UPDATED: A Practical Guide to Distributing Your Film Internationally: Who Else is Out There in the International Digital Space Beyond Just the Big Globals?

Mobile Phone Users: This page is best viewable by turning your phone horizontally (in landscape mode).

Note: This article was originally published in May 2020 and updated in March 2021. Needless to say, things have continued to evolve at lightning speed in the digital sector, so we’ve asked our dear friend and colleague Wendy Bernfeld, founder of Rights Stuff, not only to assist with updating various international platforms in the TFC’s Digital Distribution Guide, but also to summarize, in this blog post, key changes in the international landscape and buying platforms abroad.

Note: This article was originally published in May 2020 and updated in March 2021. Needless to say, things have continued to evolve at lightning speed in the digital sector, so we’ve asked our dear friend and colleague Wendy Bernfeld, founder of Rights Stuff, not only to assist with updating various international platforms in the TFC’s Digital Distribution Guide, but also to summarize, in this blog post, key changes in the international landscape and buying platforms abroad.

Which platforms closed, or radically reduced their indie buying? Which have been bought or merged, changed their content genres, altered their business models (B2B, B2C), or expanded or curtailed the regions they operate in? And which new (interesting! credible/reputable!) platforms are out there with an appetite for indie films?

As before, she looks beyond just the Big Global players to the others abroad who compete or complement them, with emphasis on the SVOD windows.

(In the future we may also request her to update her TFC blog article on FAST/AVOD in Europe, but as that is a later window and not as immediately compelling for indies with only a few films and less than 8 years old, we concentrate in this article mainly on SVOD and hybrid platforms).

Wendy specializes in Library and Original Content acquisition/distribution and international strategy / deal advice for traditional media (film, TV, pay TV), digital media (Internet/IPTV, VOD, OTT/devices), and web/cross-platform programming. She is also active on various film festival / advisory boards, such as IDFA and TFC!

Follow her on LinkedIn: Wendy Bernfeld; and Twitter: @wbernfeld.

So, without further ado, here is Wendy’s update:

Wendy:

I’m not a classic distributor or sales agent that takes IP, but rather an independent digital sector consultant. I have roots as a lawyer and senior buyer / in-house executive in the traditional film/tv sector, first in Canada and then since the ’90s based in Europe, increasingly focused on digital sector and streamers internationally, with emphasis on EMEA (Europe, Middle East, and Africa).

Most of the time I’m a buyer / business development executive for platforms, often before they launch (curation, sourcing, acquisition, deals), or afterwards when they roll out into new regions, genres, and business models. The rest of the time I’m on the filmmakers’ side of the table, helping rightsholders / producers / sales agents / festivals deal with distribution platforms and alternatives going beyond the usual suspects.

A) Intro

1) What’s shifted the past few years

For a few years, we were in the heyday of the streamers having hearty appetites for buying indie films, including docs and series – particularly post-COVID and during/after the writers’ strike and production slowdowns. As production stalled, and competition among streamers increased, more streamers turned to acquisitions of ready-made (current and/or library titles) to round out their programming. Non-exclusive licensing allowed multiple deals and windows, as per my last article. The sweet spot for SVOD acquisitions, aside from premium/first-run, opened up for indie films 2-5 years old, especially from curated platforms overseas, and older titles (5+ years) could also find a home in SVODs and/or AVODs.

Last year (particularly), when the choices and costs became too much for both consumers and platforms (too many SVODs, “subscription fatigue”), along with economic challenges overall, the tide turned and streaming platforms began contracting, consolidating, reorganizing, and cutting back. But this also led to an uptick of other business models (AVOD, FAST, ad-supported “tiers,” and hybrid offerings). This trend has continued, spreading further overseas. However, in this article we will focus more on the SVOD licensing opportunities still out there, with an emphasis on arthouse/indie film/festival titles, docs, and niche/genre features.

2) Approach

As before—and now more than ever—it is important, in my view, to look beyond mere traditional and “Big Global” platform buyers (Tier 1 types) to their head-on international competitors, such as telecom, cable, OTT services (Tier 2 types) and then to the complementary thematic or niche sites (Tier 3 types): those who also buy or fund but are lesser known and attend markets/festivals less frequently.

More recently, the free-with-ads sector, originally AVOD (Tier 4), strengthened with the addition of free linear FAST channels and combined AVOD/FAST offerings, first in the U.S. and now abroad. As mentioned before, I won’t go into this tier in too much detail, but I will give a brief update, because it may affect your deals in other tiers.

If traditional buyers or Big Globals have not led to a “Holy Grail”-type of deal for you (or you feel the film has other goals/audiences), then the Tier 2 and 3 types abroad can be a worthy pursuit, at least for those willing to dedicate time and attention to it.

Best results arise from:

- Researching the target platforms

- “Matchmaking” your film (realistically to those on their site, and/or their type of audience, kind of like online dating!)

- Doing short, personalized, tailored outreaches, not Mail Chimp-style mass mailings

i.e., contextualizing your film to their platform, so as to help do the buyers job for them

This can be either DIY (since most of these platforms will deal direct) and/or with your sales reps or agents, in a hybrid manner, to help cover all the bases in this industry-wide time of blurred windows, rights, and international audiences.

3) Who Are They? Snapshot the VOD/OTT Streamers

You can cross-reference the platforms below with the broader Digital Distribution Guide (updated regularly) for further info on regions, business models, and links to company sites. In this article, I focus on a key sampling of the platforms and developments since the last blog.

Types:

-

Tier 1: Mainstream “Big Global” types

i.e., global (or on their way to global)

- For example, Netflix, Amazon, HBO / Warner Brothers Discovery / Max (formerly HBO MAX), AppleTV+, Disney+/Hulu, as well as other studio-backed entrants, such as Peacock, Paramount+ (in SVOD) and its Pluto.tv (in AVOD/FAST), and finally, other mainstream AVOD/FAST platforms such as Tubi, Roku, SamsungTV+, YouTubeTV, and Rakuten (based in EU).

- These types are often most sought after, but as before, such deals (if/when offered) will correspondingly impact the revenues, rights, windows, holdbacks, promotion, marketing, access to audience data etc. So, one always has to balance one’s goals with the offer (money, impact, marketing, etc.)

- If such a deal is not forthcoming, or not the right one for you, then – don’t stop there!

- In this article, I’ll focus more on Tier 2 and 3 players.

-

Tier 2: Mainstream Competitors to Big Globals

i.e., EMEA/International multi-regional or local VODs (via telecom, cable, OTT, pay/TVs), who strive to be head on competitors (buying and funding/co-funding, though not globally.)

- Examples include Canal+, Crave, Sky, M-Net/Multichoice/ShowMax, Stan and the more recently launched Sky Showtime (Comcast / Paramount Global joint venture based in EU).

Keep in mind that aside from competing with Tier 1 types, Tier 2s also have competitors in their own regions, so you can canvas them (if non-exclusive) and/or cobble together various other deals with other Tier 2 & 3 players in different regions.

- In all Tier 1, 2, and 3 deals, windowing and holdbacks are to be balanced against traditional. Some Tier2s want to be first window, while others, and most Tier3s, are content to come in non-exclusively.

- That said, if you only do a non-exclusive deal, you’ve effectively given the platform exclusivity for the price of a non-exclusive deal.

-

Tier 3: Complementary Thematic

i.e., many curated niche or micro niche VODs, drilling down into a specific genre, theme, or target audience. These services are lower-priced and position themselves as “stackable” add-ons for households.

- Examples include services dedicated entirely to art house, docs, diaspora, horror, LGBTQ+, such as Filmin, MUBI, Curiosity Stream, Shudder, OUTtv, etc.

As above, each of these thematic types often have 5-10 competitors, with varying programming and deal offers, so one can do multiple non-exclusive deals in this sector too (unless paid very well for exclusivity).

- There are technically thousands of VODs in Europe alone, but we tend to focus on the 50-100 that are that are a good editorial fit, and ideally paying proper flat license fees or some other forms of reasonable returns (minimum guarantee / rev share).

-

Tier 4: AVOD/FAST Channels abroad

More AVOD/FAST channels are proliferating from mainstream to niche, including not only via global SmartTV platforms and studio-backed groups, but also those launched by big IP owners.

- Of more interest for indies, these are curated channels focused on buying movies, docs, shorts, and niche genre films.

- In 2024, more are expanding through UK and Europe (which can be the subject of a future update to my last blog on FAST/AVOD) but that is not the subject of this article, as they are usually rev share based for volume deals on older titles, and not buying individual titles from U.S. indies (with some exceptions).

Luckily, the practical advice, tips and takeaways set forth in the earlier articles – on how to approach licensing, monetization, windowing—still apply today, and I’ve repeated them at the very end of this article, just with more layers to take into consideration, methodically. But first let’s step back and summarize the changes in the market, film buying platforms, and business models since the last blog, and also table some new platforms for you to consider. Other info and platforms are in the Digital Distribution Guide.

