s permission (under the Copyright Act):

Viable options for educational distribution that involves either selling physical copies, download, or licensing streaming rights or other rights and type of rights or sales, including price points, terms, limitations, etc.

It’s important to understand that “educational sales & use” is not legal term and that educational institutions have the right to purchase any film that is available from a lawful source and use it in an actual physical class under the “face-to-face” teaching section of copyright law (discussed above). Also okay is for them to keep a copy in the library and circulate as they choose.

However, if as increasingly the case, they wish to make films available via streaming or to exhibit them outside of a class they must purchase those rights. A filmmaker or distributor can charge a higher price to an institution to purchase a DVD if they control all sales but that would be a contract situation and mean the film basically has no sales to individuals. This is done but mostly with non-feature films or ones whose market is intended to be only institutions and libraries.

Streaming rights offer a real opportunity for income for filmmaker provided they are willing to sell rights to institutions in “perpetuity” (meaning, forever). They will make more money and the institution is far more willing to purchase. Many if not most universities now want to have streaming rights on films that are going to be used in classes.

Exhibition of film at universities or educational institutions that is NOT paid for (not licensed or bought from copyright holder) – when is it legitimate (lawful) and when is it not so?

It is legal to show the film in the classroom provided it is legal copy (not duped, bought from pirate site, or taped off television). Any public showings outside the classroom are illegal. Streaming entire feature films is also illegal but streaming clips of films is not.

What is the reason or rationale for the non-lawful use?

If it is a public showing (exhibition) they (and this is usually either a student group or professor, not administration) claim “they are not charging admission” and/or that “it being on a campus” makes it “educational and in extreme cases they claim that it actually IS a class. Illegal streaming is far more insidious and involves everything from claiming streaming a 2-hour film is “fair use,” (which would justify showing it without permission) or, that somehow a dorm room or the local Starbucks is really a classroom. Bottom line: not all use of film can be defended as “fair use.” Exhibiting not just clips but a whole film is usually not lawful unless the “face-to-face” teaching exemption requirements (discussed above) are met.

There is a disconnect for these educational institutions between how they treat literature vs. cinema:

All the parties involved in streaming (legal and illegal) librarians, instructors, tech people, administrators know that if they scanned an entire copyrighted book and posted on campus system for students to access it would be illegal but some of the same people claim it is “fair use” to do with a film. I actually point blank asked one of the leading proponents of this at the annual American Library Association Conference if it was legal to stream CITIZEN KANE without getting permission or license and he said yes it was “fair use” when I followed up and asked if a school could scan and post CATCHER IN THE RYE for a class he replied “that is an interesting question.” It is important to note that “fair use” has never been accepted as a justification for using an entire unaltered work of any significant length and recent cases involving printed material and universities state unequivocally that streaming an entire copyrighted book was illegal.

Remedies to unlawful exhibition of copyrighted works for distributors or licensors:

Independent filmmakers need to make their voices heard. When Ambrose Media a small educational company found out that UCLA was streaming their collection of BBC Shakespeare plays and took UCLA to court supported by many, other educational film companies, academics reacted with fury and threatened to boycott those companies (sadly the case was dismissed on technical grounds involving standing & sovereign immunity and to this day UCLA is steaming films including many independent ones without payment to filmmakers). For decades the educational community were strong supporters of independent films but financial pressures and changing technology have made this less so. (Jessica Rosner’s personal suggestion is that when instructors protest that they should not have to pay to stream a film for a class, they should be told that their class will be filmed and next year that will be streamed so their services will no longer be needed). Orly Ravid gives this a ‘thumbs up’.

Of course remedies in the courts are costly and even policing any of this is burdensome and difficult. Some films have so much educational distribution potential that a distribution plan that at first only makes a more costly copy of the film/work available would prevent any unauthorized use of a less expensive copy or getting a screener for free etc. But not all films have a big enough educational market potential that merits putting everything else on hold. And once the DVD or digital copies are out there, the use of that home entertainment copy in a more public / group audience setting arises. As discussed above, sometimes it’s lawful, and sometimes, it’s not but rationalized anyway. It is NEVER legal to show a film to a public group without rights holder’s permission. Another viable option for certain works, for example documentaries, is to offer an enhanced educational copy that comes with commentary, extra content, or just offer the filmmaker or subject to speak as a companion piece to the exhibition. This is added value that inspires purchase. Some documentary filmmakers succeed this way. It is extremely important to make sure your films are available for streaming at a reasonable price.

