ABOUT THE PROJECT

LOGLINE

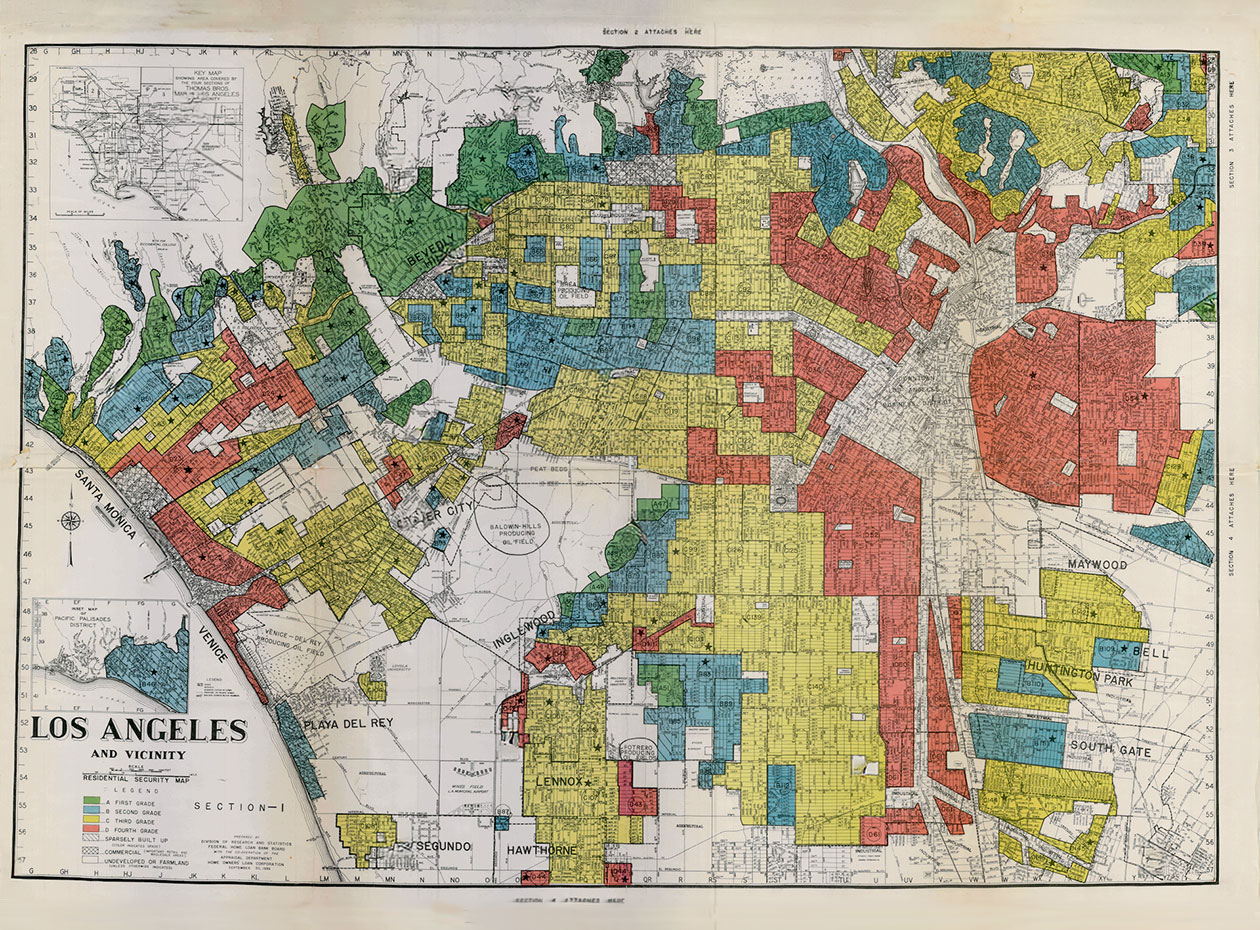

In the 1950s, the Rodgers family moved to Los Angeles, escaping the South but facing redlining. Today, the Great Migration’s descendants break redlining’s legacy, creating opportunities and reclaiming their power.

SYNOPSIS

I GET OUT traces the journey of the Rodgers family from Little Rock, Arkansas to Los Angeles, California highlighting the impact of the Great Migrations and redlining over three generations. Lazell Rodgers moved from Little Rock, Arkansas, to Los Angeles during the housing boom of the 1950s and 60s, following his cousin JW, a construction worker with dreams of becoming an actor. Despite their efforts in shaping suburban areas along the newly built highways, Lazell was restricted to South Central Los Angeles by redlining.

In the early 20th century, the Los Angeles Realty Board (LARB) implemented racially restrictive covenants, making Los Angeles one of the first cities to institutionalize racial segregation. Redlining’s impact is not unique to Los Angeles; it spreads nationwide. By the mid-20th century, California, home to half of the U.S. realtors, had helped make redlining a national norm. Studies show that redlining maps from the 1930s are more segregated today than 100 years ago.

Lazell’s son, John, later returned to his childhood home to raise his children but found the neighborhood deeply affected by the crack epidemic, the 1992 LA Riots, and the 1994 earthquake. Feeling boxed in, John’s daughter, Talia Rodgers sought freedom in New York but faced similar struggles in her redlined Brooklyn neighborhood.

In Talia’s return home, she sought a community focused on revitalization through art, technology, and literacy. With the help of local cultural leaders, I GET OUT defies the lines of redlining maps by revealing how technological advancements and organizations continue to empower communities shaped by historical oppression. Through meaningful archival, verite moments, poetry, apposite song lyrics, and beautiful movement sequences — we experience a different perspective of the people and places in South Central Los Angeles.

PROJECT TYPE Documentary Feature

DIRECTOR Talia Rodgers

PRODUCER Talia Rodgers, Christina Radburn

🎬 Support independent film through The Film Collaborative

The Film Collaborative (TFC) is a 501(c)(3) nonprofit supporting independent filmmakers.

Federal Tax ID: 32-0295081

Your gift is tax-deductible as allowed by law.

💳 Ways to Give

- Online:

Click the Donate button above. You can:- Use your PayPal account, or

- Check out as a guest with your debit/credit card — no PayPal account required.

- ACH or Wire

Email us for instructions.

- Zelle

Email us for instructions.

- Check

Checks are accepted, but for time and security reasons, electronic donations are preferred when possible.

Check donation instructions are here.

- Stock

Donating appreciated stock can increase your impact by up to 20%.

Learn more about advantages of stock donations here.

Email us for instructions.

- Donor-Advised Funds (DAF):

Instructions for donating from a DAF are here.

📈 Maximize Your Gift

- Many employers offer matching gifts, doubling or even tripling your donation. Some match contributions up to a year after they’re made.

- When donating via PayPal, consider covering the small processing fee to make the most of your gift toward the project.

📄 Tax Receipts

- In compliance with IRS rules, tax receipts are issued for the amount TFC receives after payment processor fees are deducted.

- PDF tax receipts are emailed within 30 days of your online donation.

- The “receipt” immediately sent by PayPal is only a payment confirmation — it is not your tax receipt.

Thank you for helping bring powerful independent films to life.

ID: 697