B) CHANGES IN THE SECTOR

1) Business Models, Rights, Windows:

- Earlier COVID innovations in TVOD (such as Premium VOD, Festivals Online/Hybrid) did continue to some extent, and in some cases are still ongoing, but Virtual Cinema has largely phased out.

- AVOD vs FAST

- In brief, FAST is exhibition on Free, Ad-supported Streaming TV (usually SmartTVs/OTT devices), and programs are scheduled linearly, supported by ad revenue share, but not viewed “on demand,” (unless coupled with AVOD rights/capability).

If a FAST platform asks FAST rights from you for a rev share, look to see if it also offers its viewers fast forward and rewind capabilities, as that is more properly an AVOD right (on demand) and indies, where possible, should strive to be paid for both rights, from the viewpoint of monetization/dealmaking, instead of lumping them together.

- SVOD with Ad-supported tiers:

- Some services, such as Netflix, Disney+, and now Sky Showtime, offer SVOD at various priced tiers: one ad-free subscription, and then other cheaper subscriptions with ads.

- This is not to be confused with regular AVOD rights or windows (like YouTube) where viewers watch free and on-demand without any subscription, while filmmakers share in ad revenues.

Indies should be alert when dealmaking that they are still within an SVOD window/right. Watch out for holdbacks against AVOD/FAST, if applicable.

2) PLATFORM changes – and other new buyers

A) TIER 1 TYPES

All are increasingly focused (in EU markets) on content produced/co-produced originally from EU, due to quotas (formal and informal), and regulatory, political, and cultural pressures. This means they have relatively less bandwidth operationally in 2024 for volumes of pure U.S. indie material, after factoring in their inventory and pipeline of MPA studio output deals, deals with local distributors, and local EU indies; however, there is still some room.

-

- Added linear version experiments (e.g. in France) but has not yet added FAST.

- Added an ad-supported tier (not AVOD) in some regions and cracked down on password sharing to enhance revenues.

- Initially stepped up indie feature film buying and Netflix Originals in 2021 (but reduced in 2023, along with sad layoffs in the higher end art/indie feature film and docs staffing)

- Started limited theatrical distribution, finally open to occasional theatrical prior window (limited and selective) but is still mainly an SVOD first-run service.

- Stepped up licensing its own Netflix Originals to third-party competitors/networks. (Some other streamers (MAX, Viaplay) have followed this move)

- Moved into other genres/formats (gaming, interactive experimentation), then more steadily moved into mainstream reality, true crime, and an increased emphasis on foreign (non-US) indie series and film to support its expansion abroad.

- Diminished Africa content focus (after initial push) to concentrate more on EU.

As of 2023-4, not always a one-stop-shop for global-style big $ license deals, increasingly buying for specific (e.g. English Language) regions. This can be a double-edged sword, and as per the prior blog, one must balance the desire for ease/single deal with monetization, audience, marketing, data etc. and producer goals (impact? revenues? future pipeline?).

- Also, a deal that is US-only Netflix can limit the attractiveness for buyers from other competing platforms (in some cases) where they want more key regions, while tier 2/3 players can consider it an asset.

-

- IMDB.tv renamed its AVOD service “Freevee”, in U.S. and UK, but is not yet across EU.

Licensing to Freevee still allows multiple other AVOD licenses, also abroad, however ensure the SVOD route has been canvassed first, to not accidentally cut out the prior window for Prime or other competing SVODs (subject to a compelling deal as in some cases as in the prior blog AVOD can be a bigger revenue generator than small SVODs. Again, depends on goals of filmmaker).

- Prime Video Direct dropped self-upload capability for docs and shorts, except for TVOD/EST

- Still buying indie films selectively, with room for a limited theatrical window

- Increased carriage of other SVOD’s (including niche thematics) on its platform via add-ons internationally

This means a deal an indie may have done earlier with a specific SVOD (for example with Docubay), can end up on Amazon Prime, where it is carried to wider audiences. This can create more reach, but not necessarily more money, depending on the type of deal struck (consider implications if the deal is rev share vs. flat fee, or with “bump-ups,” for example).

-

HBOMAX / WBD / Discovery+ / MAX

- Wildly expanded then contracted in the past few years, via mergers (WarnerBrosDiscovery), rebrands, and various re-orgs, including the bloodbath in the indie doc/feature buying and funding sector, both in the U.S. and EU.

- Just launched MAX domestically (wiping out the beloved HBO brand) and rolling out to more regions in EU and international markets through summer 2024-26.

Buying indie films and/or docs can happen out of U.S. HQ and sometimes via separate buyers still in the international regions (CEE, Benelux, Nordic). It’s not a fully consolidated picture yet, don’t give up, particularly if your theme translates culturally abroad.

- Discovery+ Service (different programming) continues, replacing d-play as OTT SVOD in UK/IE, Germany, Austria, Italy, Brazil, Canada, Netherlands, Nordics, India, Spain

-

- DISNEY+ expanded wider within Americas, EMEA, Indo-Pacific regions but still no separate Hulu brand site in Europe. Programming is subsumed selectively within the broader Disney+ umbrella and STAR sites.

B) TIER 2 TYPES

-

- Viaplay had been at its high-point in recent years; very attractive to indies (including U.S. indies) for buying and funding, as it was rolling out and spreading in regions beyond Nordic and Benelux, to CEE (Central and Eastern Europe, GAS, UK, and N. America. It was also heavily funding or coproducing 80+ Viaplay Originals per year and buying (mainly series but some English/American and local indie films and high profile docs)

- However, last year Viaplay widely contracted; shutting down expansion, closing most regions, shutting down projects in development/production stages, staff reorgs, and overall changing focus.

- NOTE: Today, it still remains a Tier 2 competitor in Nordic, (buying and funding mainly locally) and a complementary service in Benelux (local and sports emphasis).

- But in North America, Viaplay has become more of a Tier 3 thematic/niche (“Best of Nordics”) SVOD called Viaplay Select, and is carried as an add-on, such as via Amazon.

This means U.S. indies selling film/docs should approach Nordic HQ, rather than the U.S./Canada service.

-

- This Paramount/Comcast JV launched in 22+ EU regions (those that are not UK, Italy, or Germany, so as not to compete with sister company SKY).

- Initially began with its own well-stocked catalogs from JV partners, (NBCU, Peacock, Paramount, Showtime, etc., so it was not buying from indies

- More recently started acquiring series and films from select higher-end indies, albeit either more commercial in nature or increasingly from EU sources (however, still buying very limited docs), sometimes buying for all regions, other times purely local flavor.

- Current emphasis is EU titles (Originals and acquisitions) for EU, but high-profile English buying can selectively come via UK office.

- In April 2024, just began an ad supported SVOD tier as well.

-

CANAL+ / Canal+ International / Canal+ Group

- After initial contractions a few years ago (including their shut down of SVOD and other VOD operations in favor of their core Pay-TV business channels), fast forward to 2024, they’ve since wildly expanded:

- As a Group, they currently reach 50+ countries in Africa, France, Benelux, (including in 2024 a dedicated local Canal+ in Holland), CEE, Asia Pacific, Caribbean, Indian Ocean. These channels/services are alongside their other corporately owned channels, such as Film1 in Netherlands and related basic SPI channels (FilmBox and FilmBox Arthouse).

- They started a new dedicated Canal+ Docs channel, rolled out their Canal+ Series OTT and other thematics (C+ Horreur) and also have a “StudioCanal Presents” art house SVOD via their StudioCanal arm.

- Recent corporate acquisitions which affect your sales include:

- Takeover/merger of Orange Telecom’s OCS (Orange Cinema Series) SVOD, which was formerly a separate buyer and funder for mainstream and indie film, and now is subsumed operationally within Canal+ Group.

Thus, buying of films/series and docs will go via Canal+ group buyers and/or SPI buyers in CEE.

- April 2024, corporate buyout underway with Multichoice Africa (affecting, among others, indie film channel buyers and programming from M-Net Movies and Showmax channels and SVOD’s).

Buyers are still in place in Multichoice group channels but may be impacted by the Canal+ broader group (more on this below).

- Dutch Filmworks (local distributor in Benelux and sales agent) is now in a merged cooperation/integration with Studio Canal.

- SPI International (thematic pay and basic channels like Film1, FilmBox, FilmBox Arthouse, Docustream, Filmstream etc. as per the last blogs)

-

Vodafone/Ziggo’s “MOVIES and SERIES” SVOD

- Sadly, Ziggo is no longer buying individually from international/US indies. Their SVOD is now superseded by carriage of Sky Showtime streamer, as of 2024, and other carriage deals like Viaplay etc. (so indies lost another Tier 2 competitor buyer).

One would now go to Sky Showtime buyers (UK, NL (Netherlands), or other region-specific) in order to be seen on VodafoneZiggo, along with the potential 20+ other regions.