Parting thoughts about educational distribution and revenue:

Overall, we believe most schools do want to do the right thing but they are often stymied when they either can’t find the rights or they are not available so get the word out.

Streaming rights should be a good source of income for independent filmmakers but they need to get actively involved in challenging illegal streaming while at the same time making sure that their works are easily available at a reasonable price. It can range from $100 to allow a school to stream a film for a semester to $500 to stream in “perpetuity” (forever) (all schools use password protected systems and no downloading is allowed). TFC rents films for a range of prices but often for $300. You may choose to vary prices by the size of the institution but this can get messy. Be flexible and work with a school on their specific needs and draw up an agreement that protects your rights without being too burdensome.

Happy distribution!

Orly & Jessica

Orly Ravid August 20th, 2015

Posted In: Distribution, education, Legal

Tags: educational distribution for films, fair use, film exhibition, film streaming rights, independent film, Jessica Rosner, Orly Ravid, The Film Collaborative

Letter to Filmmakers of the World: What Do You Want Next?

Dear Filmmakers of the World,

I write to you to ask: what do you need, what do you want?

For five years The Film Collaborative has been excelling in the film festival distribution arena and education of filmmakers about distribution generally and specifically as to options and deals. TFC also handles some digital distribution directly and through partners. And we have done sales though more on a boutique level and occasionally with partners there too, though never for an extra commission. You know how we hate extra middlemen! We even do theatrical, making more out of a dollar in “P&A” than anyone and we do a really nice job TFC has a fantastic fiscal sponsorship program giving the best rates out there.

TFC published two books in the Selling Your Film Without Selling Your Soul series and we are probably due to write a third, detailing more contemporary distribution case-studies. I got a law degree and am committed to providing affordable legal services to filmmakers and artists, which I’ve started doing.

We have never taken filmmakers rights and find that most filmmakers are honorable and do not take advantage of that. We trust our community of filmmakers and only occasionally get burned. And we have accounted without fail and paid every dollar due. No one has ever said otherwise. We do what we say we’re going to do and I am so proud of that and so proud of the films we work with and the filmmakers in our community.

So, now what? What do you, filmmakers of the world, want more of? What don’t you need anymore?

Personally, I find it staggering and sad how much information is still hidden and not widely known and how many fundamental mistakes are made all the time. Yet, on the other hand, more information is out there than ever before and for those who take the time to find and process it, they should be in good shape. But it’s hard keeping up and connecting-the-dots. It’s also hard knowing whom to trust.

TFC continues to grow and improve on what it excels at, e.g. especially festival/non-theatrical distribution. We’ve got big growth plans in that space already. My question to you is, do you want us to do more Theatrical? Digital? Sales? All of it? More books? What on the legal side? Please let us know. Send us an email, tweet, Facebook comment, a photo that captures your thought on Instagram, or a GoT raven. I don’t care how the message comes but please send it. We want to know. TFC will listen and it will follow the filmmakers’ call.

We’re delighted to have been of service for these last 5 years and look forward to many more. The best is yet to come.

Very truly yours,

Orly Ravid, Founder

p.s. our next new content-blog is coming soon and will cover educational distribution and copyright issues.

Orly Ravid July 29th, 2015

Posted In: Distribution, education, Film Festivals

Tags: film distribution, film festival distribution, Film Festivals, independent filmmakers, Selling Your Film Outside the U.S., Selling Your Film Without Selling Your Soul, The Film Collaborative

How to Win at Film Festival Roulette: Stacking Your Odds at the Top Fests

This article was originally posted on indiewire on June 26, 2015.

Be smart in organizing your priorities, do your homework and prepare for the emotional roller coaster of festivals. To help you, we’ve asked an experienced distributor to run down the numbers, so you can determine your odds.