-

MNET / Showmax / Multichoice Group

- Since 2023 various buyers from MNET South Africa (mainstream pay/SVOD) and Showmax (African themed OTT service) left the Group, some for Tier 1 streamers.

- MNET/Showmax also announced a cooperation with Sky/NBCU/Comcast groups re a joint streaming approach to production and service offerings in Africa.

- Now, due to April 2024 merger with Canal+ International, buying is being consolidated further (and at time of writing, indie one-off buying appears frozen for the moment).

-

- Spain, Portugal Pay-TV, TVOD, and SVOD buyer and Originals funder, usually mainstream/commercial and local fare, but appetite for Spanish/Portuguese language indie content as well.

- Occasionally they still buy from indie sources including U.S. (such as a non-current SXSW Audience Award winning feature drama)

-

- Channel 4 rebranded its All4/4oD in UK, consolidating digital and traditional all into one place; “4.” Still tbuying and sometimes funding indie film and docs on a flat-fee basis generally but more heavily still emphasizing series and UK creators, with some exceptions.

- And Channel 4’s AVOD/SVOD for foreign (non-UK) series, Walter Presents, expanded to more regions (including as Walter’s Choice in U.S.). Walter Presents is only buying, not funding.

-

- Added BINGE SVOD and FOXTEL DOCOS channels (100% docs). Usually flat fee deals.

C) TIER 3 TYPES – Changes and new buyers

Although some of the earlier indie film and doc services profiled in my last blog sadly fell away, others have stabilized, morphed, and matured, and new services have also launched. CAVEATS: This list and the DDG is NOT exhaustive, but an illustrative snapshot at this time. To help bring it down to earth, I’ve focused only on services that have done a deal with a niche indie/doc filmmaker from the U.S. in the recent past.

As before, most deals are non-exclusive, which allows you to ripple the film to genre competitors as well. For example, if dealing with a horror site such as Shudder, one can explore the other various competitors in horror; if dealing in art house, e.g. MUBI or Filmin, one can explore deals with 10 others, and similarly with documentary and niche/micro niche sites.

I can’t stress enough the necessity to matchmake the film to the platform. For example, if looking at 10 docs sites for your film, go deeper into the programming; is the character of the site you are about to pitch millennial/reality docs, fast paced (e.g. like an Insight.tv) or educational/tv/science type docs (e.g. like a Curiosity Stream) or character-driven features (e.g. like a Docsville)? Can you identify or reference films already on their site that are comparable, so that when crafting your pitch you help the programmer/buyer see the fit?

In terms of business models, all of the below are still SVOD buyers, not funders (unless specified).

I first list some key indie movie sites which also buy different formats and genres (e.g. docs, shorts). I then list some niche, genre specific sites (e.g. docs only, horror only, shorts only); refer to the DDG for more.

i) INDIE MOVIE SITES

-

MUBI • Art house—around for more than a decade—is now global and has moved additionally into limited theatrical high-end acquisitions/distribution as well as adding more library titles (MUBI Releasing, MUBI Collections). Generally, a high-quality editorial prestige site, but not historically known to be the best paying site for indie filmmakers licensing titles, (with some key high-profile exceptions). Not funding.

-

FILMIN • Spain and Portugal SVOD, no longer buying for Mexico. Also going strong for more than a decade, lovely curation, with a wide catalog across different regions of sourcing and different genres. Often buying from North American indies (not just world cinema or European), in both features and docs, current and library titles. Sometimes flat fee, other times MG plus rev share, also connected to festival and theatrical in the region. Occasional Originals/funding (but not with U.S. indies).

-

SOONER • The former niche art house sites UnCut and Universcine consolidated/became SOONER SVOD in Benelux and GAS regions (and the parent group is still continuing as Universcine for VOD/SVOD in France). Buys films, indie series, and shorts from abroad as well, but with smaller flat fee or rev share.

-

FILMO (formerly FilmoTV) • Rebranded to FILMO and comprises TVOD/SVOD art house/France region (originally via its founder Wild Bunch sales agent, with similar calibre films, no series). Flat fee or rev share/MG. Wildbunch also started a related AVOD/FAST called Wild Side TV for older library titles of that genre.

-

SBS / SBS On Demand / SBS World Movies • networks (Australia): World Movies was first SVOD/PAY but now changed to AVOD and free tv, like SBS network with flat fee deals. They still focus on films, and some docs, from outside Australia (emphasis on world cinema, diversity themed). Flat fee.

-

Starz Play Arabia • As part of the severe contractions and shutdowns in former Starz International and Lionsgate+ SVODs, MENA (Middle East and North Africa) region still remains and thrives, thus if your film or doc deals with MENA, they can still be a buyer. Flat fee. Their mainstream competitors include SHAHID.

-

Rakuten TV • Mainstream and niches. Since last blog, it changed its TVOD/SVOD business model and programming emphasis across 40+ EU regions, to be almost entirely AVOD/FAST channels (rev share mainly, or sometimes MG). They are still selectively buying, including from U.S. indies, but one-off titles are not favored against packages or thematics. Occasional funding (Originals) but not U.S.-sourced, rather EU and mainstream.

…and some NEWER INDIE MOVIE SITES (not in the last blog)

-

Rialto • (NZ) – Indie film tv channel and also SVOD in NZ, Australia, Japan. Flat fee.

-

Studio Canal Presents and MK2 Curiosity • These two unrelated newer sites are each art house SVODs in France but generally for films they’ve picked up for distribution,with very limited third party licensing.

-

Highball TV • Acquires indies films and docs for SVOD and sometimes other models. Programmed by a former longtime TIFF festival programming head. Curation criteria are basically films that played in festivals, but with monetization (even though it is an SVOD) mainly on a rev share basis.

ii) DOCUMENTARY (100%) SITES

-

Curiosity Stream • A global SVOD founded by original Discovery founder. This mainstream SVOD is across 200 countries, and has since added an AVOD/FAST business model (Curiosity Now) to SVOD Curiosity, and has also continued to fund Originals selectively. Flat fee deals. In 2023-24, buyers changed frequently, however, and acquisitions were more limited as of time of writing, hopefully opening up later this summer.

-

Docsville • SVOD of curated and character-driven docs. After being dormant a few years since the time of last blog, was recently reborn, and is now actively curating and buying (after the corporate investment by Lightning International (Asia) last year). Now they seek global rights, not just in UK; however, sadly, switched generally to a rev share model for SVOD/AVOD/FAST. They also have Docsville Studios for Originals/funding.

-

Docubay • (India, SVOD, linear) They’ve added linear (a sort of FAST but without ads/monetization!) to their rights “ask” in acquisitions, but disappointingly moved from earlier higher flat fees to rev share or lower flat fees. They ask now for more regions (global or at least English abroad) and the service is often carried on other platforms like Amazon as an add on. They frequently buy from U.S. indies, but preferably in volume packages via distributors (or sometimes via producers joining together in a common deal).

-

Insight.tv • (SVOD/Pay-tv, linear, FAST/AVOD) Global, UHD (Ultra High Definition) offerings (linear) but also SVOD, AVOD/FAST channels globally. Flat fee deals, and fund Originals and coproductions. Completely different style, i.e. commercial and very fast paced nonfiction/reality/lifestyle/ and increasingly mainly series, but some one-off feature doc buying is possible.

And some NEWER DOC SITES (not in prior blog):

-

GuideDoc • (Spain) Curated site with flexible deal terms (contract posted on their website, transparent), multi region and avid docs buyer from makers abroad and in EMEA (but can carve out regions). Rev share.

-

DocPlay • (Australia) A platform run by Madman Entertainment (the local Oz distributor), they show films in their own catalog of course, but also acquire various from third parties and international markets (including U.S.) not represented by Madman. Usually licensed on a flat fee basis for the Docplay platform.

-

Tënk • (Docs-only SVOD) Expanded beyond France roots to Quebec and English Canada. However, although highly reputed in editorial quality it is still very low “rev share” or flat-fee monetization.

iii) Some NICHE OR MICRONICHE AUDIENCE SITES

-

Shudder • Horror leader, expanded its SVOD regions to UK/IE, U.S., Canada, Australia, New Zealand, and some other EU. Occasionally still funding Originals.

Keep in mind in nonexclusive deals can also be suitable for other competitors in the sector such as Planet Horror, Cine+ Horreur, Screambox, etc., and this approach applies to all Tier3 niches and genres. As above, look not only at the more known sites but also its competitor buyers.

-

Britbox • Although Britbox is still available in the rest of the world, this “Best of British” site, as of April 2024, has ceased in the UK and its content there is now rolled into ITVX Premium (SVOD) (now owned by BBC). It still continues internationally, in North America, Australia, South Africa, and Nordic region (Sweden, Denmark, Finland, Norway). The opportunities for indies are more for licensing works that were co-produced with or connected to the UK. Flat fee.