Bryan Glick is the director of theatrical distribution for The Film Collaborative. Some of his notable releases include "I Am Divine," "Manos Sucias" and "1971". He has also worked for LAFF, AFI Fest and Sundance. Below is his take on the top festivals.

We at The Film Collaborative frequently hear from filmmakers after the fact that they regretted premiering at festival "A" and wish they had opted for festival "B." Similarly, when we ask a filmmaker why they want to premiere at a particular film festival, we rarely get an answer grounded in research.

The truth is that all the top festivals have certain types of films they gravitate towards, and all attract certain kinds of buyers looking for a particular type of product. With Sundance, Berlin, SXSW, Tribeca and Cannes behind us (and many filmmakers going into production to meet their Sundance deadline or wrapping up to apply for TIFF), we thought that now would be the perfect time to step back and look at the bigger picture of the 2015 festival landscape (including TIFF 2014).

We chose to define this list based on the number of films that screened at each festival and had not publicly stated they were being distributed before the festival lineup was announced.

The number of films listed as being acquired is to the best of our knowledge. This includes many films that have yet to go public with their distribution deals but that we can confirm from filmmakers, distributors and/or sales agents.

While we focused on a small list of top festivals, please note that major deals can come from any of a variety of festival. All that said, the following is the look at the major premiere festivals most filmmakers we meet with are pursuing.

2015 Sundance Film Festival

By the numbers:

- 74 Sundance acquisitions (including 19 for over $1 million)

- 74 of 104 films acquired

- 18 of 25 award winners acquired

Buyers: A24, Alchemy, Broad Green Pictures, Film Arcade, Fox Searchlight, Gravitas, HBO, IFC, Kino Lorber, Lionsgate, Magnolia, Netflix, Showtime, Sony Pictures Classics and The Orchard.

The lowdown: Sundance is perhaps the Holy Grail as far as buyers are concerned. Sundance is a popular stomping ground for Netflix and the all rights deals that

are much harder to come by at Cannes or TIFF. The fest is especially effective for highlighting documentaries and top notch narrative films.

The only catch is that Sundance simply isn’t an international festival. If you don’t take the all rights deal it can be much more work selling the film abroad. Since Sundance is the first big festival stop of the year, many distributors jockey for position. But if your film is not American, this might not be the festival for you. Half of the world doc/world dramatic films have yet to secure North American distribution; all but four films in the U.S . Dramatic and Documentary section have secured distribution and almost all were in six or seven figures.

As far as getting into the festival, the festival is notoriously insular. A strong majority of U.S. Competition films are backed by the Sundance Institute and/or come from Sundance alumni. Also, Sundance tends to stick to theatrical length films. You will rarely see 50-70 minute films accepted. They show a particular interest in politically-oriented documentaries.

SXSW 2015

By the numbers:

- 37 SXSW Acquisitions

- including 3 for over $1 million

- 37 of 100 films acquired

- 11 of 17 award winners acquired

Buyers: Netflix, Drafthouse Films, Roadside Attractions, Gravitas, FilmBuff, Alchemy, Vertical Films, Ignite Channel and IFC

The lowdown: SXSW is always a tricky proposition. With 145 films (20+% more than Sundance or Tribeca) presented over nine days instead of 11-12, there’s simply a lot going on. This means it is much easier to fall through the cracks. Since the festival doesn’t sell tickets ahead of time, it’s very possible nobody will show up to your screening.

However, the fact that the slate skews younger and is more adventurous often means that films have large built-in fan bases, and that there are bold discoveries that distributors can sometimes get at bargain prices. There is a reason FilmBuff and Gravitas nabbed at least eight films combined. Throw in Netflix and you have 11 titles that we can confirm going a targeted digital route.

This is the one top festival where your film is guaranteed to get screened by a festival programmer when you submit. They go out of their way to find filmmakers who are not as connected to the industry. If you don’t have industry contacts, this might be your best bet. The festival primarily programs American films and is a popular follow up to TIFF and Sundance. They also shine a light on local Texas talent.