-

Acorn TV • SVOD, also a “Best of British/Colonies” thematic, lately more series than film, expanded so it can buy for U.S., Canada, UK, Latin America, Spain, Australia, New Zealand, and the Nordics. But has since pulled back from other regions like the Netherlands and South Africa. Flat fee.

-

Shorts.tv • (Shorts) Market leader in shorts licensing. Flat fee. Pay-TV, TV, SVOD, including Oscar shorts. Multi-region.

-

discover.film • (Shorts) SVOD/AVOD buyer, aimed more at B2B travel sites and exploitation. Rev share.

-

Out.TV and OUTTV • (LGBTQ+) Despite having similar names, these are two unrelated/different sites. They are the main European- and Canadian-based services who compete against each other in LGBTQ+ content for SVOD/AVOD/FAST across different regions. They pay flat fees, and sometimes fund Originals. They also have multiple other competitors in the space.

iv) Other

Note there are many other international micro-niche sites (SVOD and also AVOD/FAST) that you can sell to non-exclusively, each of which have multiple competitors around the world, such as kids (Hopster), wildlife (Love Nature), expats/diaspora (Afroland, Zee TV, and their many competitors), lifestyle, performing arts (Marquee.tv), dance, millennials/nonfiction reality (Insight.tv), hobbies, and series

C) Stepping Back: Considerations and Takeaways

1) Considerations

- Platforms’ tastes, needs, and appetites (and competitive positioning) are always changing.

- So, on the plus side, even if a title is rejected now, one can circle back 6 months later (if the rejection reason was more that the platform was overstocked in a category or bad budget timing).

- But obviously do not circle back if they rejected the film because they didn’t like it/ it’s not suitable for them.

- Your film benefits most overseas if it travels well culturally, has strong acclaim, or is particularly topical and/or has other marketable appeal.

- Language is very relevant but does not have to be a barrier:

- English OV films generally travel easiest first to other English regions/sites (Canada, UK, IE, AU, NZ, South Africa).

- Then next easiest, is subtitling-friendly regions (like Nordic, Benelux) as well as the pure cinephile arthouse and documentary sites (where audiences are accustomed to subtitles).

- In other regions such as Germany, Italy, Portugal, Spain, and Brazil, dubbing requirements have to be factored in. That said, if you have a few potentially interested platforms in one region/language, it is easier to assess the value of dubbing costs. No need to do so in advance.

- Politically: U.S. films are, frankly, not at the top of some EU platform priorities at the moment – so be realistic in your expectations.

- For example, EU platforms now have content country of origin quotas (official and unofficial) to balance, ranging from 20-50% in practice.

- This means after a platform has 1) bought its MPAA (Motion Picture Association of America) studio, major output deals (if applicable), 2) bought from its own EU or local minimajor and indie distributors, and 3) bought its own direct local indie filmmakers, then and only then can they have room for ad hoc cherrypicked U.S. indie sector films.

2) Takeaways

As before, our basic rules have not changed:

- Act quickly and work collaboratively (filmmakers + agents/distributors) to seize timing opportunities.

- Balance traditional and digital to best capture cumulative and incremental revs in the non-exclusive deal sector, while also developing a longer-term platform pipeline.

- Be aware many platform buyers rarely attend markets/festivals and instead work virtually (even pre COVID-19, as I did) to better allocate their leaner budgets towards programming spend, rather than markets.

- Don’t stop at just one deal unless exclusivity or funding elements are in play and worth it.

- Don’t be blocked per se by rights issues. Pragmatic business deals where others are “cut in” can help make those melt away.

- Consider hybrid distribution; traditional and digital specialists sharing the job for maximum bang for your buck. “100% of Zero is still Zero.”

- After the deal is done, help audiences know where to find your film!

I look forward to seeing more of your films and docs here and in other parts of the world!

—Wendy Bernfeld, Rights Stuff • @wbernfeld

David Averbach May 15th, 2024

Posted In: Uncategorized

TFC’s Distribution Days is upon us!

Next week, The Film Collaborative is holding a free virtual distribution conference, Distribution Days, which will offer concrete takeaways on the state of indie distribution and how filmmakers can navigate it. Attendees will hear from exhibitors, distributors, consultants, and filmmakers, some with case studies, as they describe and reflect on the landscape.

This conference hopes to help filmmakers develop critical thinking skills around distribution by looking at what is and what is not viable within a traditional distribution framework. It will also offer some alternative approaches. Willful blindness or a doomsday mindset are equally unproductive.

So, we are offering this pre-conference primer to set the tone, take stock of what myths are out there, and talk about what thought leaders in this space are coming up with as ways to deal with the current landscape.

Here we go!

Remember the days when creators and distributors were lying back in their easy chairs, proclaiming their satisfaction with how independent cinema has been evaluated by the marketplace? Yeah, we don’t either…and we’ve been in the industry (in the U.S.) for more than two decades. Nevertheless, there is a pervading sense that the state of independent film has never been worse—and that we’ve been going downhill from this mythic “better place” ever since Sundance was founded in 1978.

Why do we insist on bemoaning a Paradise Lost when the truth is that being a filmmaker has never been a paradise? Filmmakers have always been confronted with predatory distributors, dense and confusing contract language, onerous term lengths, noncollaborative partners, lack of transparency, and anemic support, if any (just to name a few). For an industry that prides itself on creating and shaping stories that speak to diverse audiences, we should be better at articulating truer narratives about our field.

It doesn’t help that, at Sundance this past year, all one could talk about was how streamers were “less interested in independent film than a few years ago, preferring [instead] to fund movie production internally or lean on movies that they’ve licensed” and how Sundance itself was “financially struggling, presenting fewer films than in previous years and using fewer venues.” (https://www.thewrap.com/sundance-indie-film-struggles-working-business-model) Still others like Megan Gilbride and Rebecca Green in their Dear Producer blog have put forth ideas how Sundance should be reinvented completely.

But we all know that independent film isn’t just about Sundance. We have heard a lot of discussion recently about the need to reshape the narratives we tell ourselves regarding the state of the independent film industry.

Distribution Advocates, which is also doing great work chasing the myths vs. the realities of the field, also believes that we must all question “some of our deepest-held beliefs about how independent films get made and released, and who profits from them.”

In their podcast episode about Exhibition, economist Matt Stoller remarked how “weird” it is that even with all the technology we possess connect audiences, we’re still so “atomized” that all that rises to the top is whatever appears in the algorithm Netflix chooses for us in the first few lines of key art when we log in (and we will note that even the version of the key art you see is itself based on an algorithm).

But is it really all that strange? One of the main reasons that myths exist is that someone is profiting from perpetuating them. The same with networks and platforms and algorithms. And the more layers of middlemen and gatekeepers there are, the harder it is for us to see the forest for the trees. Keeping us in our algorithmically determined silos numbs us into not minding (actually preferring) that we are watching things—or bingeing things—from the safety and comfort of our living rooms. The ability to discover on our own content that aligns with our true interests or consuming content in a communal space has disappeared the same way that the act of handwriting has…we used to be able to do it but haven’t done it in so long that it feels unnatural and too time-consuming to deal with.

Brian Newman / Sub-Genre Media acknowledges that the problems remain real, but that what everyone is calling crisis levels seems to him merely a return to norms that were in place before the bubble burst. No one, he says, is coming to rescue “independent film”—certainly not the streaming platforms, which merely used it as necessary to build a consumer base.

Many have posited myriad ideas about how to bypass the gatekeepers. Newman echoed what TFC has been recently discussion internally: that instead of many competing ideas, we need them to be merged into one bigger idea/solution. Like, for example, an overarching solution layer run by a nonprofit on top of each public exhibition avenue that will aggregate data and help filmmakers connect audiences to their content. A similar idea was also discussed at the last meeting of the Filmmaker Distribution Collective in the context of getting audiences into theaters.

By exclaiming that “No one is coming to the rescue,” Brian really means that we are all in this together, and that it’s going to take a village.

We agree, but a finer point needs to be made.

Every choice we make moving forward—whether you are a filmmaker, distributor, theater owner, or festival programmer, what have you—could possibly be distilled into either a decision for the independent filmmaking public good…or for one’s own professional interest. Saying that a non-profit should come in and offer a solution layer to aggregate data is all well and good until it threatens to put out of business someone whose livelihood is based on acquiring and trafficking in that data. How refreshing was it to be reminded at Getting Real by Mads K. Mikkelsen of CPH:DOX that his festival has no World Premiere requirements? It reminds us of the horrible posturing and gatekeeping film festivals do in the name of remaining relevant and innovative. For us to truly grow out of the predicament we are in, some of us are going to have to voluntarily release some of the controls to which we are so tightly clutching.

Keri Putnam & Barbara Twist have an excellent presentation on the progress of a dataset they are putting together of who is watching documentaries from 2017 – 2022. They provide some other data that was very sobering:

Film festivals: comparing 2019 numbers to 2023 – there was a 40% drop in attendance;

Theatrical: most docs are not released in theaters and attendance is down even for those that are released.

But they also note that there is really great work being done in the non-theatrical space— community centers, museums, libraries – that is not tracked by data. TFC’s Distribution Days offers two sessions on event theatrical and impact distribution, so we’ll be able to see a tiny bit of that data during the conference.

We also know that the educational market is still healthy, and that so many have remarked of the importance of getting young people interested in film…so we have three sessions where we hear from the Acquisitions Directors of 11 different educational distributors.

We also have a panel from folks in the EU who will provide advice on the landscape and how best to exploit films internationally and carve our rights and territories per partner. And we’ll speak to all-rights distributors about what kinds of films they see doing well, what they are doing to support filmmakers—and what their value proposition is in this marketplace.

We have a great panel on accessibility, and two others that relate to festivals and legal agreements.

Starting off with a keynote from noted distribution consultant and impact strategist Mia Bruno, the 2-day conference aims to summarize the state of the industry while providing thought provoking conversations to inspire disruption, facilitate effective collaboration, and to aid broken hearts.

Regardless of whether current days are better or worse than the heydays of Sundance and the independent film of yesteryear, Distribution Days will identify the current obstacles of the independent film distribution landscape, and what we can hold on to—as a commonality—to evolve the landscape together in the future.

If you look a little deeper, you will see that, despite all the challenges, filmmakers have and can still achieve “success” when they understand the terrain, (sometimes) work with multiple partners with a bifurcated strategy, protect themselves contractually, and maintain and grow their own personal audience.

We hope you will join us. And for those of you that cannot make all of the sessions we are offering live on May 2 & 3, you’ll be able to catch up on what you missed via The Film Collaborative website after the conference is over.

We look forward to seeing you next week! And if you have not registered yet, you can do so for free at this link.

David Averbach April 25th, 2024

Posted In: case studies, Digital Distribution, Distribution, Distribution Platforms, DIY, Documentaries, education, Film Festivals, International Sales, Legal, Marketing, Theatrical

All About AVOD? part 1: What To Do with Your Library Title

by David Averbach and Orly Ravid

One of the joys of working at The Film Collaborative is our extended filmmaker family. Some of the filmmakers we work with we have known for decades, back to when they made their first films. Inevitably, after seven-, ten-, or twelve-year terms, many of these filmmakers are getting their rights back from the distributors with whom they originally entered distribution deals.

They often ask us, “What is possible for my film now? What can I do to give it a second life?”

(We should state that the vast majority of these filmmakers do not have obviously commercial projects that could simply be offered to a different large streaming service like Netflix or Hulu. They are the type of films that TFC handles: solid films with good or at least decent festival pedigrees and proper distribution at the time of their initial release.)

Unfortunately, there is no one answer for every film. Nor is there a fixed answer for each type of film, as platforms’ needs can change at the drop of a hat. Except that all platforms seem to have an endless appetite for true crime docs, but we digress…

So, this blog article is less of a “how to” for library titles, and more of a “how to think” about them.

Certainly, there are non-exclusive subscription-based (SVOD) platforms that align with various content areas, such as Documentary+, Topic, Wondrium, Curiosity Stream, Coda, Qello, Tastemade, Gaia, Revry, and many more (check out our Digital Distribution Guide for more info). These are platforms that offer a revenue share based on minutes watched. Since they may have not been in existence when the filmmakers’ original distribution deals were arranged, they are definitely worth exploring when one (or more) of them is a fit for your project.

But there are also ad-supported (AVOD) platforms1, which are free to the end user and rely on commercials that play before the film starts. Generally speaking, AVOD platforms seem to be more lucrative in terms of revenue than specialized SVOD platforms, and we’ve heard that some films are making “real” money them (more on that later). While there’s no guarantee that AVOD platforms will bring in more money than SVOD platforms, or much money at all, this at least makes sense, anecdotally: with the rise in commercial streaming services and especially since the start of the pandemic, folks are watching increasingly more content, but actually spending less above and beyond the Netflix/Amazon Prime/HBO/Disney etc. combination of platforms that they have ostensibly come to view as basic utilities.2 So AVOD provides a win-win for platforms and consumers alike.

Until recently, filmmakers have been somewhat reluctant to place their films on AVOD platforms, but they are coming to realize what distributors have known for a few years now—that AVOD can continue to bring in revenue when transactional platforms such as iTunes are no longer performing for a film the way they might have at the beginning of their digital run.

So, we set out to ask what we believed was a simple question: which AVOD platforms are taking which type of library content? The Film Collaborative has some limited experience with AVOD platforms, but we felt it prudent to talk to some folks that do this day in and day out. To that end, we reached out to Nick Savva, Vice President of Content Distribution at Giant Pictures, and Tristan Gregson, Director of Licensing & Distribution at BitMAX.

The answer turns out to be a complicated one. Here’s why:

Most AVOD platforms are looking for all kinds of content. One of the trends that has been occurring for the past few years is the addition of new platforms, not just in the U.S., but globally. And the pandemic has accelerated existing trends, so there are even more new platforms than ever. These platforms are not going to be able to produce or acquire enough new content to justify their existence, so they rely on library titles as much as they do new releases. So, the good news is that there are more outlets and revenue opportunities for library titles than ever.

The not-so-great news is that sometimes AVOD platforms are actually looking for specific types of films, but only for a limited time to fill a specific need. Platforms have a good sense of what percentage of their films are, for example, comedies, dramas, thrillers, horror, documentaries, true crime, etc. When they look at who is watching what, if comedies are overperforming on the platform relative to the percentage of titles they occupy overall, the platform may not take as many comedies for a while until that changes, or they could decide to double down and take more comedies at the expense of other types of films. Conversely, if there is a category that is underperforming, they could decide that they need some fresh meat in that category, or simply decide to take less of it.3

So why exactly is this bad news? Because as the needs of AVOD platforms ebb and flow, the entities with the best chance of succeeding are those that can respond quickly to calls from these platforms for specific content. A high percentage of the work Giant Pictures does with AVOD platforms involves their distributor clients, who use Giant as a sort of white label service. Giant is tasked with placing their content libraries on these platforms because these distributors don’t have the bandwidth to keep up with which platforms want what from month to month. Similarly, BitMAX works with many studios to deliver to these platforms, but the studios are the ones handling the licensing. What this means is that the bulk of content going to AVOD platforms is coming from the content libraries of studios and distributors. That is not to say that films from individual filmmakers aren’t being placed on AVOD platforms by Giant/BitMAX, it’s just that studios and distributors are their go-to sources for content because they can provide a bunch of titles with a quick turnaround.

The sad reality here is that AVOD is one area of distribution where middlemen are being added to the mix in a way that makes it harder for individual filmmakers to take back control of their films.

Many of the filmmakers who have just gotten their rights back often remark to us how glad they are to have done so, as if they are finally getting out of a bad marriage. Even if the relationship wasn’t such a badmarriage, this sentiment—justified or not—perhaps stems from the fact that their TVOD sales had dropped over the years and they felt like their distributor was no longer doing anything for their film, or that they were tired of not receiving reporting because there were long periods of time with no earnings. The last thing they appear to want to do is start up a new relationship with a new distributor or aggregator and incur more encoding costs for a shot in the dark in terms of being accepted by these platforms only to earn $12 a quarter in earnings.

It’s important to really have a look at the reporting your old distributor provided you. There’s a good chance that simply re-creating what your old distributor did—perhaps your film was already on AVOD platforms—is going to give you a completely different outcome. But to the extent that your project has not been tested in the current landscape, what should a filmmaker be thinking about if they find themselves in the position of deciding whether to go it alone or offer their film to another distributor?

It’s Your Time and Money

Bandwidth:

Tristan Gregson remarked that the same rules apply for library titles as when just starting out, and his stance was the following: if you know how to engage your audience then put it somewhere. If not, then don’t. Whether you try to go it on your own or partner with another distributor, unless there is someone that’s going to remind your audience that it’s there, there’s a good chance your film will sit unnoticed in a glut of content. This is going to take some effort and while a new distributor might do a bit of marketing, you are going to have to get creative. Perhaps time the re-release of this older film with a new project of yours?

Cost:

If you go through an aggregator like BitMAX, you are probably looking at a bare minimum of $2,000 for encoding, QC, and delivery and to pitch and deliver to a few SVOD or AVOD platforms. It’s a fee for service, so they will be hands off when it comes to strategy, and uninvolved when it comes to your earnings. If a distributor like Giant Pictures is willing to work with you, it can cost twice that much, but they will be real partners in the sense that they will be proactive in helping you come up with a strategy. They will also take a certain percentage of your earnings. You may also be able to negotiate lower encoding costs in exchange for an increased percentage of your earnings.

What is in it for the Platform?