2015 Tribeca Film Festival

By the numbers:

- 22 Tribeca acquisitions including 3 for over $1 Million

- 22 of 79 acquired

- 3 of 15 award winners sold

Buyers: A24, IFC, Saban Films, Paramount and Strand Releasing all took multiple titles

The lowdown: Tribeca screens fewer films than the other top North American fests and has a reduced schedule during the regular workweek. As the only top festival in a major U.S. industry hub, things tend to follow a more traditional trajectory.

However, we find films at Tribeca often don’t think about the long game. With summer being a slow period, many films will simply stop pursuing festivals while waiting for a deal—a strategy that tends to backfire, as more often than not they wind up forgotten.

While the narrative quality is growing, the star-driven fare tends to dominate. Some based on their star brand can get big deals, but at its heart, the fest is really about documentaries. They have a lot of character profile and political documentaries that fall under the awards bait category and frequently appeal to a more traditional indie film crowd.

As Sundance continues to narrowly define their documentary programming, Tribeca is proving to be an industry asset. This is also a great fest to go to as a North

American premiere. Frequently films that fall through the cracks at Berlin, IDFA and Rotterdam get more attention here, and also tend to be the winners on awards night. Accordingly, if you’re an American filmmaker and awards are important to you, recent history suggests that you might want to bypass this fest. Additionally (unlike SXSW), they embrace their local filmmakers far less, preferring to focus on the international power.

2015 Cannes Film Festival

By the numbers:

- 21 of 81 acquired

- 9 of 25 award winners acquired

Buyers: Alchemy, Cohen Media Group, IFC, Kino Lorber, Radius-TWC, Strand Releasing, Film Movement, IFC and Sony Pictures Classics

The lowdown: Cannes is the international behemoth and certainly being in competition is the best place to launch a film as a foreign language contender. The festival skews much more international in its programming and deal opportunities. While the U.S. distribution picture is bleaker, the rest of the world rapidly snatches up everything they can from the festival.

This is perhaps the most insider-y of the festivals. Only one film in competition was from a first-time director. Cannes frequently pulls from their own rank and file. They also show the fewest number of documentaries of any festival on the list and those are almost solely films about film/filmmakers/actors.

There are similarly few slots for genre fare. Films in the other sidebars like Directors Fortnight and Un Certain Regard are far less likely to get North American distribution when the dust settles, but can usually count on a long festival life.

Cannes, of course, is committed to films from France. However, the festival has continued to struggle in highlighting female directors.

This festival is easily the worst of the bunch for thinking outside-the-box when it comes to distribution. DIY is basically a dirty word and very few crowdfunded films get in. Distributors are also less likely to tout how much they paid for a film in press releases, which is why we do not list the amount of seven-figure deals.

2015 Toronto Film Festival

By the numbers:

- 99 TIFF films acquired (including 16 for over $1 million)

- 99 of 214 acquired

Buyers: A24, Alchemy, Bleecker, Broad Green, Image Entertainment, Lionsgate, Magnolia, Roadside Attractions, Paramount, Radius-TWC, Relativity, Saban Films, Sony Pictures Classics, Breaking Glass Pictures, China Lion, Focus World, Cinema Guild, Cohen Media Group, Film Movement, IFC, Lionsgate, Magnolia, Monterey Media, Drafthouse Films, Oscilloscope, Strand Releasing, Music Box Films, Screen Media, Saban Films, Kino Lorber and The Orchard

Now, keep in mind that TIFF was a full nine months ago. So why the relatively low numbers when compared to Sundance or even SXSW?

The truth is that TIFF has too much product and is largely geared toward star-driven fare. It can be a place to snatch up leftovers from Cannes and Locarno, but non-star driven English language fare (including several Canadian films), documentaries and any of the films in the Discovery, Contemporary World Cinema and Wavelength sections are unlikely to generate much attention.

The nice thing about TIFF is they take films from more countries than anywhere else. The fest also has never been too concerned with length, with many films over two and a half hours and others not even reaching 70 minutes.