Metrics:

Nick Savva advises filmmakers to think about your film like a platform would: what are your film’s metrics? These scores can tell a lot about the public’s level of familiarity with your film, and there are data tracking services that distributors and platforms use to determine them. Also among the first things that an acquisitions team would look at would be indications of basic audience awareness, such as the of the number of positive reviews on Amazon, or the ratings on IMDb. If the metrics are good, a deal might be attractive to a platform. Are there any recent reviews? In other words, does your film still hold up?

Is there one Platform that is better for my film than others?

Honestly, there are not all that many AVOD platforms in the U.S. Tubi, Pluto, Roku, Peacock, IMDb TV, and a few others. The good thing about AVOD is that most deals are non-exclusive, meaning that you can be on more than one at once. But should you apply for all of them? How does one decide?

Signal Boost:

The following might not be possible for every film, but, if possible, try to think about the likely television habits of your audience and the specifics of each platform and take advantage of the free signal boost.

People are very familiar with platforms like Netflix and Hulu, but when it comes to platforms like Tubi or Pluto, why would one choose to watch one over the other? The answer might be simpler than you would think!

Does your film have a TV star in it? If they are on the FOX network, chances are that audiences will see ads for Tubi, because Fox is the parent company of Tubi. If they are on NBC, then perhaps Peacock or Xumo will be advertised.

There are also tricks that might apply for documentaries too. Pluto just became available in Latin America and Mexico, so films with Latinx content might want to consider that platform first.

One of The Film Collaborative’s digital distribution titles, The Green Girl, has been doing extremely well on Pluto, but not so well on Tubi or Roku, and for the longest time we couldn’t figure out why. Then it hit us: this documentary is about an actress who famously appeared on the 1960s television show Star Trek. Since Pluto is owned by Viacom, which is the parent company of Paramount, Pluto is the AVOD destination platform for Trekkies!

Keywords:

Make sure your keyword game is strong. Aggregators and distributors will ask you to fill out a metadata sheet with genres/keywords, but you must make sure the choices conform to actual categories and genres on the platforms, which can differ from one another and evolve over time. Distributors have even admitted that it’s hard for them to keep up sometimes, especially if such metadata is capture via web interface. Case in point: The Film Collaborative placed a few films we have been working with for years onto Tubi, but the keywords that we chose when we first submitted the film to our aggregator were based on iTunes genres, which are very narrow. Cut to the films getting up onto Tubi, and they were almost impossible to find without searching for their exact titles. It’s been several months, and we are still struggling, with the help of our aggregator, to get these updated on the platform. Bottom line is that it’s important to be familiar with each platform and know how one might best search for your film and be proactive to ensure that the proper information is being delivered to each platform at the time of delivery.

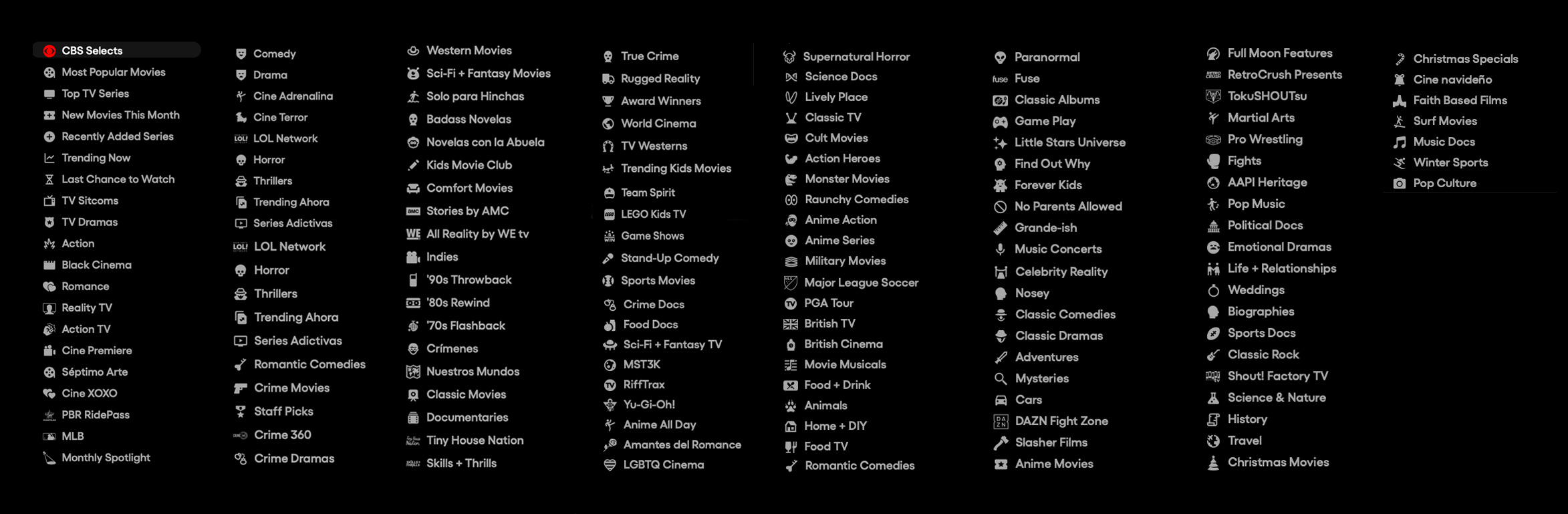

Pluto TV (owned by CBS/Viacom) offers a dizzying array of genres/categories to choose from (they appear in a vertical sidebar and seem to rearrange themselves periodically)

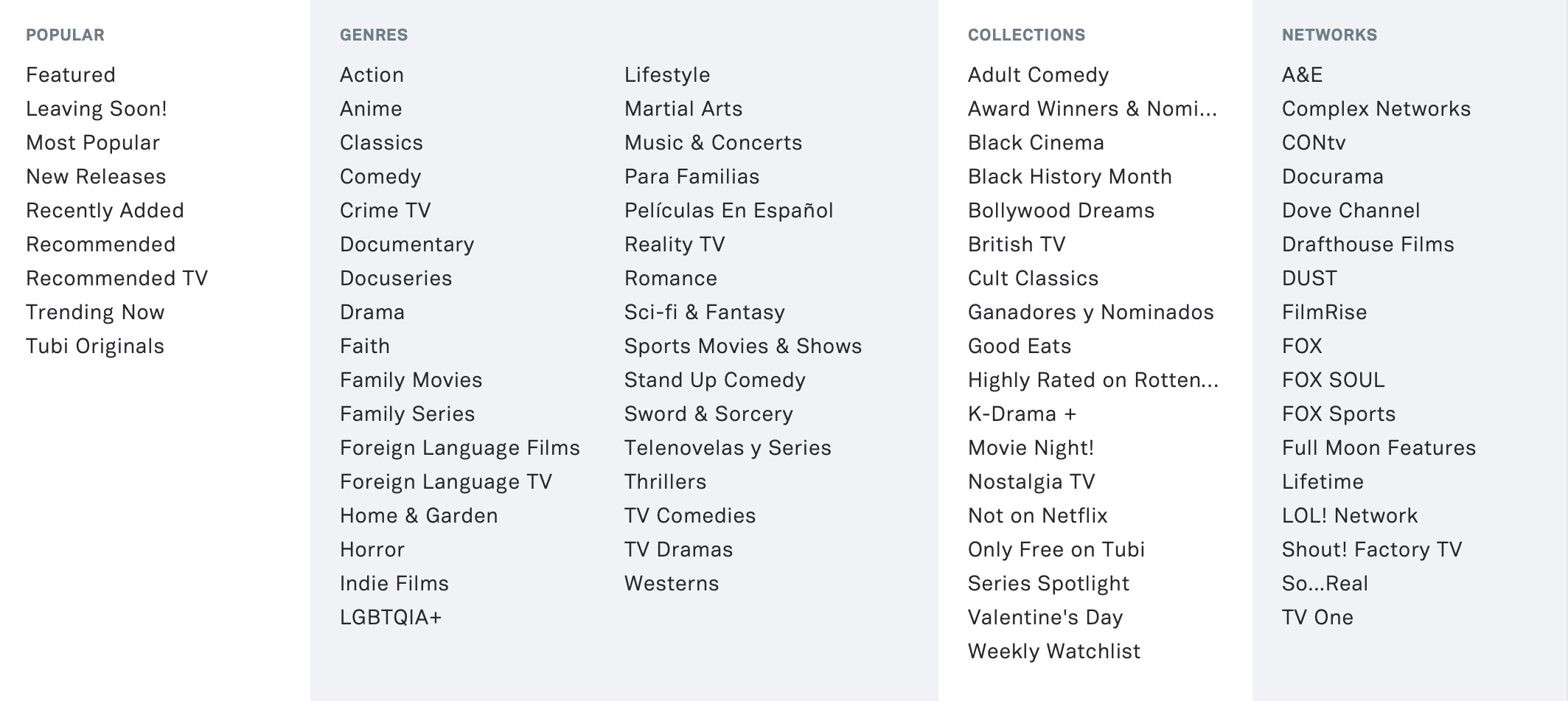

Tubi’s current “Browse” navigation tab. Tubi’s parent company is Fox Corporation.

Very Mini Library Titles Case Study

We talked to director/producer Kim Furst, whose rights to her 2014 film Flying the Feathered Edge: The Bob Hoover Project came back to her after her aggregator (Juice) declined to renew the term. She expressed that she did not want to use another aggregator like Distribber/Quiver/Bitmax/FilmHub because there was a concern that they might not be around in another 5 years. (As you probably are aware, Distribber has shuttered, and Quiver is not currently accepting films from individual filmmakers and will probably turn into something else).

So, she went with Giant Pictures.

The cost to re-encode was about $4K. While she did not feel great about having to shell out such a huge chunk of cash on a library title, Kim still felt that the film still had life in it, and she wanted to try other distribution avenues, such as public television, that she never managed to do when the film originally came out.

We should note that one of the reasons why Giant might have been interested in the film was that it is narrated by Harrison Ford. The film is about Bob Hoover, an American fighter pilot and air show aviator, and Ford has a longstanding love of flying planes. So, there is some commercial appeal that can be leveraged here.

She is at the stage where they have initiated the re-release. Right now, the film is back up on TVOD platforms, including being re-placed on Amazon, which Giant was able to accomplish despite the platform’s embargo on unsolicited non-fiction content.

We asked Kim to report back on what happens next. We suggested that she note where all of Harrison Ford’s top movies are on AVOD and take note if that platform sees any boost from the connection.

Revenue Range

With so many variables and permutations, it’s hard to give a real range in terms of what’s possible for a library title on AVOD, especially since it’s impossible to know when we are talking about the revenue of a “library” title—as opposed to that of a title that enters AVOD as part of their “new release” window.

When I asked Tristan about revenue, he acknowledged that to even talk about it would put us into “anecdotal space,” because he isn’t aware of what it took for some of his clients to earn, for example, 5 figures during an AVOD revenue period, as compared with other clients who were only able to earn, say, 3 figures. While he admitted that he has seen a single independent film title clear quite a bit, he also reiterated to me that at a certain point of revenue generation, distributors tend to get involved with a title to signal boost, so it isn’t exactly “a fair comparison to those independents working day in and day out to make a few grand on their title. But if the message is that you don’t have to be working with one of the major studios to reach seven figures in revenue, it can still very much be accomplished in this current age of VOD releasing.”

Nick spoke more specifically to AVOD, noting that they “have had a couple of indie titles which have generated $100k+ royalties in 1 month on 1 AVOD platform. But, of course, those are outliers.”

One of our filmmakers told us that they have two filmmaker friends-of-friends (whose films deal with Black Cinema content) for whom Tubi is paying well: one reported $15K a month in residuals while the other one says they are making $4-6K a month on a movie released 10 years ago. Both filmmakers allegedly went through an aggregator, but their friend said they were reluctant to allow the names of their respective films to be shared publicly.

So, as Tristan remarked, it’s best not to hold too tightly onto evidence that is merely anecdotal, because TFC certainly knows films that are making almost nothing on AVOD.

Notes:

1. As we were conceiving this article on Library titles, and realizing how important AVOD could be for an older title, Tiffany Pritchard of Filmmaker Magazine approached us about an article she and Scott Macaulay were writing about AVOD. Its title is Commercial Breaks and it is available in the January 2022 issue of the magazine (behind paywall, at least for now).

2. As a reference, this article discusses how shorter theatrical windows might be accelerating TVOD decline and shows the increase in both spending and subscription stream share from 2019 to 2021. Others, however, predict that streaming services will lose a lot of subscribers in 2022. Still, it’s hard to know how streaming services are faring, as many of them are not transparent in their total number of subscribers and average revenue per year.

3. Stephen Follows assembled a team, called VOD Clickstream, that uses clickstream data to analyze viewing patterns on Netflix between January 2016 and June 2019. He also offers a ton of information on his website. In November 2020, he presented a talk entitled, “Calculating What Types of Film and TV Content Perform Best on SVOD?”, in which he outlined how he believed Netflix navigates how popular a genre is versus what percentage of content of that genre is available on the platform.

David Averbach February 8th, 2022

Posted In: Digital Distribution, Distribution, Distribution Platforms, DIY, Documentaries, technology

Recent Blog Posts on Distribution

A review of all of our distribution-related articles of the past year or so… enjoy!

New Blockchain Distribution Platform in India

VOD Distribution in India + New Blockchain Distribution Platform/Service

Light of the Moon Case Study

SXSW Case Study Discussion – The Light of the Moon

Making Distribution Choices with Your Film

Making Distribution Choices with Your Film

Intelligent Lives Case Study

Education Market (Outcast)

Evolution of the Education Market

Blockchain Articles

Legal Issues with Blockchain Technology (Part 3 of a 3-part series on Blockchain)

Social Media Articles

Social Media Update for Indie Filmmakers, Part 1: Facebook

Social Media Update for Indie Filmmakers, Part 2: Instagram

Social Media Update for Indie Filmmakers, Part 3: Twitter

David Averbach April 15th, 2019

Posted In: Uncategorized

The Evolution of the Education Market

Our guest blog author this month is Vanessa Domico, who has more than 30 years of business experience in both the corporate and non-profit sectors. In 2000, Vanessa joined the team of WMM (Women Make Movies), first as the Marketing and Distribution Director, and eventually Deputy Director. Wanting to work more closely with filmmakers, Vanessa left WMM in 2004 to start Outcast Films.

Our guest blog author this month is Vanessa Domico, who has more than 30 years of business experience in both the corporate and non-profit sectors. In 2000, Vanessa joined the team of WMM (Women Make Movies), first as the Marketing and Distribution Director, and eventually Deputy Director. Wanting to work more closely with filmmakers, Vanessa left WMM in 2004 to start Outcast Films.

As the summer winds down and the new school year approaches, Outcast Films is revving up marketing initiatives for our fall releases. Rolling around in the back of my head is how much technology has changed the business of film distribution: everything from how we position the films to our audience of teachers and librarians to how we deliver the films.

Our primary goal at Outcast is servicing our customers: teachers and librarians. These are the folks that are going to pay money to purchase and rent your film. I think you will agree with me that if teachers and librarians don’t know about the fantastic new documentary you just finished, then what’s the point?

When I started Outcast Films in 2004, we were distributing VHS tapes. A few years later, DVDs (and Blu-rays) hit the market and VHS tapes were quickly made obsolete. Now, here we are in 2018, with educational digital platforms like Kanopy, AVON (Alexander Street Press), and Hoopla, all of whom service the educational and library markets, not to mention Amazon, Netflix, iTunes and so on, digital is moving at light speed forward.

Two years ago, 95% of our income came from DVD sales. Last year that number dropped to 75% and halfway through this year DVD sales only represent approximately 45% of our total sales. By the end of 2020, I believe DVDs will be just like VHS tapes and dinosaurs. There will be some DVD/Blu-ray sales, of course, but for students, teachers, and the increased demand for on-line college classes in the U.S. digital is the future. The problem is technology should work for everyone—big and small – and it doesn’t.

For this blog, I am focusing solely on the educational market, which is Outcast Films’ area of expertise. But giant tech companies like Amazon, Netflix and Hulu also play a huge factor especially in collapsing the markets. For a couple years now, Netflix has been demanding hold back rights for up to three years from the educational platforms like Kanopy and AVON. Now other big tech companies are placing the same demands on producers: you can come with us or go with Kanopy. Most filmmakers will obviously take the bigger money contracts. (I know I would.) But ultimately, this is driving the cost down for consumers which is good for all of us who like to watch films but bad for the bank accounts of filmmakers.

Kanopy’s collection has comprised of approximately 30,000 titles and AVON has over 100,000. It is impossible for these platforms, to market all their films, all the time. That is not a knock against Kanopy or AVON, I think they have been leaders in the industry and I have a tremendous amount of respect for them. They are providing a great service that students and teachers love.

However, a recent monitoring of VIDLIB, a listserv frequented by academic librarians, reveals that many of them are beginning to rail against some platforms like Kanopy and AVON. You can access the entire discussion by signing up for the VIDLIB listserv but for your convenience, I’ve included some anonymous excerpts below:

- “We are concerned about our rising costs from Kanopy”

- “I believe many of us could not foresee just how expensive streaming, DSLs, etc. would cost us in the long run.”

- “Librarians jobs have become more accountant in nature than collection development.”

- “Trying to balance the needs of faculty/our community for access with a commitment to continue to develop and maintain a lasting collection is difficult.”

- “Our IT department is over-taxed as is and does not have the resources to devote to hosting streaming video files.”

- “We basically had to stop all collection development.”