With such a wide variety of films TIFF is the most eclectic and hardest to define programming-wise. They take a lot more genre fare than the other fests and their docs tend to reflect an international worldview. The seven figure deals almost exclusively come from star-driven fare. If a film is in English and Oscar bait, but lacks distribution this is the place to be. Keep in mind that documentaries account for less than 15% of the festival’s lineup.

Of course, keep in mind that many more films from these festivals will ultimately secure some form of domestic distribution. It took TFC’s "Gore

Vidal: The United States of Amnesia" nine months after its Tribeca premiere to secure its IFC deal and it ultimately went on to become the second highest grossing film from Tribeca 2013.

So be smart in organizing your priorities, do your homework and prepare for the emotional roller coaster of festivals.

Bryan Glick June 26th, 2015

Posted In: Distribution, Film Festivals, Theatrical

Thoughts on the EU Digital Single Market

Some of you may have heard that about a week ago the European Film Commission announced the Digital Single Market Plan (which may also apply to TV licensing). Variety covered the story HERE and HERE.

You can read for yourself what the fuss is all about but essentially, the EU Film Commission’s plan is to combine the 28 European territories into a common market for digital goods, which would eliminate “geo-blocking,” which currently bars viewers from accessing content across borders – and yet purportedly, the plan would preserve the territory by territory sales model. Filmmakers, distributors, the guilds, et al argue that this proposal would only help global players / platforms such Netflix, Amazon and Google, which would benefit from a simpler way to distribute content across Europe.

The IFTA (International Film and Television Alliance) expressed concerns that this would enable only a few multinational companies to control film/tv financing. Variety noted that although politicians insist the idea of multi-territory licenses won’t be part of the plan, those in the content industry remain concerned about passive sales and portability and the impact on windows and marketing.

In the US, digital distribution is just hitting its stride and is also finally getting anchored properly in Europe. Now this idea would be one step closer to one-stop-digital shopping, or selling. Though allegedly that’s not in the plan – but it would sure be a step in that direction.

photo credit: movantia

Some are railing against it and warning against eliminating territory sales and windowing, hurting financing, and truncating important local marketing. Well, maybe and maybe not. I think it depends on the type of film or film industry player involved. A blockbuster studio hit or indie wide release sensation with international appeal may very likely be big enough to sell many territories, be big enough to warrant spending significant marketing money in each territory’s release, and be culturally malleable enough to lend itself to new marketing vision, materials, and strategies per market. On a related note, I remember hits such as Clueless being translated into different languages not just literally, but also culturally – modified for local appeal. That’s great, and possible, for some films.

But for most of the films we distribute at TFC and for the great majority on the festival circuit, they’ll be lucky to sell even 10 territories and many won’t sell even half that. Some sales in Europe are no minimum guarantee or a tiny minimum guarantee, just like it is State-side. Some films are financed per EU territory (government funding often) but that’s on the decline too.

The dilemma here about a digital single market in the EU recalls another common dilemma about whether to hold out for a worldwide Netflix sale or try to sell European TV or just EU period, one territory at a time. I’m not forgetting Asia or Africa but focusing on the more regular sales for American art house (not that selling Europe is an easy task for most American indies in any case). Sure, if you can sell the main Western European countries and a few Eastern ones that’s worthwhile taking into account. However, so often one does not sell those territories, or if one does, it’s for a pittance. Some sales can be for less than 5,000 Euros, or half that, or zero up front and not much more later. It’s not like the release then is career building either or a loss leader. It’s just buried or a drop in a big bucket.

In cases such as these, it makes little sense to hold off for a day that never comes or a day that really won’t do much for you. All this to say, I don’t think this proposal is one-size-fits all but I do think it’s worth trying on especially if you are in the petite section of the cinema aisle. If you are not sure how you measure up, ask around, comparison shop – see what films like yours (genre, style, topic, cast, festival premiere, budget, other names involved and other aspects) have done lately. Sometimes a worldwide Netflix deal may be the best thing that ever happened and I reckon that similarly, sometimes a plug and play EU digital deal (if this vision comes into fruition) will give you all that you could get in terms of accessing European audiences, while saving you money (in delivery and fees etc.). And then, get this, you can focus on direct-to-audience marketing – something few agents or distributors do much of anyway.