- “The paradox of increasing production and availability of media resources and shrinking acquisition budgets, due to streaming costs is a disturbing trend, particularly when considering that 100% of our video budget went to DVD acquisitions just four years ago.”

- “(our budget for DVDs) is $20,000 and there’s no way we can purchase in-perpetuity rights for digital files; and, really, there’s no way we can ‘do it all’ or meet all needs.”

- “We love Kanopy – but when it costs $150/year to just provide access, not ownership, to one title, it’s really, really hard to justify.”

- “State legislators are beginning to put pressure on schools to find ways to reduce the cost of things like books, etc.”

- “When colleges and universities are already under fire for the cost of textbooks, etc., asking students to pay one more additional cost gets lumped into the argument about the increasing cost of higher education.”

The concerns these librarians have expressed have been on a slow simmer the last few years but it’s only a matter of time before they hit a full-on pasta boil. One of the most significant concerns, and the one that will affect filmmakers most, is the high cost of streaming.

Another factor that we need to consider is the copyright law and the “Teacher’s Exemption”. With the help of the University of Minnesota, the law is simplified below:

- The Classroom Use Exemption

- Copyright law places a high value on educational uses. The Classroom Use Exemption (17 U.S.C. §110(1)) only applies in very limited situations, but where it does apply, it gives some pretty clear rights.

- To qualify for this exemption, you must: be in a classroom (“or similar place devoted to instruction”). Be there in person, engaged in face-to-face teaching activities. Be at a nonprofit educational institution.

- If (and only if!) you meet these conditions, the exemption gives both instructors and students broad rights to perform or display any works. That means instructors can play movies for their students, at any length (though not from illegitimate copies!)

In other words, if a teacher is going to use the film in their classroom, and they teach in a public university or high school, they do not need anybody’s permission to stream the film to their students.

That’s not the best news for filmmakers but I always say: facts are your friends. Knowing that they won’t need your permission, what can you do to ensure teachers see (and love) your film?

Stay with me because I’m going to ask you to do a little math:

If a librarian has a budget of $20,000 a year for films, at an average cost of $150 for a one-year digital site license (DSL), then they can expect to rent approximately 133 DSLs a year. According to Quora, there are nearly 10,000 films currently being made each year and that number is growing (thanks in large part to technology.) The bottom line is that you have a 1.3% chance that your film will be rented by that university or college. If we increase the library’s budget 5 times, your chance increases to 6.5% which are not great odds.

Facts are our friends. If independent film producers and companies like Outcast Films are going to survive in this volatile business, we need to embrace the facts to solve the problems which means doing your homework. Filmmakers who think they have a great film for the educational market, will have to make their film available through digital platforms. But if they want to increase their odds of selling the film, you will also have to do their own marketing – or hire someone who has experience in the business to help you.

Here are a few tips to help you get started:

- Define and establish your goals as soon as possible

- Write copy for your film with your audience in mind (i.e. teachers are going to want to know how they can use this film in their class)

- Organize a college tour before you turn over the rights of the film

- In the process, find academic advocates who will present the film at conferences AND recommend it to their librarians.

The educational market is a very important audience to reach for many filmmakers. I think most folks reading this blog would agree there is not a better way to educate than by using film. The educational market can also be lucrative, but librarians cannot sustain the increase in costs for steaming over the long haul. As information flows freely through technology, teachers are becoming savvy to the business and realize they don’t need permission to stream a film in their classroom if they respect the criteria set forth in the copyright law.

Remember, facts are our friends. If you think your film is perfect for the educational market, then do your homework: research, strategize and find partners who will help you.

David Averbach August 1st, 2018

Posted In: Digital Distribution, Distribution, education, Netflix, Uncategorized

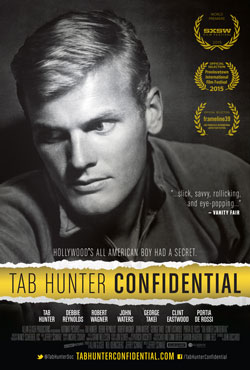

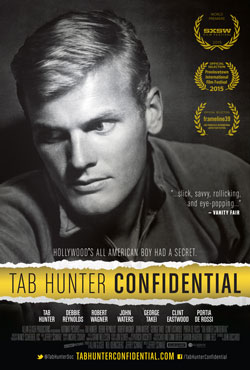

How viable is DIY Digital Distribution? The Case Study of Tab Hunter Confidential

David Averbach is Creative Director and Director of Digital Distribution Initiatives at The Film Collaborative.

When distributing your film, a lot of time is spent waiting for answers. Validation can come only intermittently, and the constant string of “no”s is an anxiety-ridden game of process of elimination. Which doors open for your film and which doors remain closed determines the trajectory of its distribution, whether it’s festival, theatrical, digital, education or home video (until that’s dead for good).

I work with filmmakers, way down-wind of this long and drawn-out process, who, after exhausting all other possibilities, have “chosen” DIY digital distribution as a last resort.

TFC’s DIY digital distribution program has helped almost 50 filmmakers go through the process of releasing their film digitally over the past 5 years and with most of them, I have often felt as though I were giving a pep-talk to the kid who got picked last for the dodgeball team. “Hang in there, just stick to it…you’ll show them all.”

Is DIY Digital Distribution anything more than a last resort? Perhaps not…

DIY vs. DOA

Since TFC was formed over six and a half years ago, we have optimistically used “DIY” as a term of empowerment, where access and transparency had finally reached a point where one could act as one’s own distributor. After all, we tell these (literally) poor, exhausted filmmakers, “no one knows your film better than you do”, so “no one can do a better job of marketing it.” With a little gumption, a few newsletters and handful of paid Facebook posts, you, too, might prove all the haters wrong and net even more earnings than Johnny next door who sold his film to what he thought was a reputable distributor but never saw a dime past the MG (minimum guarantee) in his distribution agreement. We even wrote two case study books about it.

It’s not that I’m being untruthful with these filmmakers. Nor is it the case that these films are necessarily of poor quality. What they have in common is a lack of visibility. Most had some sort of festival run, and only a handful were released theatrically, usually with one- or two-day engagements in a handful of cities. Occasionally, we’ll get a film that has four-walled in New York or Los Angeles for a week. Or sometimes ones that have played on local PBS affiliates or even on Showtime. But their films are not even close to being household brand names. So without the exposure or the marketing budget, they can do little more than to deliver their film to TVOD platforms like iTunes and hope for the best.

So what happens to these films? The news, as a whole, is not good. Based on what I’ve seen from these films in the aggregate, and all things being equal, if you DIY/dump your film onto only iTunes/Amazon/GooglePlay with moderate festival distribution but no real money left for marketing, you will be lucky to net more than $10K on TVOD platforms in your film’s digital life.

And the poorer the filmmaking quality of your film, or the less recognizable the cast, or the less “niche” your film is, the more likely it will be that you won’t even earn much more revenue than what is required to pay off the encoding and delivery fees to get your film onto these platforms in the first place (which is around $2-3K).

Which is why, as of late, I’ve been aggressively suggesting to filmmakers that holding off on high profile TVOD platforms and instead trying to drive traffic to their websites and offering sales and rentals of their film via Vimeo On Demand or VHX, two much cheaper options, might be a better use of their limited remaining funds.

But am I down on DIY? Not necessarily.

Risky Business

Granted, there are a lot of films out there for which The Film Collaborative can do very little for in the area of digital distribution other than hold filmmakers’ hands. But what about for films working at the “next level up” from last-resort-DIY? Films who have either gotten a no-MG or modest-MG distribution offer?

Many distributors and aggregators working at this level will informally promise some sort of marketing, but many times those marketing efforts are not specifically listed contractually in the agreement. So when filmmakers ask me whether going with a no-MG aggregator is better than doing DIY, this is my answer…

It’s important to remember that, once a film is on iTunes, no one will care how it got there. And by this I mean with no featured placement, just getting it on to the platform. So, if that’s all a distributor/aggregator is doing, this is not the kind of deal that a filmmaker can dump into someone else’s hands and move on to their next project. In fact, many aggregators will send you a welcome packet with tips and suggestions on how to market your film on social media, such as Facebook. In other words, they are literally expecting you to do your own marketing. Not just do but pay for. So, it is entirely possible that all that an aggregator or distributor is doing is fronting your encoding costs, which they will later recoup from your gross earnings, but only after they take their cut off the top. And if your distributor is offering you a modest MG, you must be prepared for the possibility that that MG may be all the earnings you are ever going to see. Certainly, we have seen many, many filmmakers in this position.

So the question remains: Is DIY still too risky for all but films that have run out of options?

It’s a hard question to answer, mostly because there is no ONE answer. Undoubtedly, some films will be helped with such an arrangement and some films will not.

A View from the Other Side…

Distributors, of course, will stick to the sunny side of the street. They will tell you that DIY is too risky for the vast majority of films, and remind you that distribution is more than getting a film on to one or two platforms.