I kept this blog entry short as I stand by for more information out of Cannes and beyond and also await our TFC resident EU digital distribution guru Wendy Bernfeld (Advisory Board Member and co-author of the Selling Your Film Outside the U.S. case study book) to weigh in. In the meantime, I think it would be swell if one Cannes do digital in the EU all at once.

Please email me your thoughts to contactus [at] thefilmcollaborative.org or post them on our Facebook page so we can update this blog. We turned off comments here only because of the amount of spam we received in the past.

Orly Ravid May 14th, 2015

Posted In: Digital Distribution, Distribution

Tags: Amazon, arthouse films, digital film distribution, Digital Single Market Plan, EU, Film commission, Google, independent film, International Film and Television Alliance, Netflix, Orly Ravid, Selling Your Film Outside the US, The Film Collaborative, Variety, Wendy Bernfeld

Spotlight on IndieFlix: a subscription-based streaming service for independent film

As part of TFC’s ongoing mission to help filmmakers find the right audience and the right distribution strategy for their specfic project, this month, we sat down with Scilla Andreen, CEO & Co-Founder of INDIEFLIX to talk about the service, what’s new, and what’s ahead.

1) How does IndieFlix work? Would you consider it a service or a platform?

Variety calls IndieFlix the Netflix of independent film. Based in Seattle and founded by filmmakers, Carlo Scandiuzzi and Scilla Andreen, IndieFlix launched with 36 titles as a DVD on-demand service in October 2005. In 2013 the model evolved into a subscription based streaming service for movie enthusiasts. IndieFlix helps you find great independent films from around the world and makes them available for $5 per month. We like to think that we entertain and enrich people’s lives by connecting them to more than 8,000 films selected from over 2500 film festivals and 85 countries. Our library includes shorts, features, documentaries and web-series. We have worldwide rights to over 85% or our library so members can watch our films from anywhere in the world on a variety of platforms including Amazon’s Fire TV, Kindle Fire, Xbox 360, Sony, Apple’s iPad, iPhone and Roku—basically any internet connected device.

2) Why should filmmakers work with IndieFlix?

If there is anything we have learned it’s that teamwork and transparency are essential to the future of independent film. Distribution costs a lot of money, and studios spare no expense with their blockbusters. But because of this the filmmaker is often the last person to ever get paid and they have no idea who their audience is or where they originate. We have created a model of efficiency, transparency and data that literally turns the old model of distribution on its head with our unique royalty payment system called (RPM) Royalty Pool Minutes model. In this model, filmmakers are paid for every minute their film is watched. We are currently building out the filmmaker dashboard to include analytics, and data on where the audience lives and on what device (such as Roku, Xbox, iOS etc.) they watch the film on. We will also be adding data on the point in the film at which a user exits a film. This is possible of course because technology allows filmmakers to be their own gatekeepers. My job is to grow the subscriber base and curate a library with a user experience that makes finding films to watch not only fun and entertaining but also meaningful. I want our audience to love finding and watching films on IndieFlix because the more they watch the more the filmmaker gets paid.

3) What are some of your favorite creative marketing solutions and/or partnerships that you have high expectations of?

Our most successful campaigns are with our device partners Roku and FireTV. We haven’t yet done a campaign with the others. As far as creative campaigns, we have no shortage, but those are more brand awareness campaigns like the time we had biking billboards ride up and down Main Street in Park city during the Sundance Film Festival. We were giving away cold hard cash to demonstrate to people what IndieFlix does…We pay filmmakers that’s why we created the company.

Another favorite campaign was handing out printed matches that said, “Strike a Revolution: IndieFlix is the perfect match.” I handed those out at the Cannes film Festival and actually met one of my investors there…Talk about a good match.

We also really enjoy marketing campaigns that we do with the filmmakers. When the filmmaker participates and we market together there is always a great return. Like our collaboration with filmmaker Kurt Kuenne. We met Kurt through Oscilloscope. We now offer three of his films on IndieFlix including: Dear Zachary, The Legend of Dear Zachary: A Journey to Change Law and Drive-In Movie Memories. We will also be releasing a rare black and white director’s cut of his film Shuffle in coming months. We will be highlighting his work through an exclusive branded director’s channel and an interview we conducted with him about the process of making Dear Zachary.

Of course Chris Temple and Zach Ingrasci the directors of Living on One Dollar, Lauren Paul and Molly Thompson of Finding Kind and Sarah Moshman and Dana Michele Cook of The Empowerment Project: Ordinary Women Doing Extraordinary Things are all exemplary filmmakers of the new order. They have mastered the art of making great movies and marketing their story globally.

4) Can you share any data? Revenues? Users? Number of films you have?

We are a privately held company and do not typically share numbers. However I am excited to say that we currently have low six figures of total users, and our library has grown to 8000 titles. A large portion of those titles we have worldwide rights.

It is exciting to have a growing user base but it is important to us that these users are watching. We want filmmakers to look at their dashboard and see their films being watched and minutes tallying up.

5) Any success stories? And can you share details?

To be honest our greatest success stories started with the films in the IndieFlix Distribution Lab where we put the entire weight of the company behind these films to market them in schools and communities off-line as well as strategic windows online. Of course IndieFlix is the first window and then we roll out onto iTunes, Comcast and Netflix.

We’ve also found great success with short films. The Indieflix “QuickPick” allows users to sample movies as they would music. You can sort through shorts based on running time, genre and rating. It’s a quick and easy way to sample movies.

Films about zombies, include nudity, tattooing, and music docs also do very well on IndieFlix. Social justice films are equally successful.

I’ll leave you with a quick story about a German filmmaker that had a hard time finding broad distribution due to some of the challenging nature of his film and the title. We picked up the movie changed the title (with his permission) and the film is now thriving.

6) What type of content is and is not a good fit for IndieFlix?

We have learned that our audience is really a lifestyle connoisseur. They enjoy wine, art, books and travel. They like to discover and they care about how they spend their time and money. We have found that content that is entertaining high production value and covers a wide variety of topics here in the US and abroad including fashion, art and music is very popular. In the same breath I will add that zombies, horror, mystery and documentaries are very popular. And just like in Hollywood comedies are always a favorite.

What I have learned is that marketing content gets watched. The best movie can sit in our library but if we don’t bring it to the users attention no one will watch it no matter how good it is. I guess to answer the question the best movies are the ones that start great conversations and people feel compelled to write a review, leave a comment and share it.

7) What are common misconceptions about IndieFlix?

The most common misconception is that Indieflix will take anything. It’s true that when we first started the company back in 2005 our policy was if you had played at a film festival you could submit and be accepted at IndieFlix. We quickly learned that the film festivals are not the most reliable way to curate content. We started our own curation process, which has evolved over time. We now accept 5-10% of all submissions.

8) What are some key selling points?

There are many selling points to being on IndieFlix.com, but here are a few:

- Zero fees

- Quick Turn Around

- Global Reach (with the ability to geo-block)

- Exceptional Customer Service

- A hungry audience

9) What’s the future of IndieFlix?

Part of what makes the entertainment industry so exciting right now is that the future is unknown and everything is moving very fast. The digital landscape is ever-evolving and we are always looking for what works best for our filmmakers to generate meaningful revenue. We balance this with providing our subscribers with an exceptional catalog of films they may not have access to elsewhere. IndieFlix has survived 3 technologies and remained a thriving player in the marketplace. We are bold in that we know who we are and who we want to be, and we are confident in evolving our focus and approach with the changing marketplace. At the end of the day, we want to be a household name, we have an excellent product in our catalog and we want to share our passion for it with the world.

10) Feel free to share any other predictions, analysis, data, and/or case studies or anecdotes. If you want to share about capital you have raised etc.

I’m just now starting a capital raise for IndieFlix. We have boot strapped for years. We have an amazing team of 21 people who are incredibly dedicated to the filmmakers, the audience, the film festivals and the entire industry.